|

[Open full article as pdf]

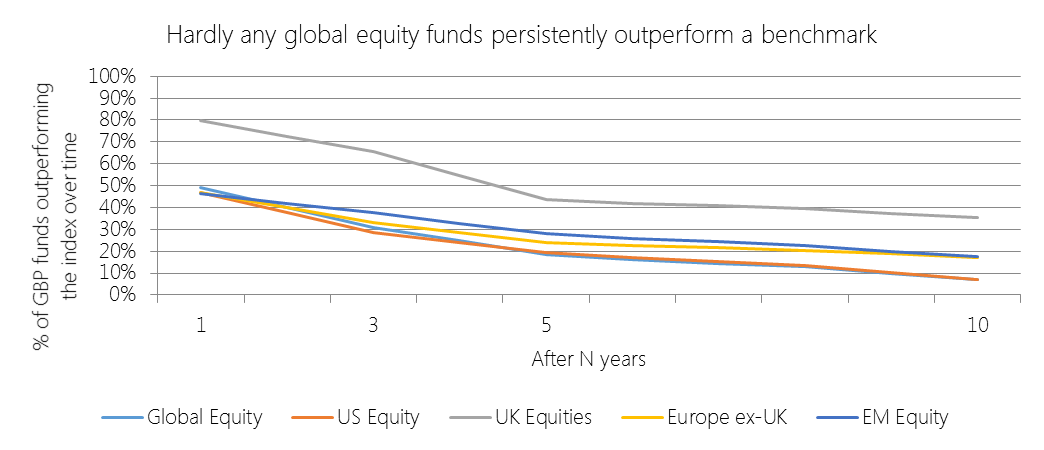

“Suppose we define a passive investor as anyone whose portfolio of U.S. equities is the cap-weight market portfolio described above. Likewise, define an active investor as anyone whose portfolio of U.S. equities is the not the cap-weight market portfolio. It is nevertheless true that the aggregate portfolio of active investors (with each investor's portfolio weighted by that investor's share of the total value of the U.S. equities held by active investors) has to be the market portfolio. Since the aggregate portfolio of all investors (active plus passive) is the market portfolio and the aggregate for all passive investors is the market portfolio, the aggregate for all active investors must be the market portfolio. All this is obvious. It is just the arithmetic of the fact that all U.S. equities are always held by investors. Its implications, however, are often overlooked.” What Bill Sharpe was saying to us was this: the performance of all active managers is, in aggregate [for a given asset class] that of the index less active fees. Which is a considerably worse deal than the charge often levelled against passive funds, namely that investors are paying for the performance of the index less passive fees. CPD Webinar: Is active management a zero-sum game? Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed