Read the full CPD Article on FT Adviser [3 min read, pdf version]

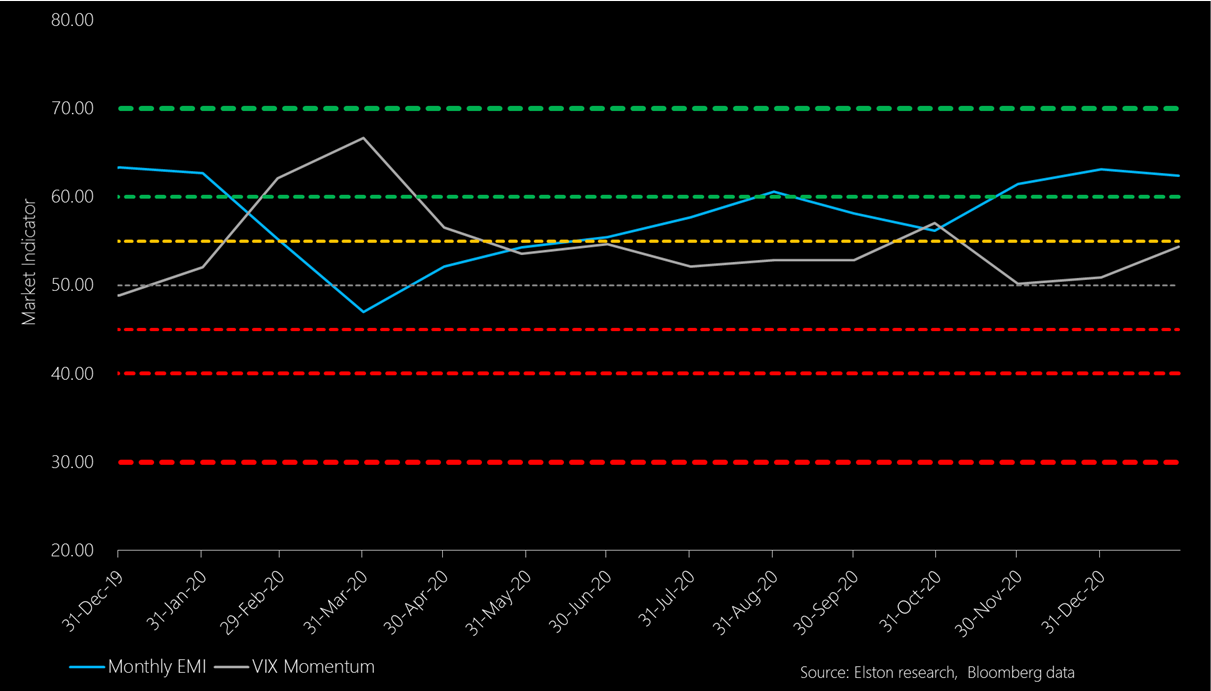

Moderate turnover strategies: Monthly Elson Market Indicator The Monthly EMI ended January 2021 at 62.37 vs 63.12 at end December 2020. For moderate turnover strategies, equity markets continue to look overbought. This drives a preference for lower relative position in risk assets. The Monthly EMI remains above the threshold (60) for a move to a Neutral position in risk assets. Momentum in the VIX Index increased from 50.9 to 54.4, whilst in absolute terms, the VIX Index closed the month at 33.1, compared to 22.8 at previous month end. High turnover strategies: Weekly Elston Market Indicator

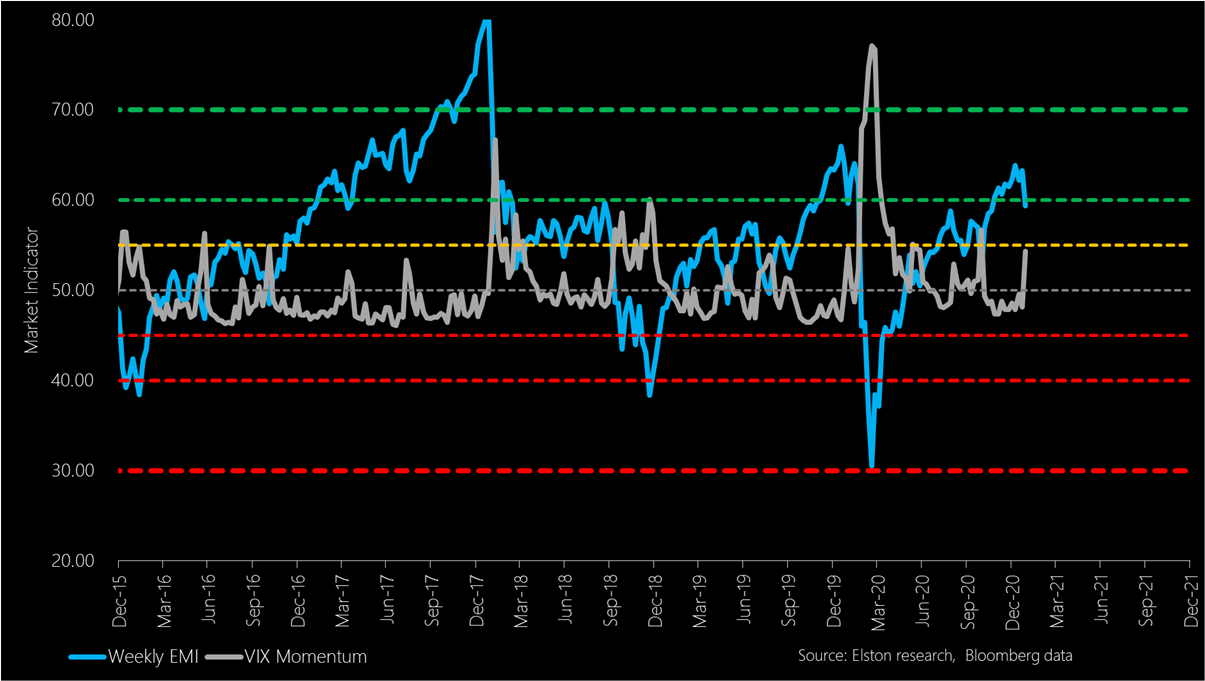

Over the last 4 weeks, the Weekly EMI declined from 63.87 to 59.35, as at last Friday close, falling below the 60 threshold. Momentum in the VIX Index increased from 48.56 to 54.35 over the last 4 weeks. The conclusion of the Retirement Outcomes Review for non-advised customers is set out in the regulator’s Policy Statement PS19/21.

The key change is the introduction of mandatory highly governed investment pathways for non-advised drawdown (we prefer the term “Retirement Pathways”, for clarity) from February 2021. In a nutshell Retirement Pathways is the new Stakeholder, but for decumulation, and with a soft price cap of 0.75% instead of 1.50%. Whilst the policy changes impact non-advised providers, a “Dear CEO” letter was sent financial advisers in January this year announcing a review of the market for pensions and investment advice “Assessing Suitability 2” (AS2) with particular reference to retirement outcomes. What are the key points of PS19/21? The policy means that:

What is the point of this policy intervention? The purpose of this policy intervention is to deliver better retirement outcomes for non-advised investors, who may not have the confidence to make robust and informed investment decisions. Key protections include, but are not limited to: ensuring cash is not a default option, ensuring costs and charges are clear, reasonable and regularly communicated ensuring investment strategies are appropriate through the introduction of default options for different objectives, and ensuring there is third party oversight of those default investment options either through an Independent Governance Committee (IGC) or a third-party Governance Advisory Arrangement (GAA). If you are thinking that sounds a bit like the governance arrangements around automatic enrolment workplace pension schemes - you are right. If you are also thinking it would have made sense to have those guidelines in place before or in conjunction with Pensions Freedom in 2014, you are also right! What will d2c drawdown look like? In the policy statement PS19/21, the regulator is requiring all d2c providers to offer mandatory investment pathways (Retirement Pathways) with effect from 1st February 2020. Retirement pathways mean offering non-advised transaction or customers going into drawdown four investment options that align to four standardised objectives formulated by the regulator. Providers must offer a single investment solution (a single fund, or a single fund from a suite of funds from the same solution such as target date funds) for each pathway. These funds will be subject to intense scrutiny by the providers Investment Governance Committee in terms of appropriateness and value for money. What are the standardised objectives? The standardised objectives are intended to align to specific actions or intended actions that non-advisers may want to take. The final wording for each standardised objective is below:

Is there a price cap? There is no price cap for Retirement Pathways. However during the consultation, the regulator suggested that providers should be mindful of the fact that in automatic enrolment workplace pension schemes the Total Cost of Investing (a term which I define to be Platform/Admin Cost + Fund OCF + Fund Transaction Costs) is 0.75%. This creates a fairly strong anchor within which d2c providers must operate. Is that price cap achievable? Yes: for example if we estimate a platform fee a for a d2c providers to be 0.30% for an investor with £100,000 at retirement, this leaves 0.45% budget for fund OCF plus transaction costs. The price anchor indirectly forces providers down the road of offering multi-asset funds that are constructed with low-cost index funds. And there’s nothing wrong with that - after all it’s the asset allocation that counts when it comes to delivering investment outcomes, not the type of fund. What kind of funds align to the standardised objectives? For investors expecting to purchase an annuity under one of the pathway options, we expect providers to offer funds that have similar asset exposures to what annuity providers hold to fund annuities. That way, when investors purchase an annuity, there is a change in how an investors receives a payout (life-long guaranteed in exchange for surrendered capital), but not a change in the asset mix used to fund that annuity. That way if annuity rates change, the assets the investor holds to purchase that annuity are the flip side of the same coin. In the workplace pension world, there are pre-retirement funds that are designed to mirror annuity providers’ annuity matching portfolios. We expect similar funds for the retail market, and are ready to construct “Annuity Conversion portfolios” should the demand arise. For the other three options, we expect that d2c providers will use multi-asset passive funds, with lower risk-return profile for investors starting to make near-term withdrawals and a medium-term risk-return profile for investors starting to make medium-term withdrawals. Whilst “relative risk” traditional multi-asset passive funds could be one option for d2c providers, we expect Target Date Funds to have an important role to play in non-advised drawdown. What does this mean for advisers? Whilst the policy is aimed at direct-to-consumer providers, there have been consistent read-throughs for financial advisers from the outset. Now that this is hardcoded into policy, we expect the forthcoming changes in the d2c market will create pressure on advisers in four different dimensions: comparison, cost, appropriateness and governance.

Assessing Suitability 2 Assessing Suitability focused on CIPs in general but in an era where advisers’ responsibility was primarily for clients in the accumulation phase. We believe Assessing Suitability 2 will focus on CRPs now that advisers’ responsibility includes clients in decumulation. Helping clients invest for accumulation and decumulation requires a fundamentally different approach. In accumulation, the focus is on attitude to risk, each client’s risk profile, and accumulation portfolios. In decumulation, the focus should be on capacity for loss (not a volatility figure, but economic measures of shortfall risk, income replacement ratio and liability matching), each client’s withdrawal profile (amount of timing of withdrawals and their size relative to asset pool, and the degree of confidence in achieving a particular level of income durability), and decumulation portfolios (the investment engines that are designed to support term-specific withdrawals, rather than targeting long-term growth). Retirement Pathways is transforming the investment approach for non-advised investors in decumulation. Advisers need to position themselves accordingly. The growing use of behavioural finance in policy interventions Harnessing behavioural finance interventions that address behavioural biases, such structured choice architecture and default strategies, is a growing feature of regulatory policy. It is based on the premise of investor “inertia” and is designed to provide protections for less confident and less engaged investors. For this reason, investment strategies with built-in lifestyling, such as target date funds, have a growing role to play in the personal pensions market, as well as the workplace pensions market. Needless to say, these highly governed pathway-type solutions then become a standard (in terms of design, appropriateness, and value for money) against which regulated advice can be compared and measured. Key behavioural aspects and price points of policy interventions:

*Retirement Pathways: there is no price cap specified by the regulator. My definition of a “soft” price cap is because there was a request by the regulator to providers to consider the comparative cost of auto-enrolment solutions when designing non-advised pathways. **DB Pension Transfers: there is no price cap specified by the regulator. My definition of a “soft” price cap is because, under PS20/6, it will become a requirement for advisers to consider and analyse a transfer to a workplace scheme, in the first instance, where the hard price cap of 0.75% does apply. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed