|

[5 min read, open as pdf]

Read full article with charts [5 min read, open as pdf]

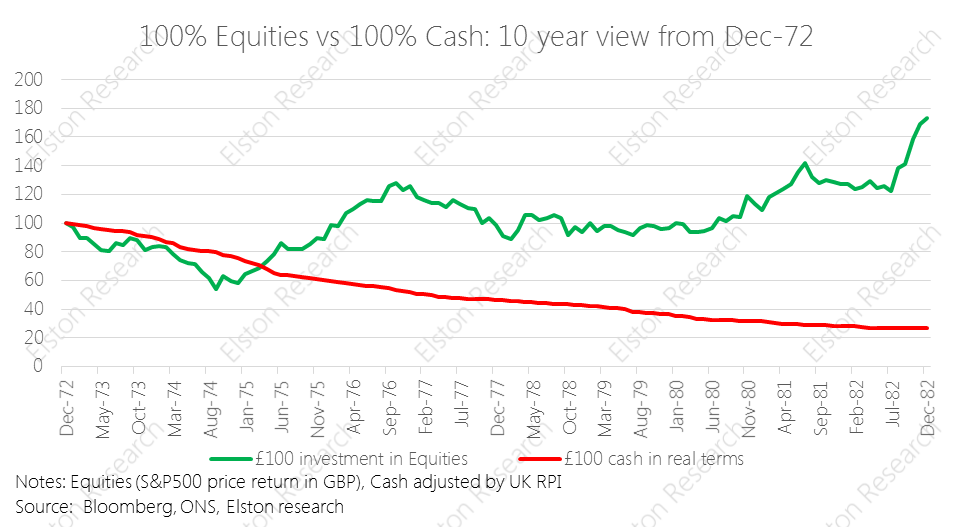

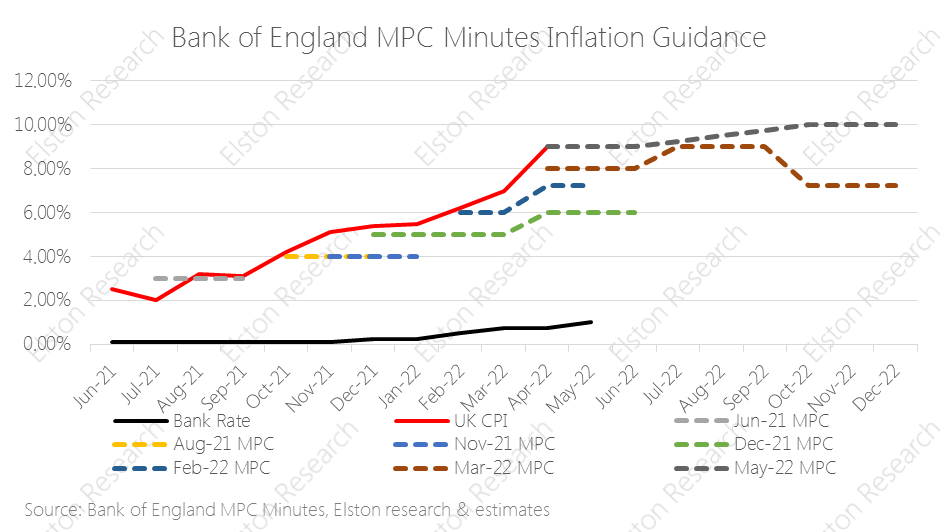

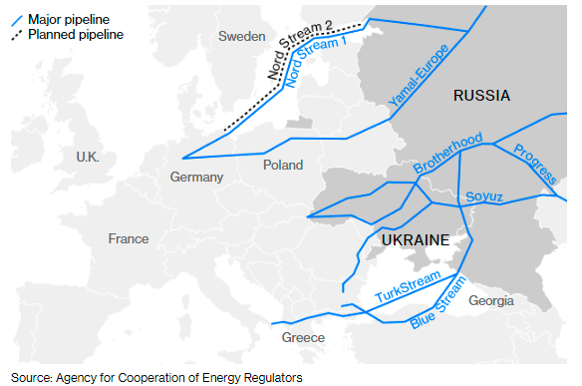

Inflation hits 40 year high UK inflation figures came out today with a print of +9.0%yy (April), from +7.0% (March) and slightly below +9.1%yy consensus estimate. This is the highest level in 40 years, putting renewed focus on the “cost of living crisis”. Rising energy and food costs are the primary drivers, linked to the sanctions regime and the Russia/Ukraine war. The Bank of England has been “behind the curve” as regards to inflation risk. A look at inflation guidance contained in recent Monetary Policy Committee (MPC) minutes shows. Near-term inflation guidance has consistently under-estimated inflation since August 2021 – rising from “above 2%”, to 4%, 6%, 8%,, 9% and now 10%. Read full article with charts [5 min read, open as pdf]

As a result of the Russia/Ukraine war, there is a political goal to reduce European dependency on Russian oil and gas supplies and to reduce the indirect financing of the Russian economy. We explore this topic further in conversation with Nadia Kazakova of Renaissance Energy Advisors. [5 min read, open as pdf]

Should equity returns be hedged into investor’s base currency? We don’t think so. From a UK perspective, part of the risk-return opportunity of global equity investing is a diversified revenue stream from multiple currencies. Read full article as pdf |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed