|

[3 min read, open as pdf]

Design matters The combination of GBP/USD rollercoaster since Brexit, the critical home bias decision and the market stresses of 2020 mean that the differentiating factors amongst multi-asset strategies have boiled down to three things.

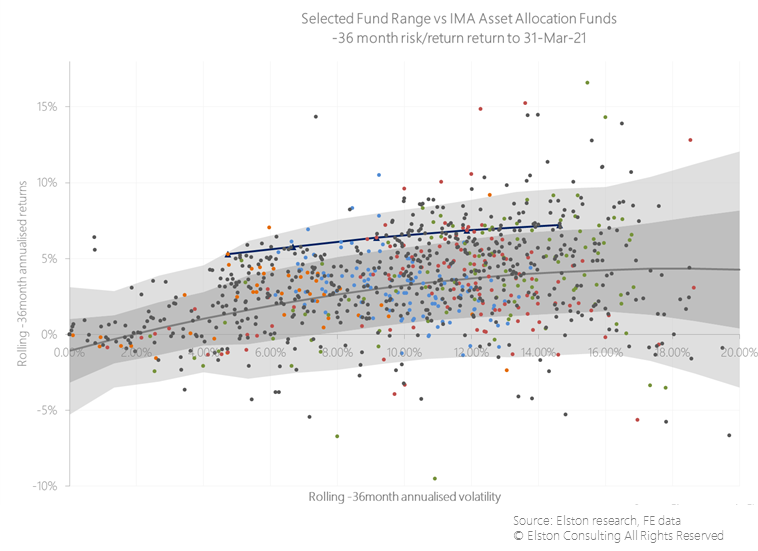

They are empirical and philosophical standpoints that portfolio designers must consider when developing a strategic asset allocation, and advisers should consider when looking under the bonnet of a multi-asset fund range. Parameter decisions are key Firms that use third-party asset allocation models that have a heavy UK equity allocation have been penalised. We have highlighted earlier the disconnect between UK’s market cap weighting at 4% of global equities, compared to its weighting in private investor benchmarks where it can be as higher as 50%. This is not rational and means UK-biased investors are penalised and missing out on world-changing trends of the broader global opportunity, set, this thing called “technology”, and demographic growth in Asia and Emerging Markets. Firms that believe that all returns should be in an investor’s base currency have been penalised for being structurally overweight a weakening GBP. There is a “hedging to your liability” argument that resonates for some liability-driven pension fund managers, but we believe that is a function of time-horizon and makes sense more for the bond portfolio, than the equity part of the portfolio. The inclusion of Alternative Assets, such as listed private equity and real assets has boosted risk-adjusted returns for some multi-asset funds but the biggest drivers remain home bias and GBP hedging policy. Results We look at the universe of multi-asset funds in the IMA Mixed Asset and Unclassified Sectors. By looking at realised risk-return, we can see how different ranges have fared relative to the median. The first thing to note is the dispersion of returns. There is very little consistency: the scattergram is more of a “splattergram” meaning selection of the right range of multi-asset funds is key. We look at the standard deviations around a regression line to get a handle on this dispersion. We also adjust these by risk “bucket”. Finally we link up the performance of each fund within a multi-asset fund range to look at the consistency of the “frontier”. Those that dominate have nothing to do with active or passive or fund selection, and everything to do with parameter design, namely UK or global equity bias and GBP hedging policy. Fig.1. Multi-asset fund universe risk-return scattergram Summary

Multi-asset funds are a convenient one-stop shop for a ready-made portfolio. But evaluating their design parameters is key to ensure it resonates with your own philosophy. Home bias, hedging policy and alternative asset policy are three due diligence questions to ask. There are many more. To see where your chosen multi-asset fund range appears in our analysis, or if you would like help reviewing your multi-asset fund choices, please contact us. https://www.elstonsolutions.co.uk/contact.htm [3 min read, open as pdf]

We look at 1Q21 in review and the outlook ahead. Macro The economic restart will be sudden, with substantial pent up demand. Corporate and personal balance sheets have been supported which should provide confidence in investment and spending. From a monetary policy perspective, the focus remains on the delicate balance between bond yield and inflation. Stable, negative real yields are supportive of risk assets. 10 year breakeven rates have climbed further since year-end amplifying demand for inflation-hedges. With nominal bonds under pressure, there is support for risk-asset. Advisers looking at liquid alternatives to bonds such as property and infrastructure: need to balance the required exposure to inflation-protecting assets with up-risking client portfolios. This balancing act means it’s time to rethink the 60/40 portfolio. Markets The rebound in risk assets is made even more pronounced, owing to a base effect from last year’s market lows. Timber and Listed Private Equity have been the best performing asset classes in GBP terms on a 12 month view. For factor-based strategies, World Equity Value factor outperformed all other factors +12.3%, compared to +3.79% for World Equity, for the first three months of 2021. The breadth and deconcentrating have been rewarded in the first quarter with equal weight US equities returning +11.49%, compared to +6.17% for the traditional cap-weighted S&P500, in USD terms, in the year to March. Regime Regime indicators point to markets being overbought in the near-term. For the full update, please view our Webinar https://www.brighttalk.com/webcast/18493/482564 [5min read, open as pdf]

We agree it’s time to rethink the 60/40 portfolio. It’s a useful benchmark, but a problematic strategy. What is the 60/40 portfolio, and why does it matter? What it represents? Trying to find the very first mention of a 60/40 portfolio is proving a challenge, but it links back to Markowitz Modern Portfolio Theory and was for many years seen as close to the optimal allocation between [US] equities and [US] bonds. Harry Markowitz himself when considering a “heuristic” rule of thumb talked of a 50/50 portfolio. But the notional 60/40 equity/bond portfolio has been a long-standing proxy for a balanced mandate, combining higher-risk return growth assets with lower-risk-return, income generating assets. What’s in a 60/40? Obviously the nature of the equity and the nature of the bonds depends on the investor. US investor look at 60% US equities/40% US treasuries. Global investors might look at 60% Global Equities/40% Global Bonds. For UK investors – and our Elston 60/40 GBP Index – we look at 60% predominantly Global Equities and 40% predominantly UK bonds Why does it matter? In the same way as a Global Equities index is a useful benchmark for a “do-nothing” stock picker, the 60/40 portfolio is a useful benchmark for a “do-nothing” multi-asset investor. Multi-asset investors, with all their detailed decision making around asset allocation, risk management, hedging overlays and implementation options either do better than, or worse than this straightforward “do-nothing” approach of a regularly rebalanced 60/40 portfolio. Indeed – its simplicity is part of its appeal that enables investors to access a simple multi-asset strategy at low cost. The problem with Bonds in a 60/40 framework In October 2019, Bank of America Merrill Lynch published a research paper “The End of 60/40” which argues that “the relationship between asset classes has changed so much that many investors now buy equities not for future growth but for current income, and buy bonds to participate in price rallies”. This has prompted a flurry of opinions on whether or not 60/40 is still a valid strategy The key challenges with a 60/40 portfolio approach is more on the bond side:

So is 60/40 really dead? In short, as a benchmark no. As a strategy – we would argue that for serious investors, it never was one. We therefore think it’s important to distinguish between 60/40 as an investment strategy and 60/40 as a benchmark. We think that a vanilla 60/40 equity/bond portfolio remains useful as a benchmark to represent the “do nothing” multi-asset approach. However, we would concur that a vanilla 60/40 equity/bond portfolio, as a strategy offered by some low cost providers does – at this time – face the significant challenges identified in the 2019 report, that have been vindicated in 2020 and 2021. For example, during the peak of the COVID market crisis in March 2020, correlations between equities and bonds spiked upwards meaning there was “no place to hide”. The growing inflation risk has put additional pressure on nominal bonds. Real yields are negative. Interest rates won’t go lower. But outside of some low-cost retail products, very few portfolio managers, would offer a vanilla equity/bond portfolio as a client strategy. The inclusion of alternatives have always had an important role to play as diversifiers. Rethinking the 40%: What are the alternatives? When it comes to rethinking the 60/40 portfolio, investors will have a certain level of risk budget. So if that risk budget is to be maintained, there is little change to the “60% equity” part of a 60/40 portfolio. What about the 40%? We see opportunity for rethinking the 40% bond allocation by: We nonetheless think it is important to:

1. Rethinking the bond portfolio Whilst more extreme advocates of the death of 60/40 would push for removing bonds entirely, we would not concur. Bonds have a role to play for portfolio resilience in terms of their portfolio function (liquidity, volatility dampener), so would instead focus on a more nuanced approach between yield & duration. We would concur that long-dated nominal bonds look problematic, so would suggest a more “barbell” approach between shorter-dated bonds (as volatility dampener), and targeted, diversified bond exposures: emerging markets, high yield, inflation-linked (for diversification and real yield pick-up). 2. Incorporating sensible alternative assets Allocating a portfolio of the bond portfolio to alternatives makes sense, but we also need to consider what kind of alternatives. Whilst some managers are making the case for hedge funds or private markets as an alternative to bonds, we think there are sensible cost-efficient and liquid alternatives that can be considered for inclusion that either have bond-like characteristics (regular stable income streams), or provide inflation protection (real assets). For regular diversified income and inflation protection, we would consider: asset-backed securities, infrastructure, utilities and property. The challenge, however, is how to incorporate these asset classes without materially up-risking the overall portfolio. For inflation protection, we would consider real assets: property, diversified, commodities, gold and inflation-protected bonds. Properly incorporated these can fulfil a portfolio function that bonds traditionally provided (liquidity, income, ballast and diversification). 3. Consider risk-based diversification as an alternative strategy One of the key reasons for including bonds in a multi-asset portfolio is for diversification purposes from equities on the basis that one zigs when the other zags. In the short-term, and particularly at times of market stress, correlations between asset classes can increase, this reduces the diversification effect if bonds zag when equities zag. We would argue risk-based diversification strategies have a role to play to here, on the basis that rather than relying on long-run theoretical correlation, they systematically focus on short-run actual correlation between asset classes and adapt their asset allocation accordingly. Traditional portfolios means choosing asset weights which then drive portfolio risk and correlation metrics. Risk-based diversification strategies do this in reverse: they use short-run portfolio risk and correlation metrics to drive asset weights. If the ambition is to diversify and decorrelate, using a strategy that has this as its objective makes more sense. Summary So 60/40 is not dead. It will remain a useful benchmark for mult-asset investors. As an investment strategy, vanilla 60/40 equity/bond products will continue to attract assets for their inherent simplicity. But we do believe a careful rethink of the “40” is required. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed