|

[5 min read]

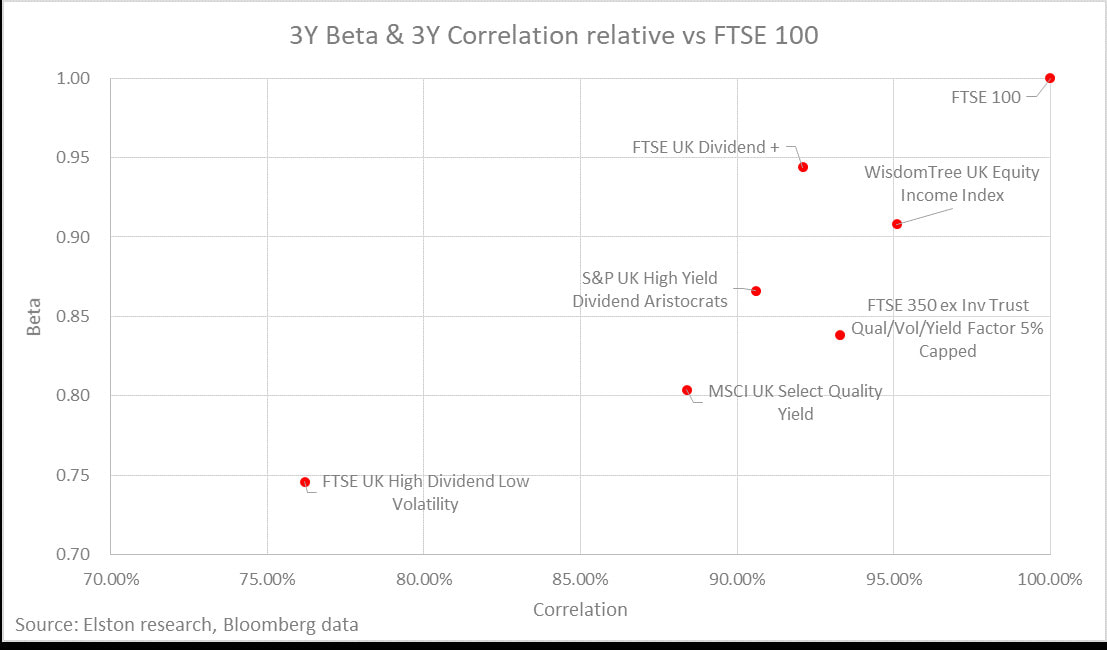

Measuring the beta of an ETF relative to an index is a measure of a fund’s volatility relative to the volatility of its respective index. The beta of an ETF relative to the index it tracks should be close to 1.00. Measuring the correlation of an ETF relative to an index measures the degree to which the fund and index move in relation to each other. The correlation of an ETF relative to the index it tracks should be close to 100%. From a portfolio construction perspective, the correlation of an ETF is important not only to the asset class it relates to, but also to the other components of a portfolio. The decision whether to select a high beta/high correlation, or a low beta/low correlation ETF depends on investor preferences as regards portfolio construction. For investors looking to substitute traditional UK equity cap-weighted exposure (e.g. FTSE 100) with a higher income alternative, without seeking to alter the risk-return characteristics of the portfolio, the ETF selection process should consider ETFs with a Beta and Correlation that is closest to the FTSE 100. For investors looking to supplement or mitigate that same exposure, but with a higher income alternative, whilst seeking also to alter the risk-return characteristics of the portfolio for diversification purposes, the ETF selection process should consider ETFs with a Beta and Correlation that is furthest from the FTSE 100. In the chart below we plot the different UK Equity Income indices historic 3 year Beta and Correlation relative to the FTSE 100. Choosing the right index/ETF depends on portfolio construction preferences

For investors wanting UK equity income exposure most similar to the FTSE 100, the best options are, on the basis of historic correlation and beta:

There are a range of options for investors seeking exposure to UK Equity Income. Whether to include an ETF/index exposure with higher correlation to the FTSE 100 for consistency purposes, or with a lower correlation to the FTSE 100 for diversification purposes is an active choice. [ENDS] Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed