|

[5 min read, open as pdf]

The FCA has now issued its Policy Statements and Finalised Guidance on Consumer Duty. From 31st July 2023, the new rules will come into force for existing products and services. From 31st July 2024, the new rules will come into force for legacy products and services. The rules create a new Consumer Principle that requires firms to deliver good outcomes for consumers by “acting in good faith, avoiding cause of foreseeable harm, and enabling and supporting retail customers to pursue their financial objectives”. Read the full article [7 min read, open link]

In this article for FT Adviser, we explore how the new Consumer Duty rules will impact the design on investment products by providers. Read the article on FT Adviser [3 min read, open as pdf]

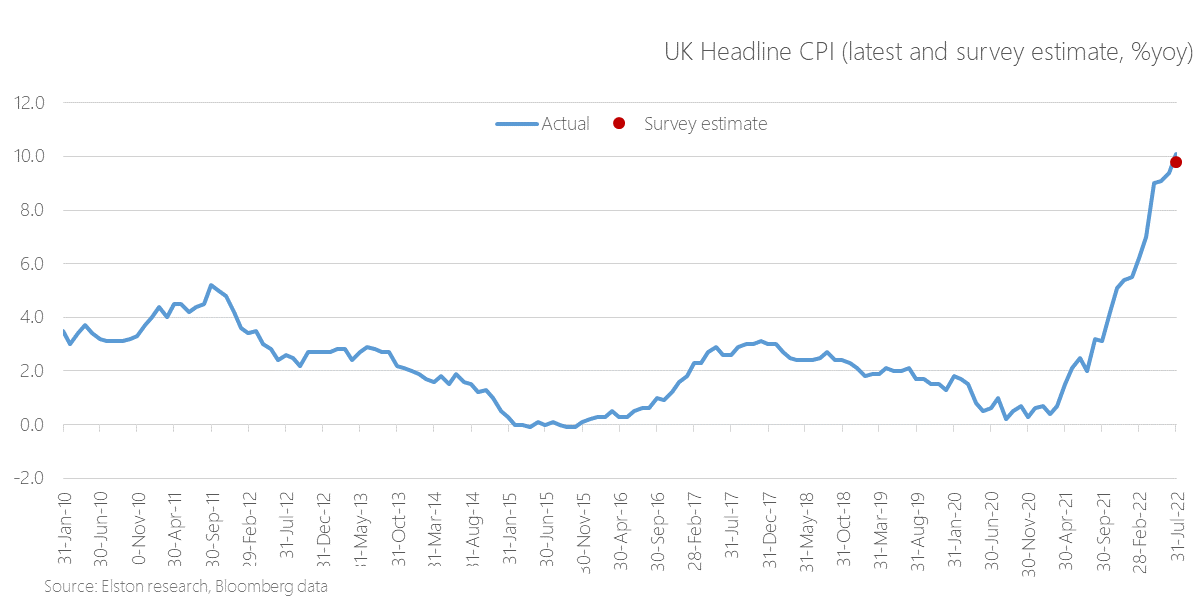

Latest UK inflation figure The latest UK inflation came in at 10.1%yy for June 2022, compared to 9.3%yy survey estimate. This is up from 9.4%yy last month and is above expectations. This is the highest UK inflation rate in 40 years, and now in double digits. Food prices rose meaningfully, especially bakery products, dairy, meat and vegetables, and this was also reflected in higher takeaway-food prices. Inflation pressure has not yet peaked with Bank of England expecting 13% in 4q22 (from 11%) and a further step-up in the retail energy price cap. The BoE remains behind the curve, in our view. See full article including all charts [3 min read, open as pdf]

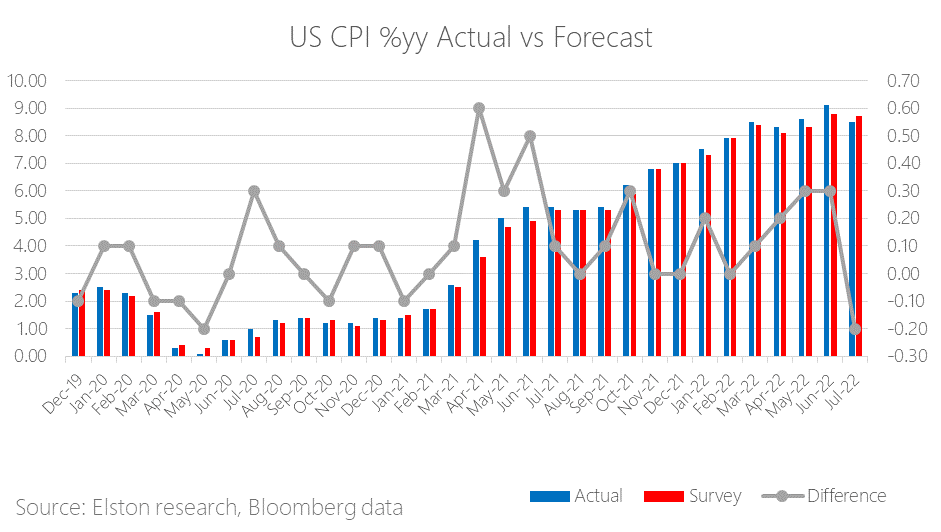

Latest US inflation figures The latest US inflation came in at 8.5%yy for July 2022, lower than survey estimate. This is down from 40-year high of 9.1%yy last month and is lower than expectations of 8.7%. Gasoline prices fell by 7.7% in July, compared to an increase of 11.2%yy in June 2022. Food prices continued rising at a fast rate of 10.9%yy. Shelter cost moved higher by 0.5% from last month and went up by 5.7% from the same time last year. Read in full including charts [3 min read, open as pdf]

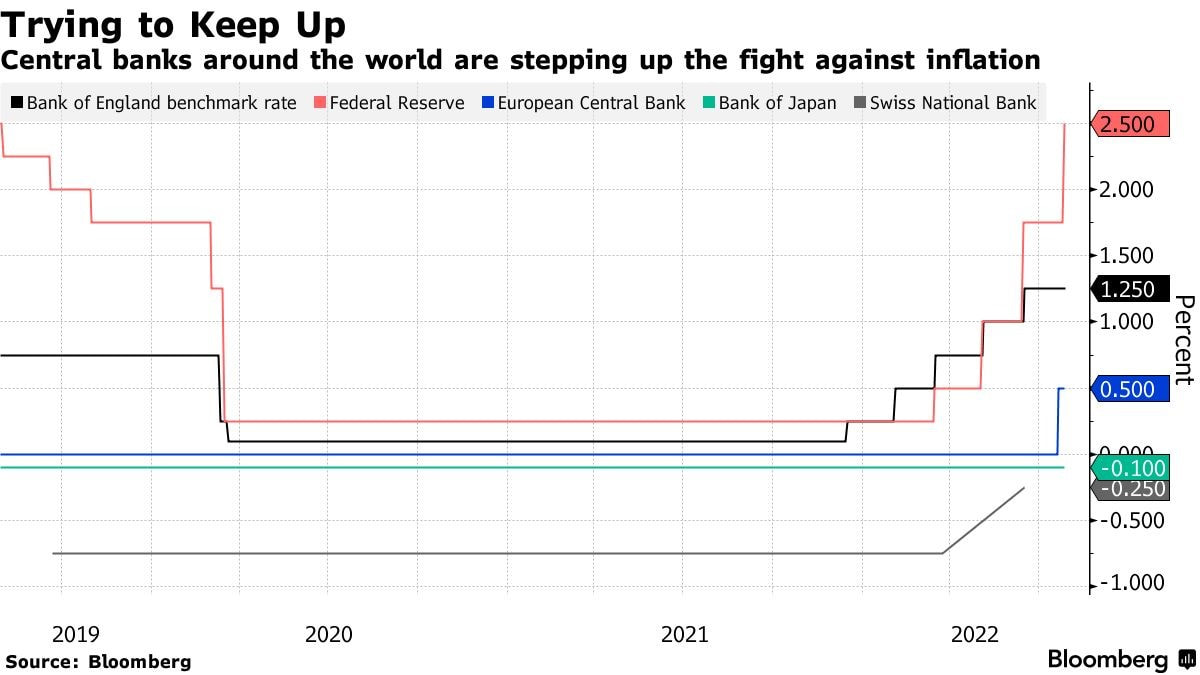

On 4th August, the Bank of England raised rates by 0.5%, the largest single increase since 1995. This followed the US Federal Reserve raising rates by 0.75% at the end of July. While these rate rises may or may not bring inflation under control, the risk they pose to growth is considerable. We consider the ways in which investors can use ETFs to build defensive resilience as an alternative to low-yielding cash or bonds. [3 min read, open as pdf]

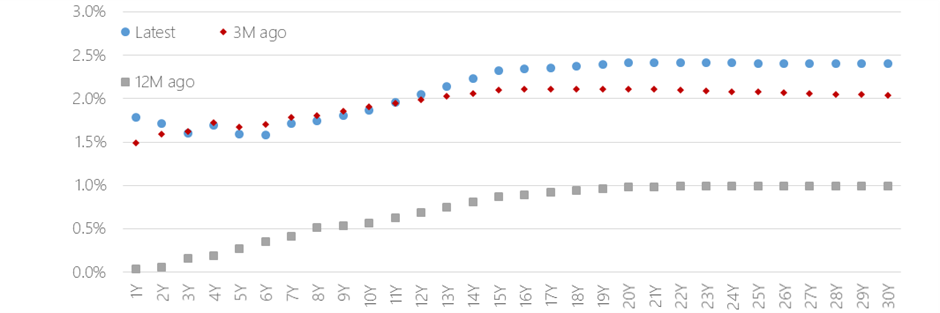

What is the yield curve and how does it illustrate future expectations for the economy? In this article, we explain how to read the yield curve and discuss what the current version is suggesting in terms of inflation, interest rates and recession. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

April 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed