|

[5 min read, open as pdf]

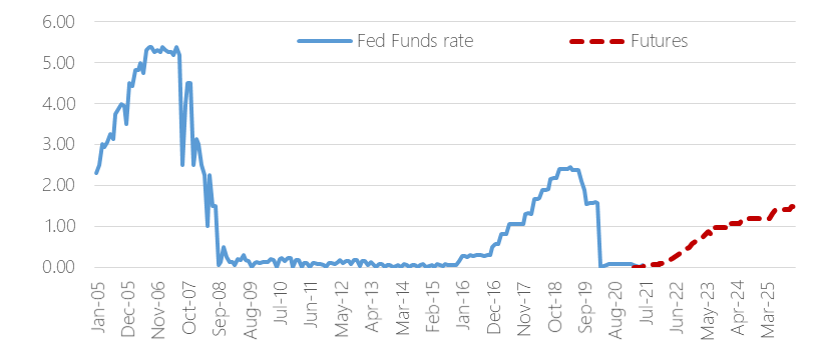

Interest rates expected to rise As the run up in inflation looks more persistent, than transitory, there is growing likelihood that Central Banks will raise interest rates in response. Following an extended “lower for longer” near-Zero Interest Rate Policy following the 2008 Global Financial Crisis and the 2020 COVID Crisis, the market futures-implied expectations for the Fed Funds rate, points to a “take off” in 2022 in response to rising inflation, following COVID-related policy support, to an expected 1.01% interest rate level in Dec-23[1], from 0.88% last quarter. Fig.1. Fed Funds Rate and implied expectations Source: Elston research, Bloomberg data

The potential for increased interest rate volatility, as rate hike expectations increase, means that investors that are seeking to dampen interest rate sensitivity (“duration”) are allocating to shorter-duration exposures, such as ultrashort-duration bonds, and also to Floating Rate Notes (FRNs). What is a Floating Rate Note? Floating Rate Notes receive interest payments that are directly linked to changes in near-term interest rates and can therefore provide a degree of protection against interest rate risk, when interest rates are rising. Issued for the most part by corporations, FRNs pay a periodic coupon – typically quarterly – that resets periodically in line with short-term interest rates. This could be expressed as a premium or “spread” over a currency’s short-term risk-free rate, such as (in the UK) the 3 month SONIA rate (Sterling Overnight Index Average, and prior to that GBP LIBOR) in the UK, or (in the US) the 3 month SOFR (Secured Overnight Funding Rate, and prior to that USD LIBOR). These indices overnight borrowing rates between financial institutions. The size of the premium or spread reflects the creditworthiness of the issuer: the higher the spread, the greater the rewarded risk for owning that security, and typically stays the same for the life of the bond and is based on the issuer’s credit risk as deemed by the market. How can FRNs benefit investors? Floating Rate Notes are a lower-risk way of putting cash to work and provide a useful direct hedge against interest rate fluctuations. When incorporated into a bond portfolio, they can help bring down duration given their reduced sensitivity to interest rate changes, as well as provide a return pattern that is directly and positively correlated with changes in interest rates. Compared to nominal bonds, such as Corporate Bonds and UK Gilts, FRNs’ yield can increase as/when interest rates increase. Relative to money market funds, FRNs may provide some additional yield pick-up, as well as very short <1 year duration. Key considerations when investing in FRNs Portfolio investors can access FRNs through funds and ETFs. Key considerations when investing in FRNs include, but are not limited to:

Summary The expected timing of interest rate “lift off” in the US and UK will change as markets adapt to evolving growth and inflation outlook during the post-COVID recovery, and in response to the risk of further disruption from new virus variants. However, as interest rate rises become more likely, and incorporating an allocation to Floating Rate Notes for protection against interest rate risk makes sense within the bond allocation. Watch the CPD Webinar: The Quest for Yield [1] Data as at last quarter end Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed