|

[5 min read]

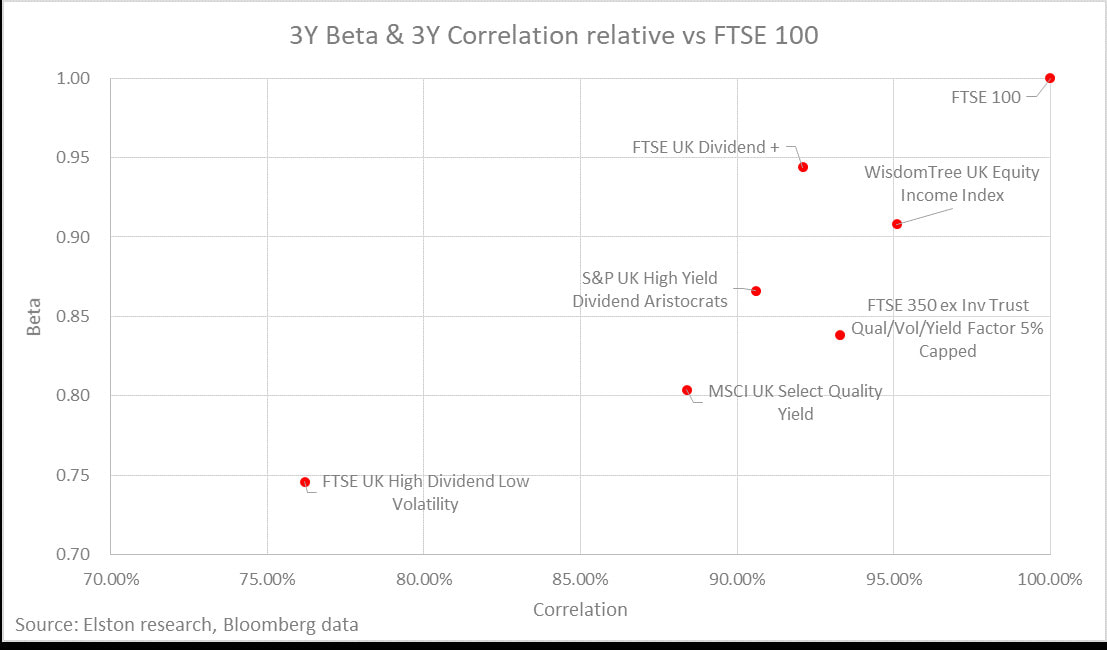

Measuring the beta of an ETF relative to an index is a measure of a fund’s volatility relative to the volatility of its respective index. The beta of an ETF relative to the index it tracks should be close to 1.00. Measuring the correlation of an ETF relative to an index measures the degree to which the fund and index move in relation to each other. The correlation of an ETF relative to the index it tracks should be close to 100%. From a portfolio construction perspective, the correlation of an ETF is important not only to the asset class it relates to, but also to the other components of a portfolio. The decision whether to select a high beta/high correlation, or a low beta/low correlation ETF depends on investor preferences as regards portfolio construction. For investors looking to substitute traditional UK equity cap-weighted exposure (e.g. FTSE 100) with a higher income alternative, without seeking to alter the risk-return characteristics of the portfolio, the ETF selection process should consider ETFs with a Beta and Correlation that is closest to the FTSE 100. For investors looking to supplement or mitigate that same exposure, but with a higher income alternative, whilst seeking also to alter the risk-return characteristics of the portfolio for diversification purposes, the ETF selection process should consider ETFs with a Beta and Correlation that is furthest from the FTSE 100. In the chart below we plot the different UK Equity Income indices historic 3 year Beta and Correlation relative to the FTSE 100. Choosing the right index/ETF depends on portfolio construction preferences

For investors wanting UK equity income exposure most similar to the FTSE 100, the best options are, on the basis of historic correlation and beta:

There are a range of options for investors seeking exposure to UK Equity Income. Whether to include an ETF/index exposure with higher correlation to the FTSE 100 for consistency purposes, or with a lower correlation to the FTSE 100 for diversification purposes is an active choice. [ENDS] Interview with Henry Cobbe, Head of Research, at the TrackInsight ETF Investor Summit Watch the video

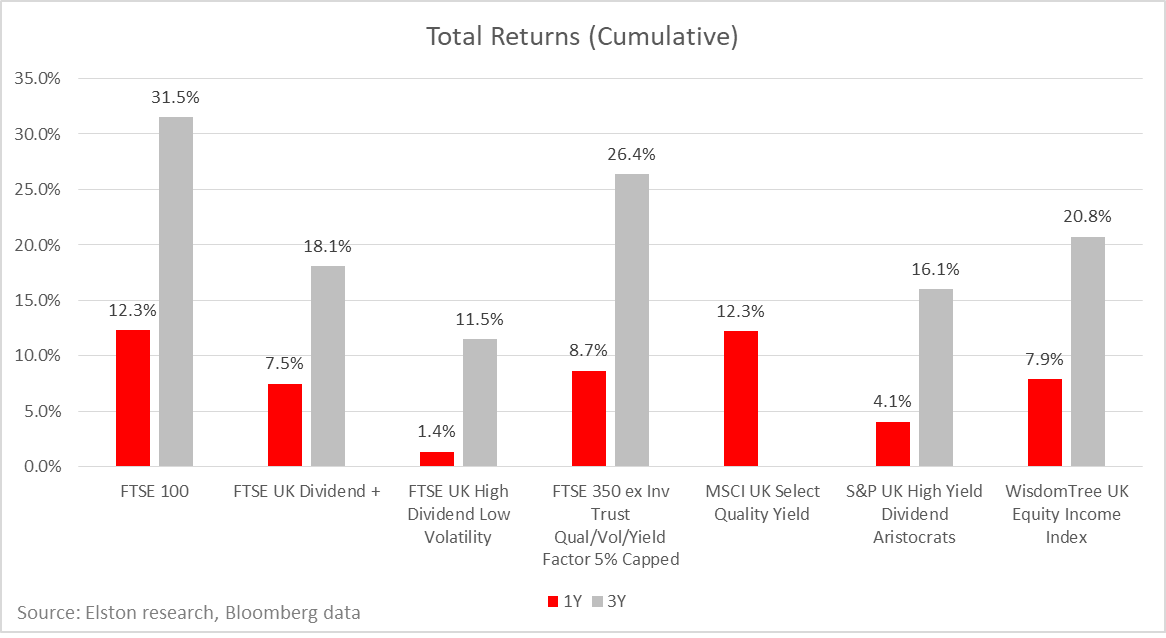

UK Equity Income Indices Investors have a choice of UK Equity Income index strategies, each with different risk-return characteristics, weightings methodologies and factor tilts. These difference influence the performance of each index strategy (all figures below are on a total return basis for GBP investors). Best performing for 2017 The best performing strategies for UK Equity Income in 2017 were:

This compares to +12.3% for FTSE 100 (best tracked by HSBC FTSE 100 UCITS ETF (LON:HUKX)). Best performing over last 3 years The best performing strategies for UK Equity Income over the last 3 years were:

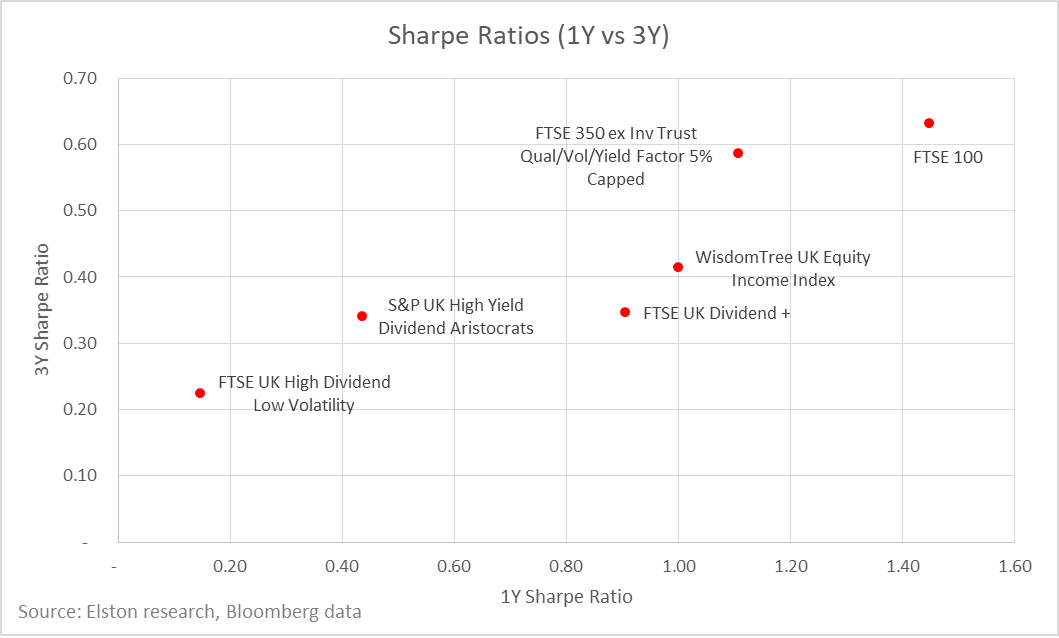

This compares to +31.5% cumulative return for FTSE 100 (best tracked by HSBC FTSE 100 UCITS ETF (LON:HUKX)). Fig. 1: Total Returns (Cumulative) by strategy/index (cumulative, GBP terms) Best risk-adjusted returns The best risk-adjusted returns in 2017 of available UK Equity Income indices was achieved by:

To look at consistency of risk-adjusted returns, we have plotted 1Y Sharpe ratios vs 3Y Sharpe ratios for each UK Equity Income index strategy in Fig.2 below. Fig.2. 1Y & 3Y Sharpe Ratios, selected UK Equity Income index strategies (GBP terms) Conclusion Different index construction methodologies has a material impact on performance outcomes – both in absolute terms and on a risk-adjusted basis. A naïve interpretation is to consider performance in isolation, however our view is that index selection is more nuanced than that: it should relate to the objectives and constraints of individual client portfolios and the desired exposure - on asset-basis, risk-basis and factor-basis and the interaction between the selected strategy and the rest of a client portfolio. Note: Scope of our comparison For these reports, we have analysed the indices and ETFs detailed in Fig.3. Fig. 3: UK Equity Income Indices & ETFs vs HSBC FTSE 100 UCITS ETF (LON:HUKX) [ENDS]

NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: N/A; Chart credit: Elston Consulting; Table credit: Elston Consulting All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. Chart data is as at 30-Dec-17

Focus on market cap indices is a choice, not an obligation A market cap weighted approach has well known drawbacks: it biases larger companies, regardless of efficiency and is "procyclical" - buying larger amounts of more expensively valued companies. This is a critique of "passive investing". We don't believe there's such a thing as passive investing. There is index investing and non-index investing. There is subjective investing and systematic investing. Choice of index, choice of methodology, choice of asset allocation are all active decisions. Index investing simply delivers the desired investment approach in a way that is efficient, transparent and cheap. Factor-based indices The arrival of factor-based indices, means that for a required World Equity exposure, we can select which factors we want exposure to: for example, Size, Momentum, Quality, Value or Minimum Volatility. The different factors can be summarised as follows:

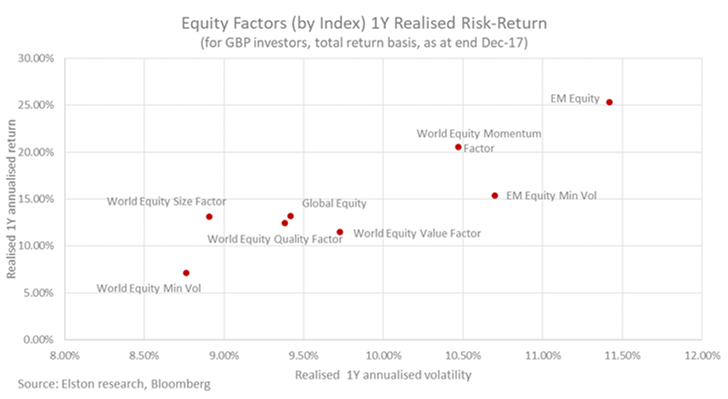

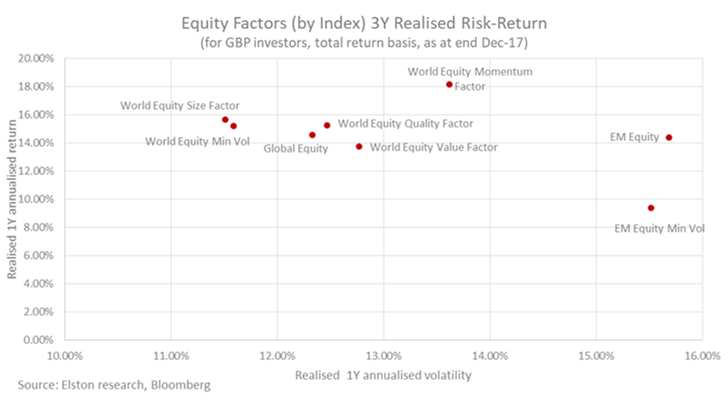

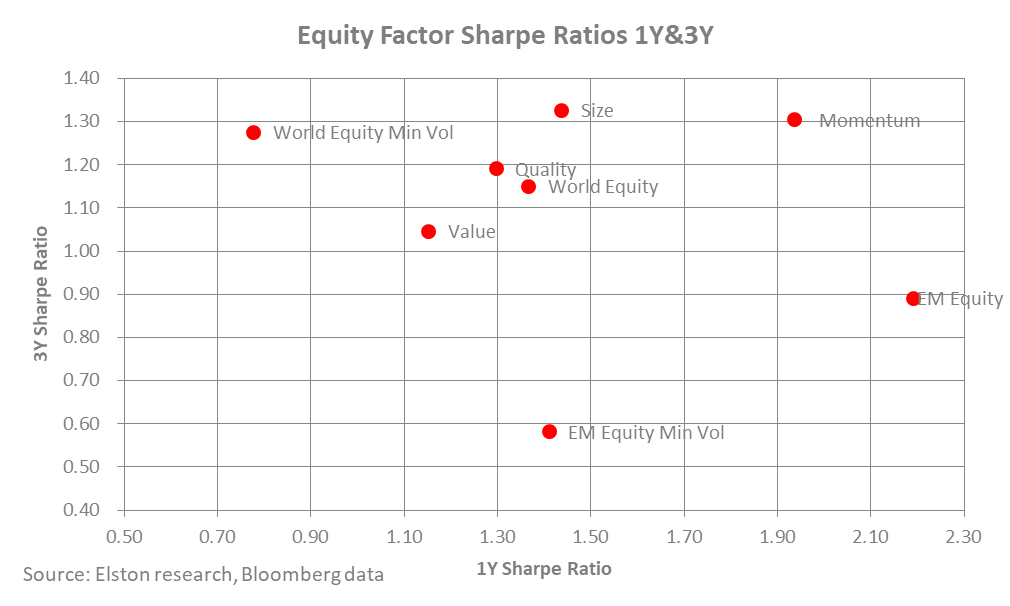

How have these different factors fared? Ranking the 1Y performance of these factors in 2017: Momentum factor delivered the highest total return at +20.6%, followed by Size factor at +13.1%, followed by Quality factor at +12.5%, followed by Value factor at +11.5%, and finally Min Volatility at +7.1%. This compares to +13.2% for the traditional cap-weighted approach. Fig 1. Equity Factor 1Y Realised Risk-Return On a 3Y basis, the annualised returns of Momentum come in at +18.2%, followed by Size at +15.7%, followed by Quality at +15.2%. This compares to +14.6% for the traditional cap-weighted approach. Fig 2. Equity Factor 3Y Realised Risk-Return Risk-Adjusted Returns Ranking the 1Y risk adjusted performance by Sharpe Ratio: Momentum leads at 1.94, followed by Size at 1.44, followed by Quality at 1.30. This compares to 1.37 for the traditional cap-weighted approach. On a 3Y basis, Size leads at 1.33, followed by Momentum at 1.30, followed by Quality at 1.19. This compares to 1.15 for the traditional cap-weighted approach. In Fig 3. we plot the 1Y and 3Y Sharpe ratio for each World Equity factor relative to traditional cap-weighted Global and EM Equity indices, to compare the risk-adjusted returns of different factor exposures over different time frames. Fig 3. Equity Factor Sharpe Ratios Conclusion: a differentiated approach

We are not suggesting that one factor approach is inherently superior to another. But with a broader array of factor exposures readily accessible to decision-makers to match with their portfolio requirements, there's no longer need to complain about the limitations of cap-weighted indices. NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: N/A; Chart credit: Elston Consulting; Table credit: Elston Consulting All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. Chart data is as at 30-Dec-17

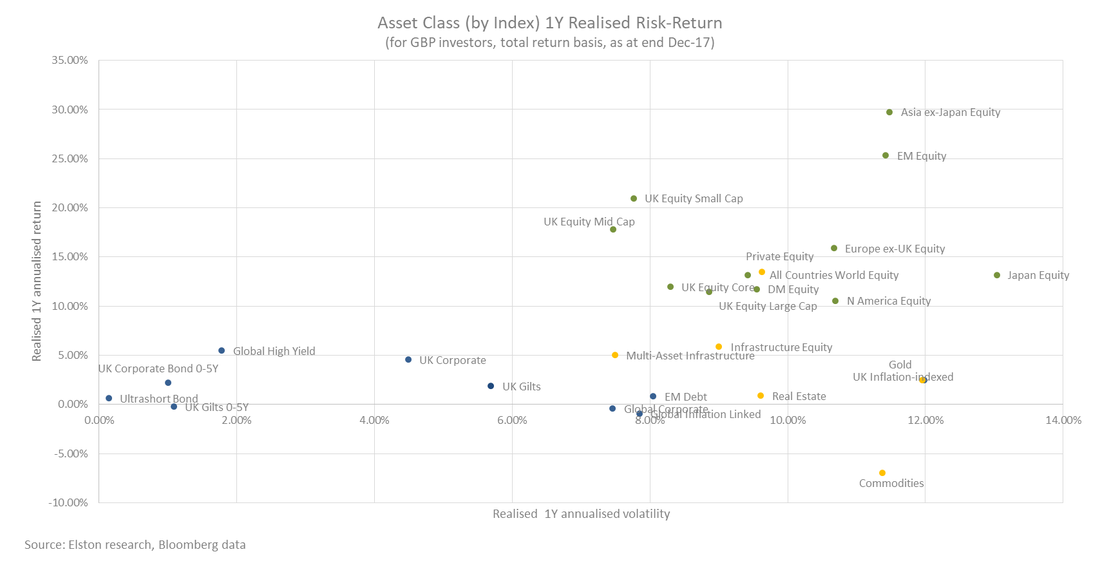

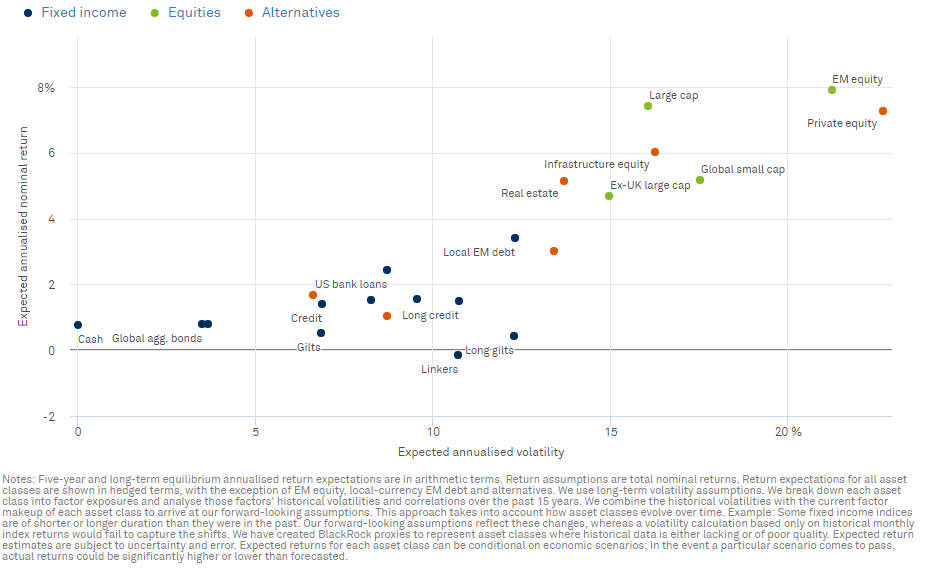

For historic and expected asset class risk-return perspectives, see below. Fig. 1: 1-year historic asset class risk-return for GBP investors Fig. 2: 3-year historic asset class risk-return for GBP investors Fig. 3: 5-year expected asset class risk-return for GBP investors Source: Blackrock Investment Institute, total returns basis (arithmetic) for GBP investors

NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: N/A; Chart credit: Elston Consulting (Fig 1&2), BlackRock (Fig 3); Table credit: N/A All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. Chart data is as at 30-Dec-17 |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed