|

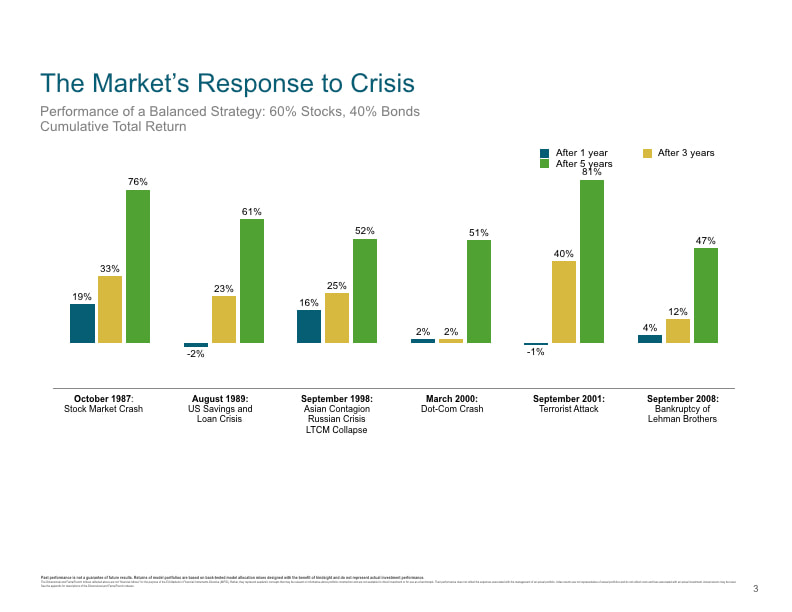

Global stocks have been on something of a rollercoaster ride just lately, with markets trading at, or near, a two-year low. Doubtless many investors, especially those who are close to retirement, are feeling fearful. Fear is a hugely powerful emotion. It makes us do irrational things, and the sad fact is that, in the context of investing, there’s no shortage of people who want to take advantage. The Californian financial adviser and blogger Robert Seawright wrote an excellent article on this subject the other day. “When the markets are roiling,” he wrote, “fear is pitched all day, every day, and human nature buys it. And pays a premium. A very big premium.” “Fear makes money,” says Daniel Gardner in his book The Science of Fear. “The countless companies and consultants in the business of protecting the fearful from whatever they may fear know it only too well. The more fear, the better the sales.” So, what’s the answer, apart from steering well clear of salespeople? First things first: don’t feed the fear. When behavioural finance expert Greg Davies was invited on to Bloomberg to talk about the market rout in 2008, he was asked, live on air, what should investors if they’re really worried. “They should stop watching Bloomberg for a start,” he replied. Apparently, they tend not to invite him now. But, more importantly, investors who are anxious need to do some reading and arm themselves with an understanding of the bigger picture. To do it properly, it’s going to take you a little while. If you don’t have time, you could just watch a short video just released by Dimensional Fund Advisors, on how markets reward investors who stay disciplined at times such as these. The video is presented by DFA’s Vice-President and Head of Advisor Communication, Jake DeKinder. In the video, Jake says this: "Recent events have increased the feeling of uncertainty and may have led some to question whether to not to make changes to their investment approach. "It’s important to remember that while these events might seem frightening in the moment, they are not necessarily unique or unusual. “Throughout history capital markets have rewarded investors who are able to stay disciplined. After many major events, financial markets have recovered and delivered positive returns.” So what sort of events is Jake referring to? Well, here’s a series of graphs showing how a balanced portfolio comprising 60% equities and 40% bonds fared in the one, three and five years following the last six major market downturns: What these graphs show very clearly is that those who stayed invested while so many others didn’t were amply rewarded on each occasion.

Here’s Jake DeKinder again: "Over the long term, investors who have been able to remain patient and tune out the short-term noise surrounding these events have been rewarded for doing so. “In the face of uncertainty, it’s important to remember this historical perspective, and focus on the things we can control, rather than the things we can’t.” If you’re in any doubt about what, if anything you should be doing, you should seek the help of a financial adviser. Otherwise, take Jake DeKinder’s advice: tune out the noise, think long term and disregard anything that’s out of your control. And most of all, fear not. Christmas is costly enough without baling out of the stock market. Here’s the Dimensional video: Dimensional Fund Advisors: Markets reward discipline

Elston's Henry Cobbe, Head of Research discusses ETF trends on Bloomberg ETF IQ programme.

Watch the Video It’s almost that time of year when thoughts turn to resolutions for the 12 months ahead. Financial resolutions are always among the most common and, according to a poll by YouGov, the most popular resolutions in the UK this time last year included reading new books and learning a new skill.

For 2019, how about aiming to improve your knowledge of investing and personal finance through reading? No, we’re not talking about articles and blog posts, which only give you a tiny snapshot, but actual books which will leave you feeling that you’ve genuinely broadened your understanding. If that appeals, here are seven books we would recommend. THE BIGGER PICTURE The Geometry of Wealth: How to Shape a Life of Money and Meaning by Brian Portnoy Most people embark on an investment strategy without having a plan, and it’s not a good idea. True wealth, explains Brian Portnoy, is “funded contentment”. So, first of all, you need to work out what contentment looks like for you. What do you want from life? How much money do you need to enable you to lead that life? And when are you going to need it? Tackling these big questions and tending to everyday financial decisions, says Portnoy, are complementary, not separate, tasks. His book will help you to find the answers. The Financial Wellbeing Book by Chris Budd Personal wellbeing has almost become a new religion, but there are very few books that specifically tackle the financial aspect of it. In this book, former financial planner Chris Budd picks up on many of the issues discussed in The Geometry of Wealth. The starting point, he says is to “know thyself”. He then goes on to explain the secret to feeling in control of your finances, being able to cope with a financial shock and ensuring you always have options — and the peace of mind that goes with each of those. INVESTING The Little Book of Common Sense Investing by Jack Bogle Jack Bogle is the founder of Vanguard Asset Management, and the world’s most prominent advocate of low-cost index funds. This short, best-selling classic explains, in simple terms, how to guarantee your fair share of stock market returns by simply tracking global markets at minimal cost. The tenth anniversary edition has been updated and revised and is personally endorsed by none other than Warren Buffett. How to Invest with Exchange-Traded Funds (ETFs): A practical guide for the modern investor by Henry Cobbe & Shweta Agarwal OK, we’re not entirely impartial — Henry Cobbe is, of course, Elston Consulting’s Head of Research. But this book will particularly suit those who are looking to manage their own investments. It explains how to diversified and manage a low-cost, diversified and robust portfolio constructed entirely with ETFs. The Four Pillars of Investing by William Bernstein Learn about investing in just three books? Are we serious? Yes, we are. To quote William Bernstein in The Four Pillars of investing, “the body of knowledge that the individual investor, or even the professional, needs to master is pitifully small.” Bernstein’s book is a superbly written, down-to-earth and easy-to-read explanation of how to design an effective investment strategy and how to construct and manage an investment portfolio that reflects your personal capacity for risk. FINANCIAL HISTORY The Ascent of Money: A Financial History of the World by Niall Ferguson Uh? Why do you need to know about history to be financially savvy? Well, it’s true that history doesn’t repeat itself exactly, but having a very long-term perspective helps you to understand how financial markets work. “Sooner or later, says Niall Ferguson, “every bubble bursts (and) greed turns to fear.” But the good news is that capitalism has proved remarkably resilient over the centuries and, for patient investors, equities have delivered strong returns compared to cash and bonds. PSYCHOLOGY Thinking Fast and Slow by Daniel Kahneman What? How does a knowledge of psychology make you more financially literate? The answer is that, as the legendary investor Benjamin Graham once said, “the investor's chief problem – and even his worst enemy – is likely to be himself.” As Nobel laureate Daniel Kahneman explains, our minds are tripped up by error and prejudice, and investors are a classic example. His book includes a wealth of wisdom, as well as practical techniques for improving the decision-making process. Book lists are, of course, subjective. Books that we find helpful might not do the trick for you. Let us know how you get on with these, and if you have any suggestions for books we should add to future lists, we would love to hear from you. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed