|

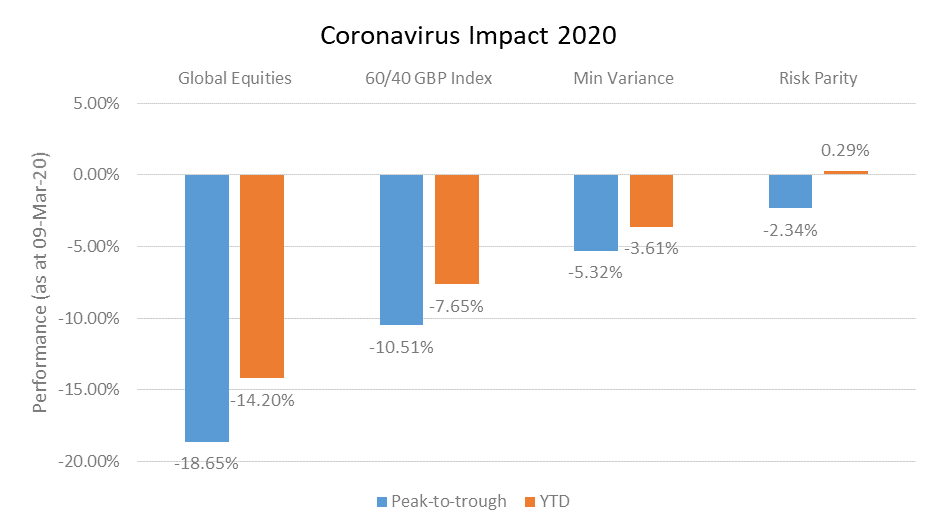

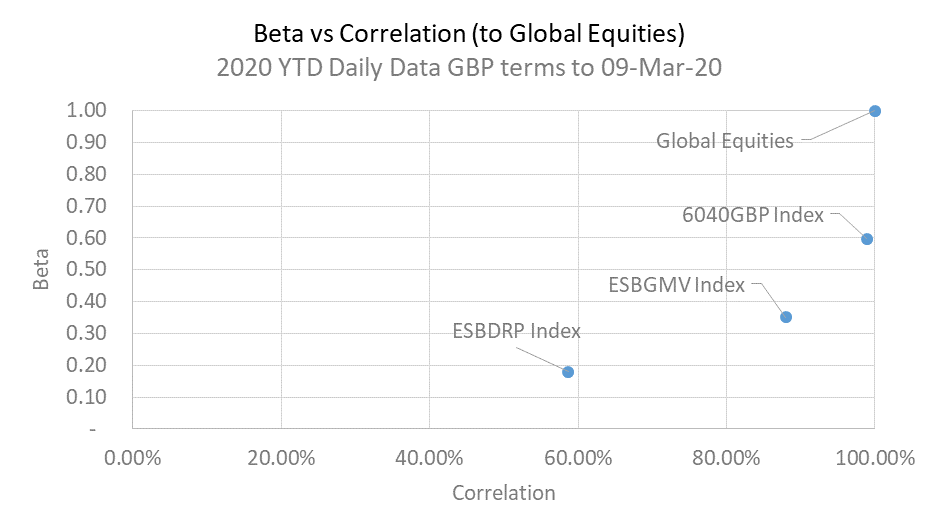

The impact of Coronavirus on multi-asset strategies is summarised below. This chart shows the peak-to-trough and YTD performance of Global Equities and Elston's multi-asset indices for GBP investors. Asset-based diversification has its limits Whilst a traditional asset-based approach to diversification can help reduce equity market beta, but it doesn't necessarily help reduce correlation. Why does (de)correlation matter The maths of diversification means that the less correlated an asset within a portoflio, the greater the diversification effect. Comparing multi-asset approach A 60/40 equity/bond portfolio (represented by 6040GBP Index), reflects a traditional multi-asset approach. Year-to-date this strategy has a beta of 0.60x but a correlation of 98.9%. By contrast, a risk-based approach to diversification not only reduces beta, but also reduces correlation. A Minimum Variance multi-asset strategy (represented by ESBGMV Index) has a beta of 0.35x and a correlation of 88.0%. A Risk Parity multi-asset strategy (represented by ESBDRP Index) has a beta of 0.18x and a correlation of 58.7%. Summary

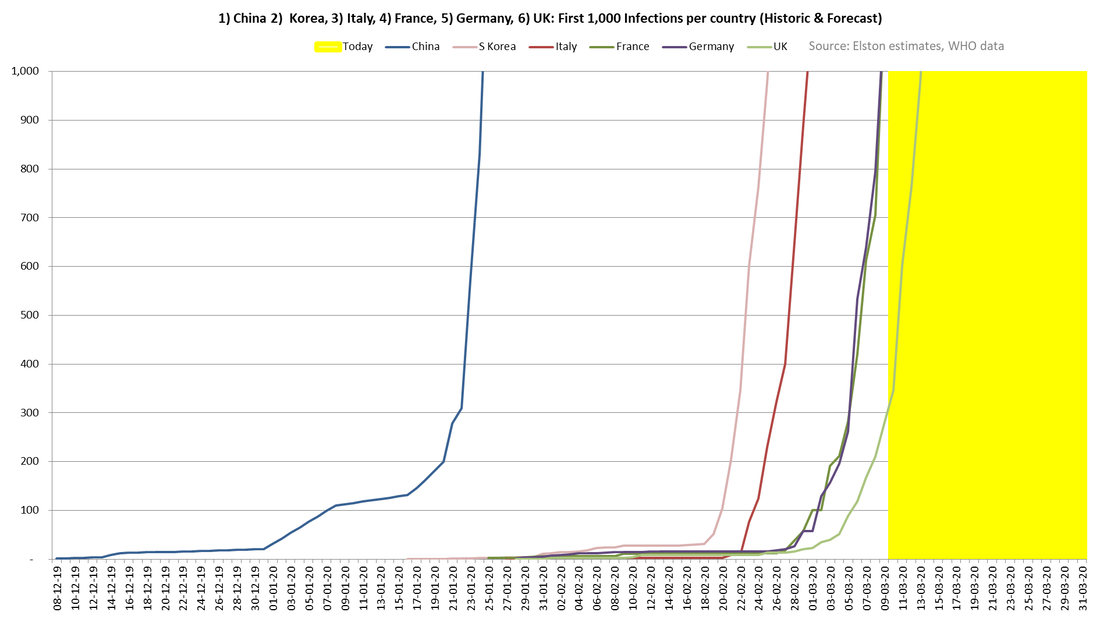

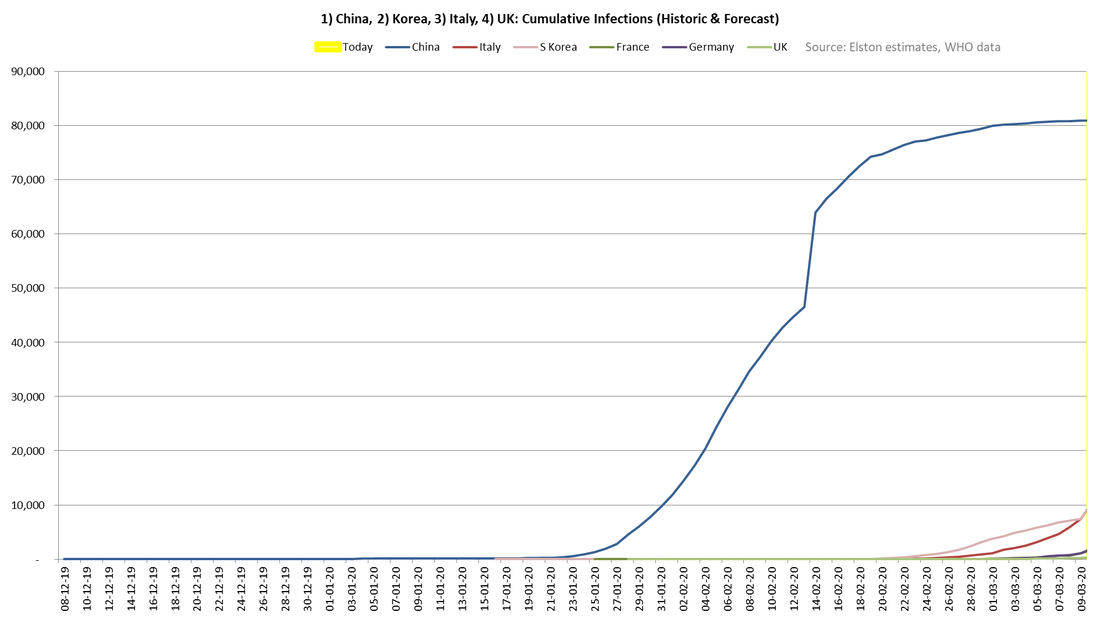

For effective risk-based diversification, whilst maintaining exposure to risk assets with returns potential, a risk-based approach to portfolio construction makes sense. A local problem? In January, when the Coronavirus story broke in China, the global response was that this was a localised issue. Like other viral outbreaks such as SARS (2003) and H1N1 (2009), the issue look localised to China and Asian Emerging Markets. Going global In February, as the virus spread aggressively in South Korea and Italy, markets woke up to the fact that this was a global issue. The questions being how far would it spread; how fast would it spread; and how long would it last? All of these questions were to ascertain how materially the outbreak would impact global growth, as demand falls, businesses' cash flow struggles and supply chains are disrupted. A false sense of security What was deceptive is that the time from the first infection in a country to the virus "j-curving" has been quite long 20-30 days. This gave Europeans a false sense of security that the outbreak was containtable. The J-Curve The chart below shows the J-curve as to how long it has taken for some key countries to reach 1,000 cases. The reality is that once it gets going, containment is difficult without some of the extreme measures introduced quite promptly in Wuhan (wide area quarantines or "lockdowns"), and more recently in Italy. Tracking the J-curve gives helpful cues as to when the UK government might move through the different phases of its response plan to Contain, Delay, and Mitigate the virus' impact undperpinned by Research. On this basis, whilst we are still in the Contain stage, we can expect to move into the Delay stage (closing schools, cancelling large scale gatherings, encouraging working from home) in coming weeks. Economic impact and policy response The economic impact of self-isolation, travel restrictions and lock-down are in addition to the human cost of the virus. That is why we have seen, and expect to continue to see, a co-ordinated economic policy response that supports business, monetary policy and markets. China plateau Meanwhile, in China, where the outbreak started, case numbers have plateaued suggesting that the drastic measures taken have worked, and that it is in aggregate a 2-3 month disruption. What next?

The next 4-6 weeks will see an acceleration in cases in key European and potentially US markets. So we may not be at "peak panic" yet at a social level, but the key question for markets is will this be a short run (3-6) month impact on otherwise resilient trend growth, or a trigger to a global recession. Our view is the former, but there's more fear to come first. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed