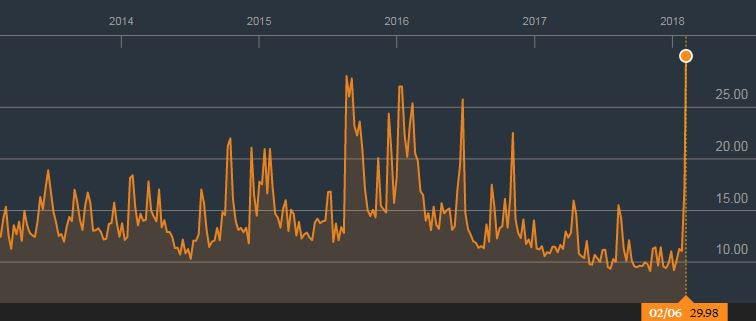

A well flagged correction There was near consensus amongst investment managers in their 2018 outlook as regards the risk of a market correction. Equity markets had climbed relentlessly higher in 2017 with little red ink and eerily low volatility. The fact that equity volatility had converged with bond volatility illustrates the limitations of an asset-based approach to diversified multi-asset investing. Of course, it was not to last. It was a question of “when, not if” equity volatility mean reverted. And now we at least know when “when” was. Fig.1 VIX spikes as equity volatility comes back into play. Source: Bloomberg.com What was the trigger? A potential trigger was identified as above-expected inflation trends, leading to increased expectations of monetary tightening. And so it was. Higher than expected wage growth forced a reassessment of inflation outlook, creating expectations of additional Fed tightening. What happens next? A correction enables portfolio managers to consider a fresh look at portfolios.

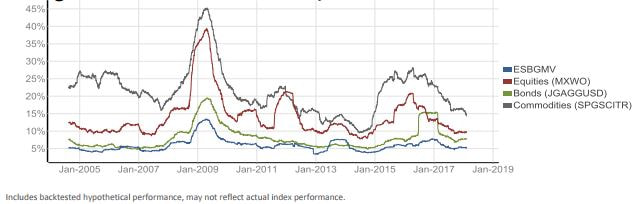

What is risk-based diversification? In periods of market stress (when the VIX index spikes), correlations between asset classes tend to increase in the short-run, thereby reducing the diversifying power of a traditional asset-based approach. A risk-based approach means that allocations to asset classes are not driven by their label but to their realised risk, return and correlation characteristics. This means that genuine diversification can be delivered using a mathematical risk-based approach, rather than relying on labels alone. Accessing risk-based diversification US portfolio managers can consider the S&P 500 Managed Risk Index (SPXMR Index), which dynamically allocated between the S&P500 index and cash, whilst maintaining a constant allocation to bonds to deliver a risk parity multi-asset portfolio. This index is tracked by the DeltaShares® S&P 500® Managed Risk ETF (NYSEARCA:DRML). UK portfolio managers can consider the Elston Minimum Volatility Index (ESBGMV Index), which dynamically allocates across asset class to deliver a minimum variance multi-asset portfolio. This index is tracked by Commerzbank Elston Multi-Asset Minimum Volatility Certificate (Bloomberg: COSP867<Go>, professional investors only) Fig.2 ESBGMV Index 12 month rolling volatility for index and asset classes Source: Elston website, ESBGMV index factsheet as at 6/Feb/18

References: http://www.spindices.com/indices/strategy/sp-500-managed-risk-index https://www.deltashares.com/products/sp-500/overview/ http://www.elstonconsulting.co.uk/factsheets.html https://www.bloomberg.com/news/articles/2018-02-02/u-s-added-200-000-jobs-in-january-wages-rise-most-since-2009 [ENDS] Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Business relationship disclosure: The Elston Minimum Volatility Index is licensed to Commerzbank for the creation of investable certificates (professional investors only). Additional disclosure: This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: as per specified source; Chart credit: as per specified source; Table credit: as per specified source. All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed