|

It's hard not to get emotional when markets get difficult.

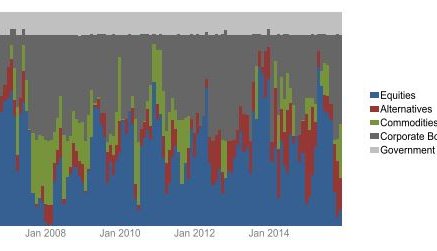

As with any temper-tantrum, having a clear rules-based approach can help maintain investment discipline when emotions run high. One of the attractions of a multi-asset Smart Beta approach is that portfolios can dynamically adapt to "reflect the pulse" of the markets following clearly defined, systematic rules. While this may be short on art, and long on science, compared to smart Alpha managers, the scientific approach also benefits from the certainty of much lower fees. Furthermore, a dynamic approach can help mitigate tail-risk. For anyone except those with an infinite time horizon (endowments), relying on a traditional single-period mean variance optimisation model for asset allocation strategy is problematic, because the long-run assumptions on which they rely do not necessarily hold for the short-run. And when it comes to managing tail-risk, the short-run matters. This is why our portfolio construction approach is outcome-oriented, aiming to create for example a Max Sharpe portfolio or Min Volatility out of a broad opportunity set of liquid, physical ETFs representing a broad range of asset classes and geographies. We've just past the 1-year live-pricing anniversary of the Elston Strategic Beta indices - the Global Max Sharpe strategy (Ticker ESBGMS) and Global Min Volatility (Ticker ESBGMV) strategy. For asset-owners looking at alternative ways to manage risk beyond a long/short 2&20 approach, low-cost risk-based multi-asset strategies are becoming a compelling alternative. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed