|

[5 min read, full article in pdf]

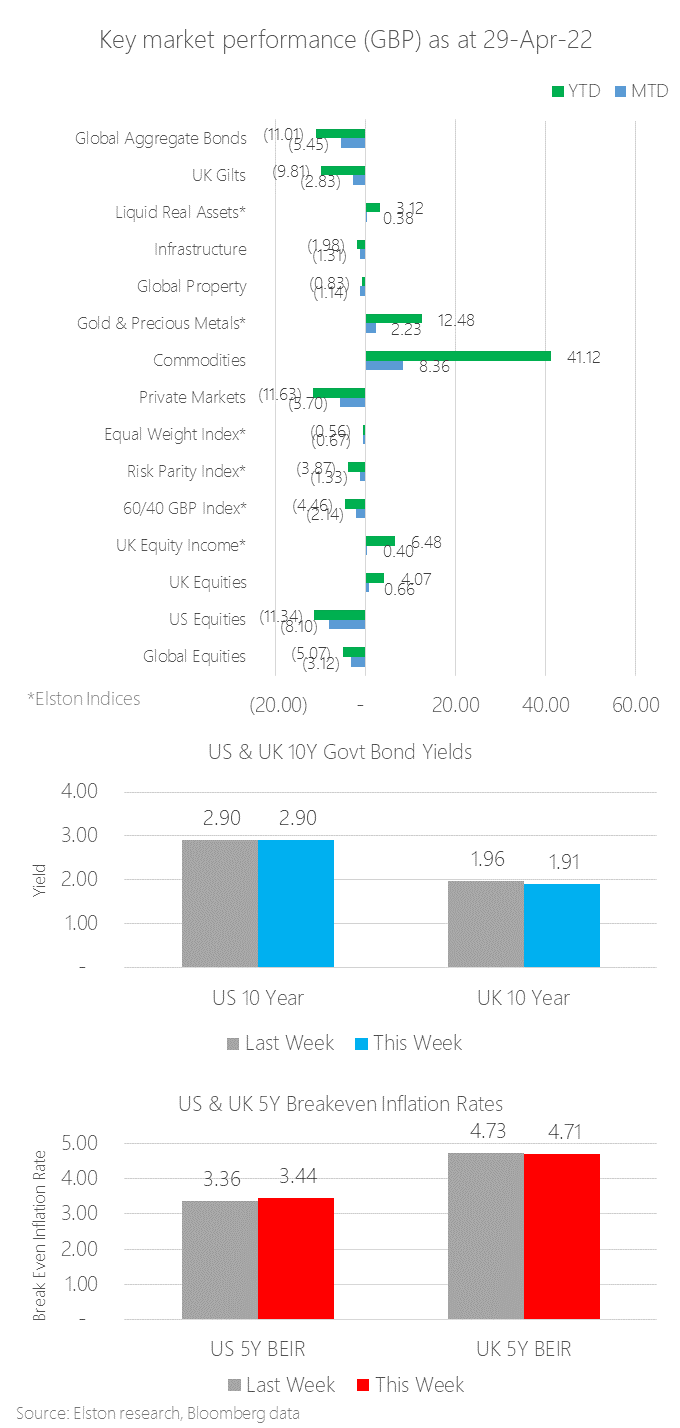

Monthly update, by exposure Once again, Commodities were the top performing asset class in April, returning +8.36% in GBP terms, owing to ongoing inflation pressure from the Russia/Ukraine war, supply-chain, sanctions and energy crisis. Gold & Precious Metals returned +2.23% as an inflation hedge. UK Equities were up +0.66%, and UK Equity Income +0.40%, compared to -8.10% for US Equities and -3.12% for Global Equities, in GBP terms. UK Equities performance was not an indicator of underlying strength, but a function of the translation effect of overseas revenues, in the context of a dramatic -4.37% decline in Sterling vs the USD – the worst decline since COVID March 2020. This came on the back of weaker retail sales and low consumer confidence. Without government spending to fill a growing vacuum, the cost of living crisis (which will only get worse in the autumn) could become recessionary in nature as consumers and businesses defer spending. This risk to growth is greater than the risk of persistently high government debt levels, in our view. Bonds continued to show they offered no place to hide with Global Aggregate Bonds down -5.45%. Our Liquid Real Assets index returned +0.38% for the month, compared to Gilts -2.83%, with comparable volatility. Within the multi-asset space, our Equal Weight index declined -0.67%, and “Equal Risk” (or “Risk Parity” Index_ returned -1.33%, compared to -2.14% for a traditional 60/40 GBP portfolio. US & UK 10 year yields closed at 2.90% (from 2.32%) and 1.91% (from 1.62%) respectively. US & UK 5 year market-implied Break Even Inflation Rates closed at 3.44% (from 3.51%) and 4.71% (from 4.72%) respectively. See full article in pdf [5 min read, full article in pdf]

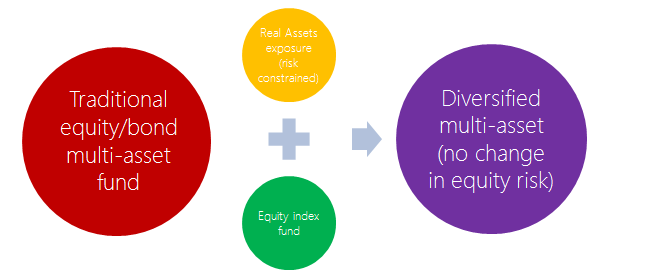

In theory, through 2021 we have argued that bonds would remain under pressure against the twin pressures of rising interest rates and rising inflation. In practice, market dislocations of 1q22 evidenced this as bonds provide no place to hide in a time of market stress, and lost both their diversification and their protection characteristics. Indeed, the losses sustained on the bond side of a traditional multi-asset equity/bond portfolio were more extreme than the losses sustained on the equity side. The pressure on bonds will continue so long as we are in an inflationary regime. And that may be for the medium-term (e.g. 5 or more years based on market implied inflation rates). This is forcing a rethink for advisers reliant on equity/bond multi-asset funds to deliver a core investment strategy for their clients. [Read full article in pdf] Find out more about our Liquid Real Assets index strategy [5 min read, open as pdf for full article]

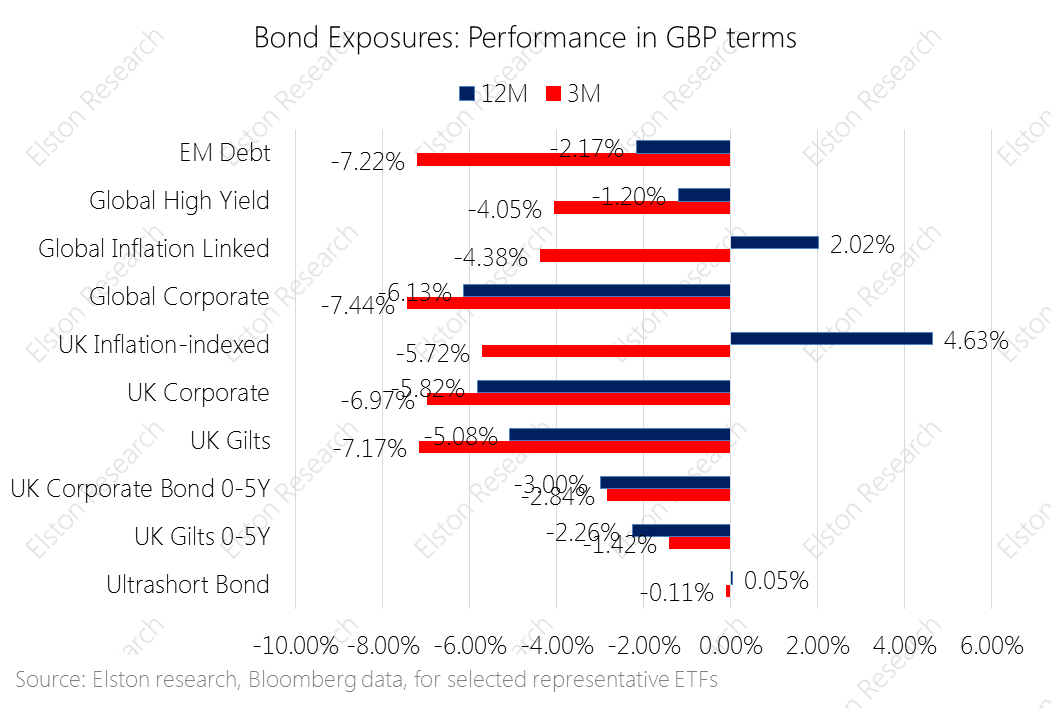

Equity markets endured a triple shock in the first quarter of 2022: a dramatic steepening of the likely path of interests, multi-year high inflation levels and a horrific war unleased in Ukraine. The traditional rational for including nominal bonds was to provide steady income, lower but positive returns, and diversification – a place of safety in periods of market stress. In face of rising inflation and rising interest rates, nominal bonds are providing none of these portfolio functions. Indeed in 1q22 not a single bond exposure delivered positive returns, and over 12 months only inflation-linked exposures delivered positive returns. Open as pdf for full article CPD Webinar Alternatives to Bonds in a Portfolio [5 min read, open as pdf for full article]

The pressure on nominal bonds from rising inflation continues. Real assets provide potential for inflation protection. Our Liquid Real Assets Index represents a combination of higher-risk, inflation-sensitive assets (such as listed property, infrastructure, commodities and natural resources) and lower-risk, rate-sensitive assets (such as Floating Rate Notes). This mix is intended to provide exposure to a real asset return pattern, with bond-like volatility. [5 min read, open as pdf for full article] |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed