Markets don't stand still. Should portfolios?

We explore two apparently opposing schools of thought. Read the full article in FT Adviser [5 min read, open as pdf for full article]

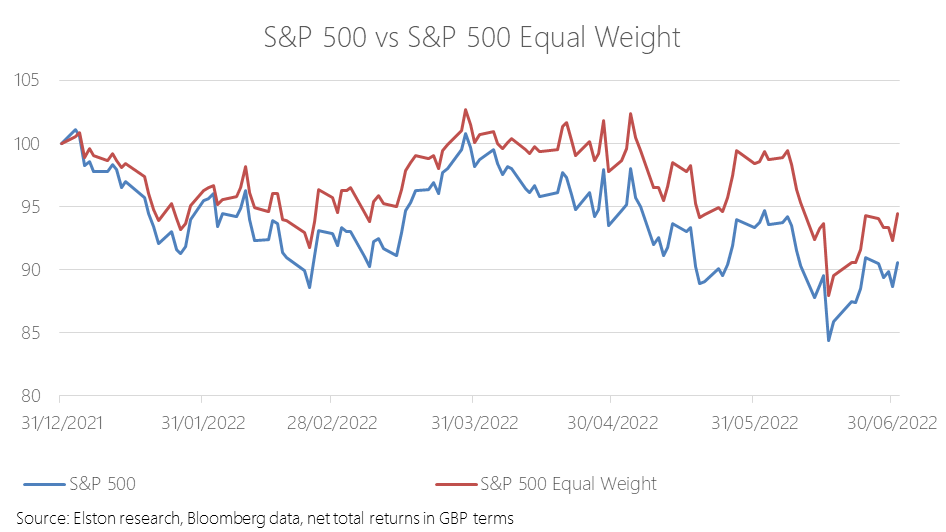

Critics of tracker funds often flagged concentration risk or the “big get bigger” approach of passive investing as a structural flaw to index investing. But concentration risk is a choice, not an obligation for the index investor. As would be expected, an equal weight approach has proved relatively more defensive in the down-market year-to-date. The S&P500 Equal Weight index has returned -5.2% against the traditional S&P 500’s -9.3% YTD, in GBP terms. For more on this topic, please see our CISI-endorsed CPD webinar: The curious power of equal weight, with guest speaker Tim Edwards, Managing Director, Index Investment Strategy, S&P Dow Jones Indices [Open full article as pdf]

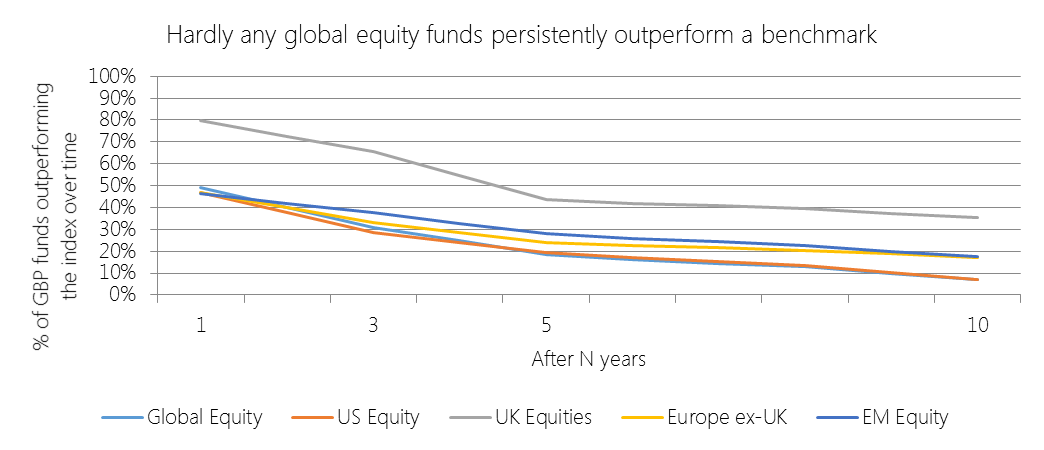

“Suppose we define a passive investor as anyone whose portfolio of U.S. equities is the cap-weight market portfolio described above. Likewise, define an active investor as anyone whose portfolio of U.S. equities is the not the cap-weight market portfolio. It is nevertheless true that the aggregate portfolio of active investors (with each investor's portfolio weighted by that investor's share of the total value of the U.S. equities held by active investors) has to be the market portfolio. Since the aggregate portfolio of all investors (active plus passive) is the market portfolio and the aggregate for all passive investors is the market portfolio, the aggregate for all active investors must be the market portfolio. All this is obvious. It is just the arithmetic of the fact that all U.S. equities are always held by investors. Its implications, however, are often overlooked.” What Bill Sharpe was saying to us was this: the performance of all active managers is, in aggregate [for a given asset class] that of the index less active fees. Which is a considerably worse deal than the charge often levelled against passive funds, namely that investors are paying for the performance of the index less passive fees. CPD Webinar: Is active management a zero-sum game? |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed