|

[5 min read, open as pdf]

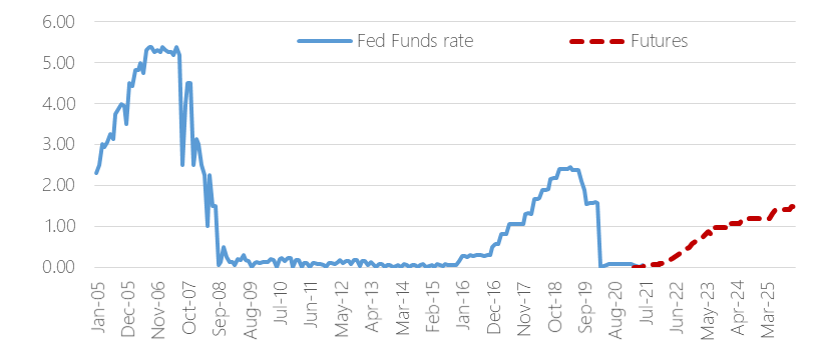

Interest rates expected to rise As the run up in inflation looks more persistent, than transitory, there is growing likelihood that Central Banks will raise interest rates in response. Following an extended “lower for longer” near-Zero Interest Rate Policy following the 2008 Global Financial Crisis and the 2020 COVID Crisis, the market futures-implied expectations for the Fed Funds rate, points to a “take off” in 2022 in response to rising inflation, following COVID-related policy support, to an expected 1.01% interest rate level in Dec-23[1], from 0.88% last quarter. Fig.1. Fed Funds Rate and implied expectations Source: Elston research, Bloomberg data

The potential for increased interest rate volatility, as rate hike expectations increase, means that investors that are seeking to dampen interest rate sensitivity (“duration”) are allocating to shorter-duration exposures, such as ultrashort-duration bonds, and also to Floating Rate Notes (FRNs). What is a Floating Rate Note? Floating Rate Notes receive interest payments that are directly linked to changes in near-term interest rates and can therefore provide a degree of protection against interest rate risk, when interest rates are rising. Issued for the most part by corporations, FRNs pay a periodic coupon – typically quarterly – that resets periodically in line with short-term interest rates. This could be expressed as a premium or “spread” over a currency’s short-term risk-free rate, such as (in the UK) the 3 month SONIA rate (Sterling Overnight Index Average, and prior to that GBP LIBOR) in the UK, or (in the US) the 3 month SOFR (Secured Overnight Funding Rate, and prior to that USD LIBOR). These indices overnight borrowing rates between financial institutions. The size of the premium or spread reflects the creditworthiness of the issuer: the higher the spread, the greater the rewarded risk for owning that security, and typically stays the same for the life of the bond and is based on the issuer’s credit risk as deemed by the market. How can FRNs benefit investors? Floating Rate Notes are a lower-risk way of putting cash to work and provide a useful direct hedge against interest rate fluctuations. When incorporated into a bond portfolio, they can help bring down duration given their reduced sensitivity to interest rate changes, as well as provide a return pattern that is directly and positively correlated with changes in interest rates. Compared to nominal bonds, such as Corporate Bonds and UK Gilts, FRNs’ yield can increase as/when interest rates increase. Relative to money market funds, FRNs may provide some additional yield pick-up, as well as very short <1 year duration. Key considerations when investing in FRNs Portfolio investors can access FRNs through funds and ETFs. Key considerations when investing in FRNs include, but are not limited to:

Summary The expected timing of interest rate “lift off” in the US and UK will change as markets adapt to evolving growth and inflation outlook during the post-COVID recovery, and in response to the risk of further disruption from new virus variants. However, as interest rate rises become more likely, and incorporating an allocation to Floating Rate Notes for protection against interest rate risk makes sense within the bond allocation. Watch the CPD Webinar: The Quest for Yield [1] Data as at last quarter end

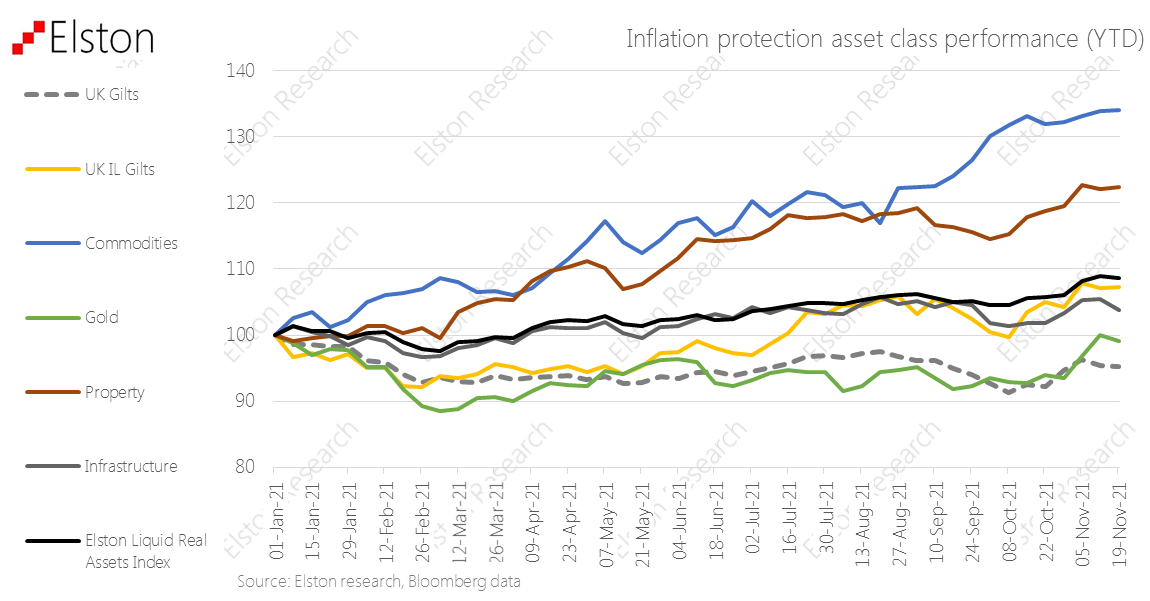

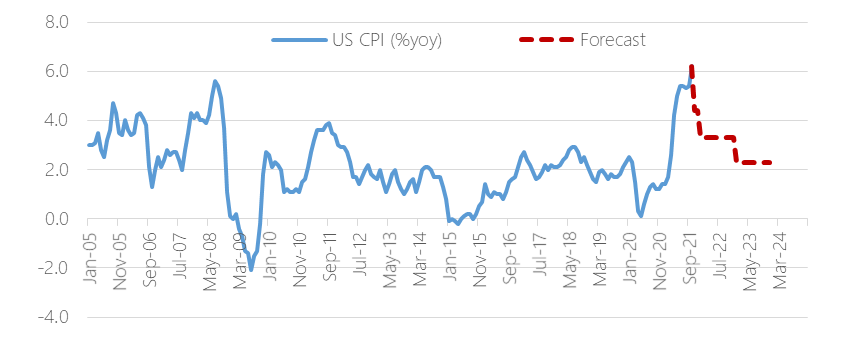

Inflation on the rise With inflation on the rise – and potentially interest rates too – nominal bonds are likely to remain under pressure. Whilst “real assets” – such as property, infrastructure and gold – have potential to preserve value in inflationary regimes, how can a switch from bonds to real assets be made without materially up-risking portfolios? This was the challenge we addressed in the design of our Liquid Real Assets index. Our Liquid Real Assets Index was developed to combine exposure to higher risk-return real asset exposures, with lower risk-return interest rate-sensitive assets, to deliver a real asset return exposure for inflation protection, in liquid format, with bond-like volatility to keep risk budgets in check. Given the rising inflationary pressures both in the US (where in Oct-21 it crossed 6%, the highest level in 30 years) and in the UK (where in Oct-21 it crossed 4%, the highest level in a decade), we take stock on the index performance year-to-date and are glad to say it’s “doing what it says on the tin. [Read full article] [Watch the webinar] [3 min read, open as pdf]

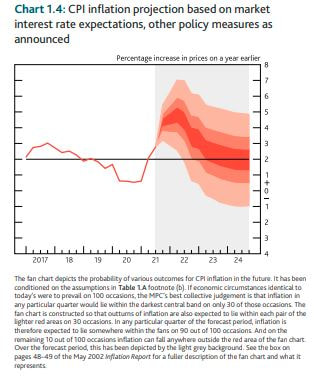

Ahead of estimates UK CPI print for October came in at 4.2%yy vs 3.9% estimate and 3.1%yy in September. Inflation rates were higher than expected and the highest in a decade, putting more pressure on the Bank of England to raise interest rates and creating a palpable squeeze on cost of living for households through the winter. The increase was driven by energy prices and the impact of supply shortages across the economy.

Inflation is proving more persistent than transitory. In an inflationary environment, Value style investing has the potential for continued outperformance relative to other factors. For UK fund investors, actively managed funds with a value-oriented philosophy, UK equity income funds with an inherent value bias and Value-factor index funds/ETFs offer ways of increasing allocation to Value within a portfolio. Read the article (5 min read) Watch the webinar

Ahead of estimates, again US CPI print for October came in at 6.2%yy vs 5.9% estimate and 5.4%yy in September. Higher prices for energy, accommodation, food and vehicles drove the October print and suggested that inflation pressure is broadening out beyond just the “reopening” sectors. Get the full report Visit our Liquid Real Assets page Register for the webinar/View the replay Read the full article

What is the 60/40 portfolio? Trying to find the very first mention of a 60/40 portfolio is a challenge, but it links back to Markowitz Modern Portfolio Theory and was for many years seen as close to the optimal allocation between [US] equities and [US] bonds. Harry Markowitz himself when considering a “heuristic” rule of thumb talked of a 50/50 portfolio. But the notional 60/40 equity/bond portfolio has been a long-standing proxy for a balanced mandate, combining higher-risk-return growth assets with lower-risk-return income-generating assets. What’s in a 60/40? Obviously the nature of the equity and the nature of the bonds depend on the investor. US investors look at 60% US equities/40% US treasuries. Global investors might look at 60% Global Equities/40% Global Bonds. For UK investors – and our Elston 60/40 GBP Index – we look at 60% predominantly Global Equities and 40% predominantly UK bonds Why does it matter? In the same way as a Global Equities index is a useful benchmark for a “do-nothing” stock picker, the 60/40 portfolio is a useful benchmark for a “do-nothing” multi-asset investor. Multi-asset investors, with all their detailed decision making around asset allocation, risk management, hedging overlays and implementation options either do better than, or worse than this straightforward “do-nothing” approach of a regularly rebalanced 60/40 portfolio. Indeed – its simplicity is part of its appeal that enables investors to access a simple multi-asset strategy at low cost. The problem with bonds (the ‘40’) in an inflationary environment Over the years, the relationship between asset classes has changed so much that the validity of 60/40 as a strategy can legitimately be questioned. Read the full article or register for the webinar/View the replay

The era of quantitative easing programmes have had a distorting effect on markets since the 2008 financial crisis has given value investors a torrid time in the past decade. The near-constant sugar-rush of liquidity has served to de-link valuations from underlying fundamentals prompting a huge bias towards growth. While pockets of investors have been braced for a long-expected correction that has never really materialised, the recent sharp increase in inflation may constitute an inflection point of sorts. In inflationary periods and when interest rates rise, the time horizon for future discounting shrinks, leaving equities exposed. Income-yielding shares have an inherent value-bias, owing to the types of company that pay steady dependable dividend). This provides a measure of inflation protection both in absolute terms and relative to nominal bonds. Read the full article Watch the webinar |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed