Last week, the US Senate passed a $1.2trillion infrastructure bill that now awaits a House vote as part of the "build back better" campaign, and another part of the "bazooka" post-COVID policy stimulus. Whilst there are plenty of infrastructure equity funds like INFR (iShares Global Infrastructure UCITS ETF) and WUTI (SPDR® MSCI World Utilities UCITS ETF) that benefit from infrastructure spend, for those not wanting to uprisk portfolio, we like GIN (SPDR® Morningstar Multi-Asset Global Infrastructure UCITS ETF) which invests in infrastructure equity and debt securities. Infrastructure & Utilities forms a core part of our Liquid Real Assets Index, for the inflation-protective qualities (tariff formulae typically pass through inflation). The "hybrid" nature of infrastructure - with both equity and bond like components is why we place it firmly in the Alternative Assets category. Helpfully this can be accessed in a highly iquid and (relatively) low-cost format, compared to higher cost, less transparent and potentially less liquid infrastructure funds.

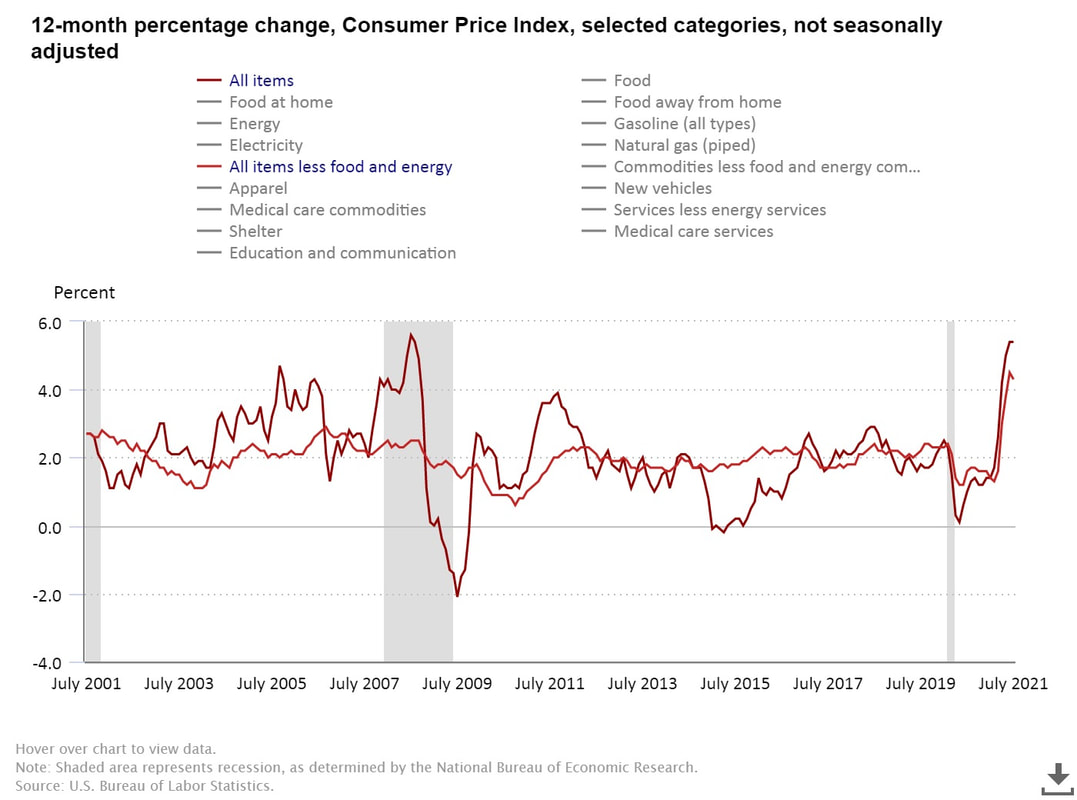

US inflation at highest level in 13 years running at +5.4%yy for second month, Core inflation (excl energy) +4.3%yy (Jul) from +4.5% (Jun). With a slight moderation in core inflation, economists are calling this as the inflation "peak". Whilst this may represent "peak inflation" year over year, overall inflation levels will remain elevated on restart and supply chain constraints As explored in our recent article on “catch-up” rates, we believe Fed policy will remain accommodative, with interest rates "lower for longer", as it lets inflation run "hotter for longer". This is positive for risk assets that offer inflation protection In inflationary regime we favour value-bias equities and real assets for diversification. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed