|

[5 min read, open as pdf]

[5 min read, open as pdf]

[5 min read, open as pdf]

[5 min read, open as pdf]

[5 min read, open as pdf]

[5 min, open as pdf]

[5min read, open as pdf]

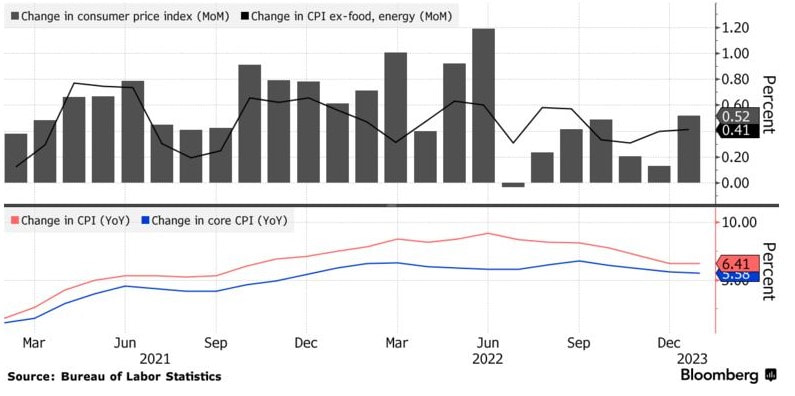

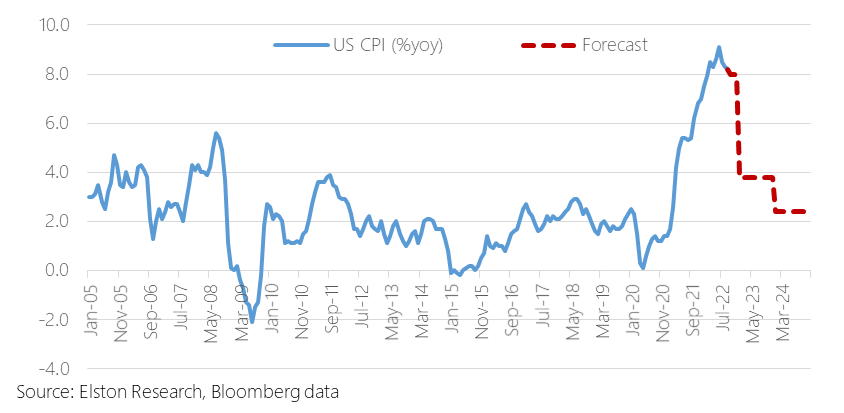

- This is in line with the survey estimate… - … and a decrease from 7.1%yy last month - Lessening inflation pressures means US is past the peak Open as pdf for full update including charts NMA speaks to investment consultant Henry Cobbe about positioning equities for higher inflation using sector and factor equity investing.

Listen to the podcast [5 min read]

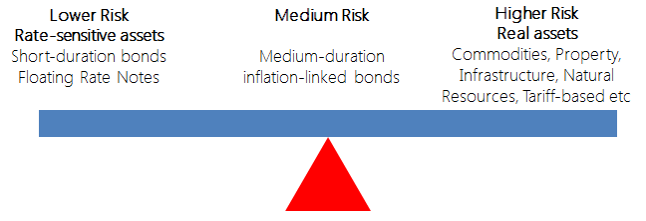

1. Yield is back: for equities, bonds and alternatives - the yield drought is over 2. Selectivity matters more: within and across asset classes 3. Inflation is getting stickier: getting past the peak, but still a problem Read the summary article Find out more:

UK inflation at 10.7%yy for Nov-22

This is lower than 10.9%yy survey estimate… … and an decrease from 11.1%yy last month Represents falling inflationary pressures For full update including charts, open as PDF US inflation at 7.1%yy for Nov-22

This is lower than the survey estimate… … and a decrease from 7.7%yy last month Represents lessening inflation pressures For full update including charts, open as pdf [5 min read, open as pdf]

UK inflation at 11.1%yy for Oct-22

For full updates including charts, open as pdf US inflation at 7.7%yy for Oct-22

This is lower than the survey estimate… … and a decrease from 8.2%yy last month Represents lessening inflation pressures For full update including charts, open as pdf [3 min read, open as pdf]

UK inflation at 10.1%yy for Sep-22

This is higher than 10.0%yy survey estimate… … and an increase from 9.9%yy last month For full update including charts, open as pdf [3 min read - open as pdf]

[5 min, open as pdf]

[5 min read, open as pdf]

The thirty-year anniversary of Black Wednesday was marked by the Sterling reaching its lowest levels against the dollar since 1985. Part of this is a function of dollar strength against global currencies, another part about rising concerns on the UK economic outlook and future policy-making. Sterling’s weakness and outlook is forcing investors to consider how to manage currency risk in their portfolio across each asset class. Full article available as pdf [3 min read, open as pdf]

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed