Introducing Elston Liquid Real Asset Index

About this index

Inflation is on the rise. A combination of liquid real assets can help provide near-term and medium-term inflation protection.

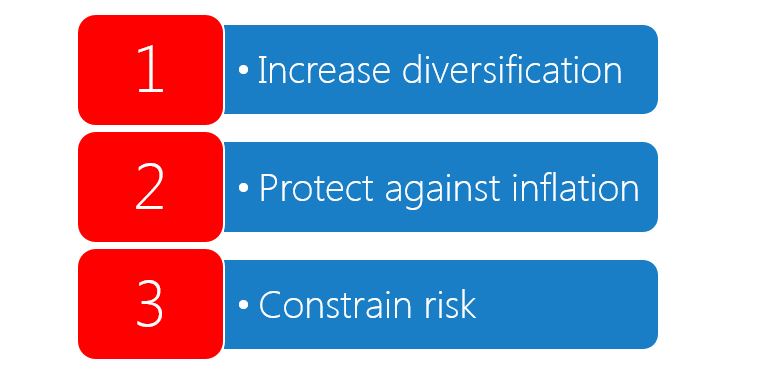

This Index aims to:

1. Increase Diversification: The index represents a range of real asset exposures that focus on providing a real income, a real value or a real difference.

2. Protect Against Inflation: The index provides access to key exposures that enable a layered approach to inflation protection over different time-frames.

3. Constrain Risk: The index is designed to have a volatility comparable to UK gilts to enable partial substitution of bond allocations, without altering a portfolio’s overall risk profile.

Find out more

Sign-up to receive updates and information on this index

See our 2021 index performance update and Insights and Commentary on Liquid Real Assets

Accesing this index

Indices are for benchmarking purposes. You cannot invest in an index.

Visit Valu-Trac Investment Management's website to learn more about funds linked to this index.

This Index aims to:

1. Increase Diversification: The index represents a range of real asset exposures that focus on providing a real income, a real value or a real difference.

2. Protect Against Inflation: The index provides access to key exposures that enable a layered approach to inflation protection over different time-frames.

3. Constrain Risk: The index is designed to have a volatility comparable to UK gilts to enable partial substitution of bond allocations, without altering a portfolio’s overall risk profile.

Find out more

Sign-up to receive updates and information on this index

See our 2021 index performance update and Insights and Commentary on Liquid Real Assets

Accesing this index

Indices are for benchmarking purposes. You cannot invest in an index.

Visit Valu-Trac Investment Management's website to learn more about funds linked to this index.

Index InformationElston Liquid Real Assets Index [ELSLRA Index]

Index Objectives: The Index uses a strategic weighting scheme to allocate across a diverse range of liquid instruments representing real asset classes, such as listed property securities, listed infrastructure securities, asset-backed securities, natural resources, gold, commodity baskets, as well as other instruments that are directly or indirectly inflation-linked. Format: Non-significant Benchmark Index Data Contributors: Elston Methodology Owner: Elston Benchmark Index Administrator: Elston Fund InformationVT Elston Liquid Real Assets Index Fund

ISIN: GB00BLB58C88 |

|