|

[3min read, open as pdf]

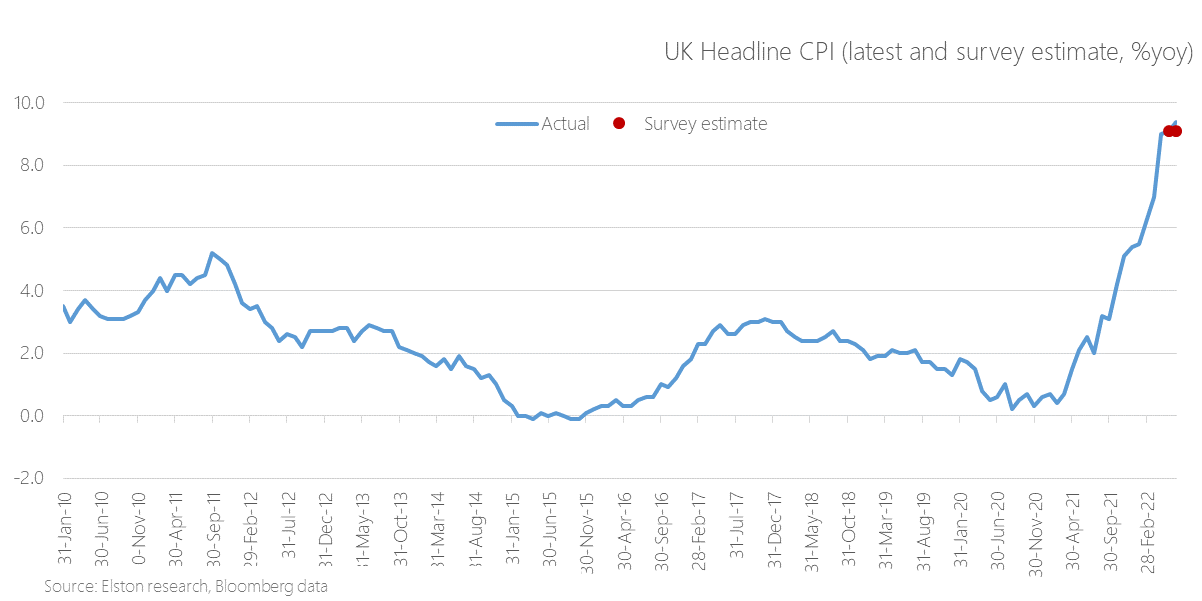

This is the highest UK inflation rate in 40 years. Higher prices for motor fuel and food explained the increase in prices [5 min read, open as pdf for full article]

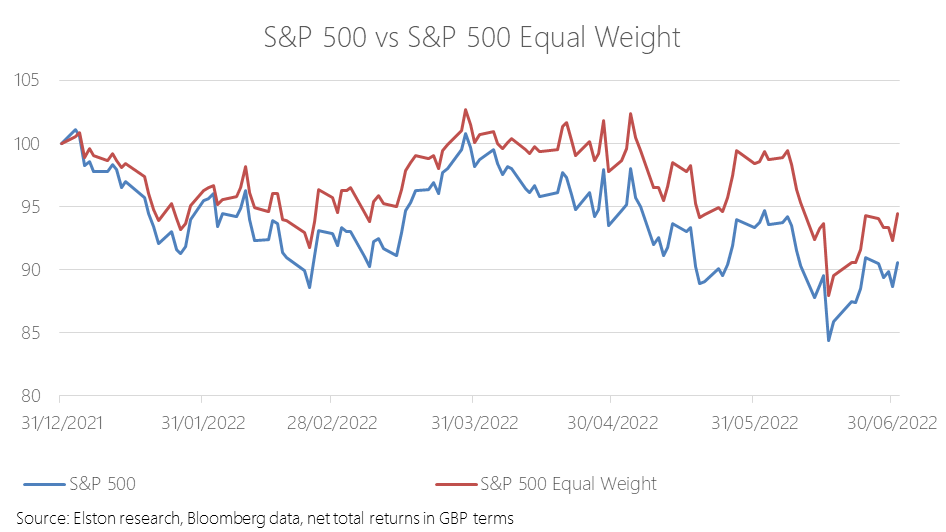

Critics of tracker funds often flagged concentration risk or the “big get bigger” approach of passive investing as a structural flaw to index investing. But concentration risk is a choice, not an obligation for the index investor. As would be expected, an equal weight approach has proved relatively more defensive in the down-market year-to-date. The S&P500 Equal Weight index has returned -5.2% against the traditional S&P 500’s -9.3% YTD, in GBP terms. For more on this topic, please see our CISI-endorsed CPD webinar: The curious power of equal weight, with guest speaker Tim Edwards, Managing Director, Index Investment Strategy, S&P Dow Jones Indices [3 min read, open as pdf]

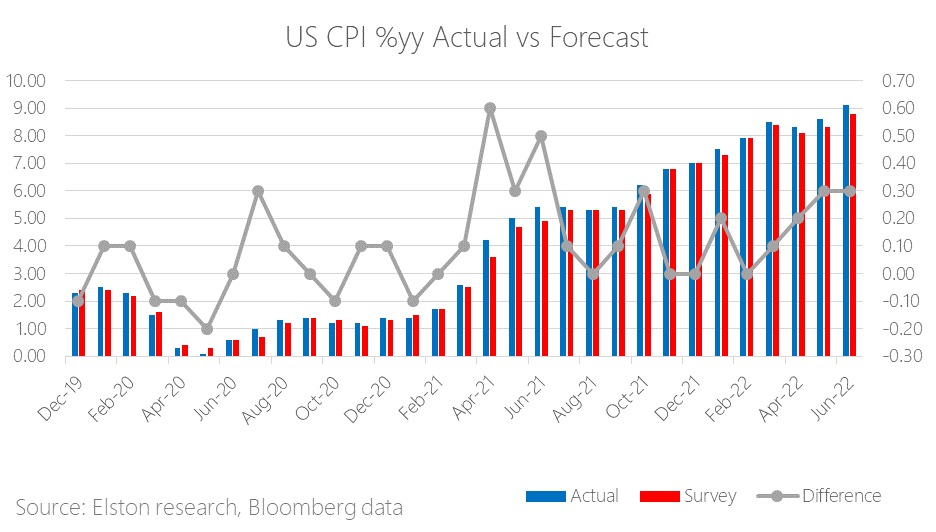

Gasoline prices jumped by 11.2% compared to May 2022. Higher prices of food and shelter also contributed to the highest US inflation rate in 40 years. Inflation pressure is broadening as energy and groceries prices surge. [5 min read, open as pdf]

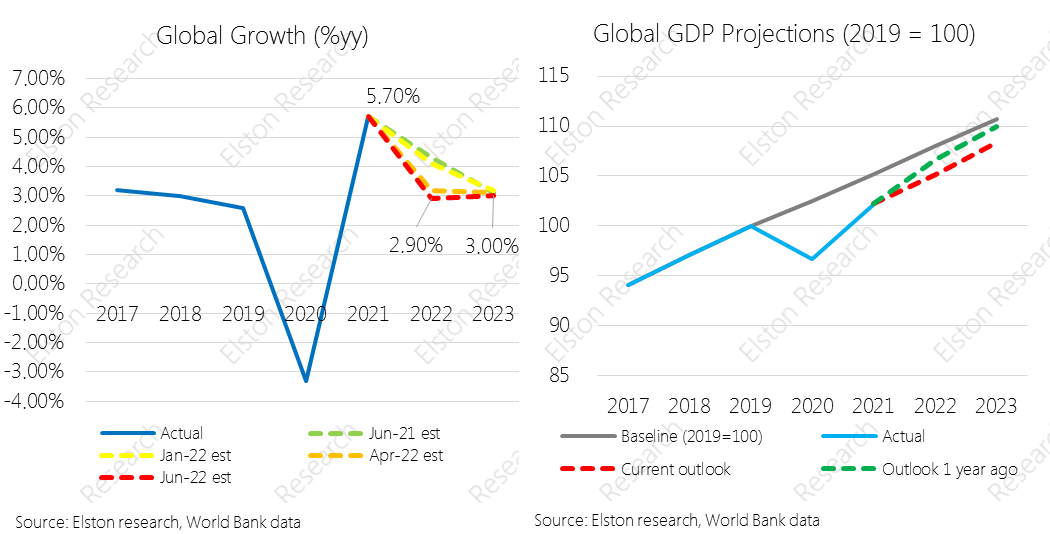

A perfect storm of events is giving rise to the gloomiest global economic outlook since the 1970s. Supply chain disruption brought about by the Covid-19 pandemic has collided with a spiral in energy and commodity prices triggered by the Ukraine war, unleashing a bout of persistently high inflation. Central banks have been slow to react, sticking to their line that the inflation was transitory, meaning that they are now faced with the finest of tightropes to walk between curbing inflation and triggering recession. The World Bank has been steadily revising down its 2022 global growth estimates over the last 12 months. From +4.3%yy in June 2021, to +3.20% in April 2022 to +2.90% in June 2022. For full article, open as pdf As an investment consultant, a lot of what we do for financial advisers & DFMs we work with is to use our research & development capabilities across Portfolios, Fund & Indices to support our clients' own "proposition development", that goes beyond just portfolio design.

So we were delighted that both our Custom Portfolios solution for advisers - with Elston Portfolio Management - and our Liquid Real Assets Index strategy for inflation protection were "Highly Commended" in the "Best Proposition Development - Overall" Category at the 2022 Investment Week Innovation & Marketing Awards against some very well respected colleagues and providers! We were also very happy to be a Finalist in the "Best Thought Leadership - Retail" category for our extensive CISI-endorsed CPD webinar programme. We would be delighted to work with UK advisers to support your investment proposition, please get in touch if you would like an initial consultation. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

April 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed