|

[7 min read, open as pdf]

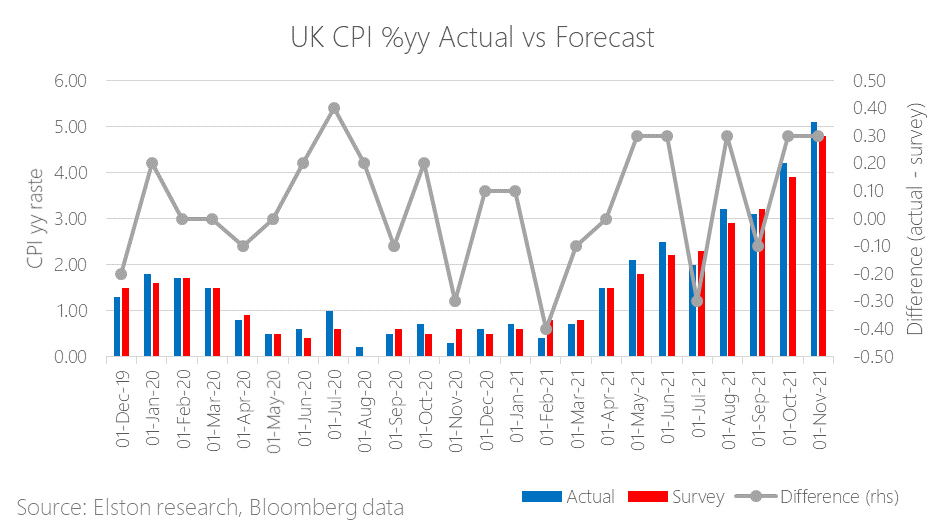

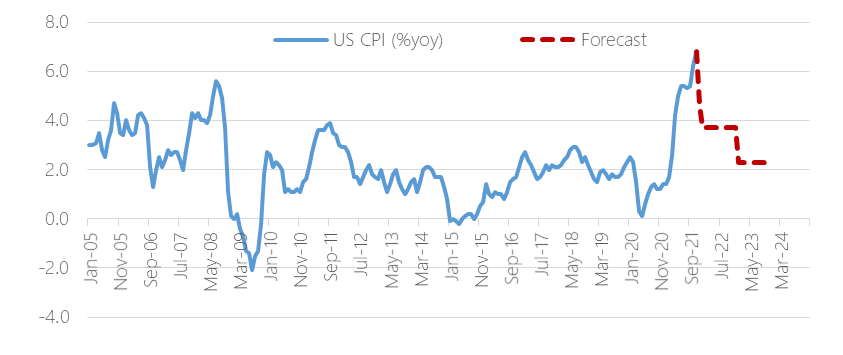

Fed signals tightening Fed Chairman Jerome Powell signalled that inflation is now the biggest risk to growth, and getting the labour market back to pre-pandemic levels. The US will accelerate “tapering” or reduction of supportive asset purchases, and set out the potential for rate hikes in coming years (although no change in long-term target rate). And despite rate hikes usually spooking markets, markets rallied: why? Because the bigger concern was that the Fed was behind the curve and not getting on top of inflation. The risk of a so-called “policy error” had investors concerned. The fact that market-implied policy rates did not change before and after the policy announcement, suggests that this was a case of the Fed catching up with the market, than the market catching up with the Fed. UK inflation Meanwhile, UK inflation pressure continues, with November inflation data coming in at +5.1%yy, ahead of +4.8%yy forecast, the fastest rate in a decade. Transport, clothing and food were the main contributors. The risk is that inflation creeps into wage growth which would make it harder to bring inflation down to long-term target of 2.0%. This is the second month in a row of an upside surprise. The figure is also at the upper end of scenarios envisaged by the Bank of England at the November MPC meeting. Bank of England raises rates The Bank of England today announced a +0.15% increase in the Bank Rate from 0.10% to 0.25% citing “more persistent” inflation, and following the Fed’s lead in a greater level of tightening. Furthermore, the Bank of England minutes suggest that inflation could remain at elevated levels and “expect inflation to remain around 5% through the majority of the winter period, and to peak at around 6% in April 2022” Markets are pricing a 80% chance of a further +0.25% to 0.50% in February 2022. In October, BoE Governor, Andrew Bailey guided that rates would need to rise to address inflation. Where are breakeven rates? The UK 5 year breakeven rate is at 4.38%, following the announcement, compared to 4.66% at the end of last week. The US 5 year breakeven rate is at 2.73% today from 2.80% at the end of last week. Liquid Real Assets performance Our Liquid Real Assets Index combines exposure to higher risk-return real assets for inflation protection and lower risk-return rate-sensitive assets for interest rate hike protection for an overall volatility that is comparable to UK bonds. By incorporating allocations to exposures that are driving inflation, such as Commodities, or can pass-through inflation, such as Property and Infrastructure, the real assets index can provide a return premium in excess of inflation and in excess of nominal bonds. Summary Inflation is proving persistent, policy makers are catching up to keep it in check. Nominal bonds will remain under pressure, particularly longer-duration in a rising inflation, rising interest rate environment. We advocate pairing equity allocations with diversified real asset exposure that can respond to inflation and floating rate notes that can respond to interest rate hikes. Read full article with charts as pdf Register for our Quarterly Investment Outlook on 26 January 2022 US CPI November data came in line with expectations at +6.8%yy vs +6.2%yy in October, meaning there is no additional pressure on expected interest rate rises for 2022.

[5 min read, Open full article as pdf]

Triple whammy of external factors saw market risk spike The emergence of the Omicron COVID variant spooked markets last Friday as a growth scare, with a knock-on effect of increased supply chain disruption and inflationary pressure. But as material were the Fed Chair, Jerome Powell’s statements on bringing forward tapering, partially in (some might say, belated) response to inflation risk. Open full article as pdf Register for our Quarterly Investment Outlook on 26 January 2022 |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed