|

In December we conducted a Survey of senior portfolio managers and decision makers from firms whose combined assets under management is in excess of £500bn. The survey was designed to get a better understanding on how those managers approach sector investing.

Our key findings based on the survey are summarised below:

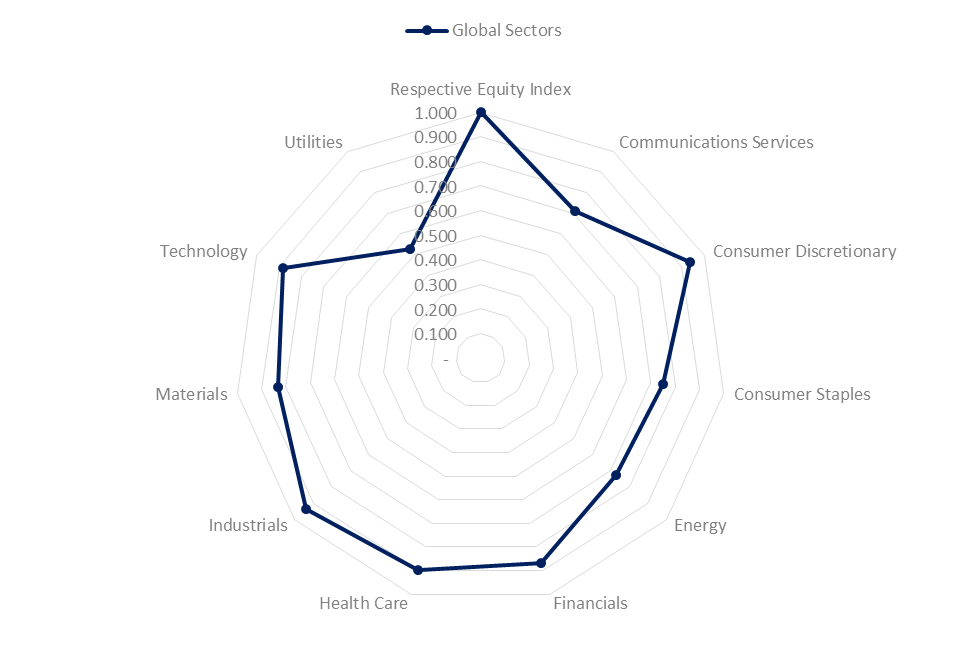

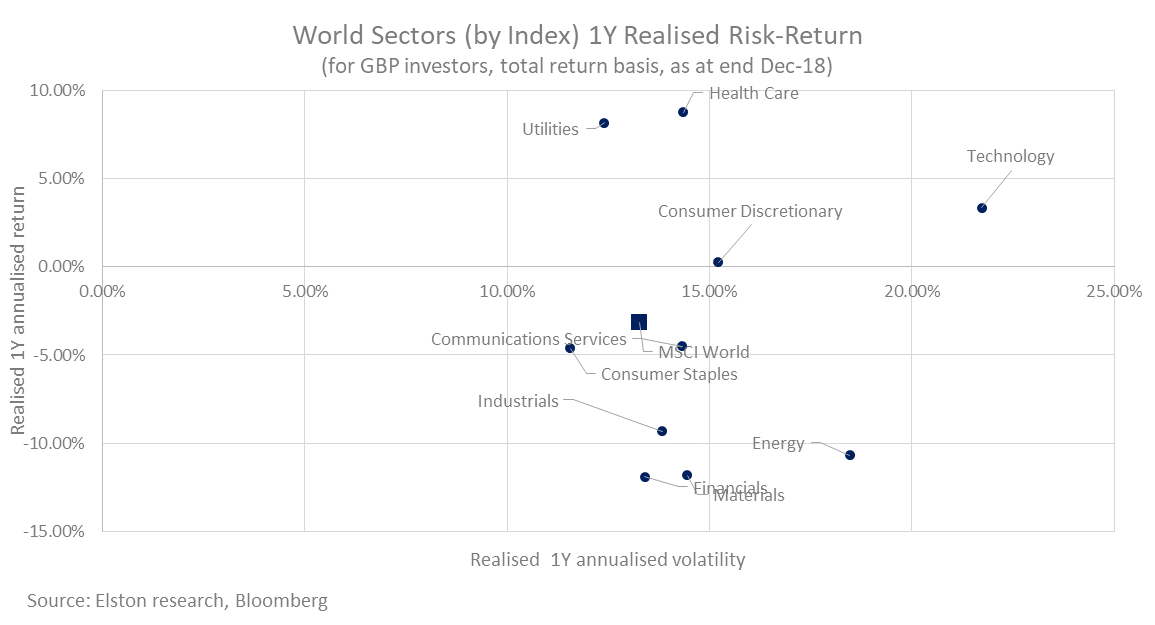

Anywhere to hide? For investors with a broad mandate, asset allocation decisions between equities, alternatives, bonds and cash and equivalents gives scope to limit the impact of market volatility. But what about for mandates which necessarily must remain fully invested in equities. Within the equity sleeve, we believe a sector perspective enables investors to make nuanced adjustments to their equity portfolio. Lower volatility On a one year basis, the lowest volatility sector is Consumer Staples with a volatility of 11.6% compared to 13.3% for World Equities. Consumer Staples is nonetheless 75.1% correlated to world equities. Potential Diversifier Over the last two years, Utilities has shown both lowest beta (0.52) and lowest correlation (52.8%) to world equities. This makes the Utilities sector a potential diversifier within a portfolio context. Chasing growth? From a momentum perspective, Technology remains the strongest performing sector with an annualised return over 3 years of +20.2% (in GBP terms). Conclusion Whilst economic outlook remains key driver for sector-based performance, the current volatility and correlation characteristics of specific sectors are informative from a portfolio construction perspective. Source: Elston Research, Bloomberg. Indices used: MSCI World Index and MSCI World sector index data Notes: Volatility: annualised 260 day volatility to 31-Dec-18; Correlation: 2 year correlation of daily returns to 31-Dec-18; all data expressed in GBP terms. Notices and Disclaimers: Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Additional disclosure: The data in this article comes from an Elston ETF Research report “Sector Equities: 4q18 Update” that was sponsored by State Street Global Advisors Limited. We warrant that the information in this article is presented objectively. For further information, please refer to important Notices and Disclosures in that Report which is available on our website www.ElstonETF.com This article has been written for a UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This article reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.ElstonETF.com Photo credit: N/A; Chart credit: Elston Consulting; Table credit: Elston Consulting

John Clifton Bogle, who died recently at the age of 89, may not have been a household name in Britain, or even in his native country, the United States. But he was a true legend in the world of investing.

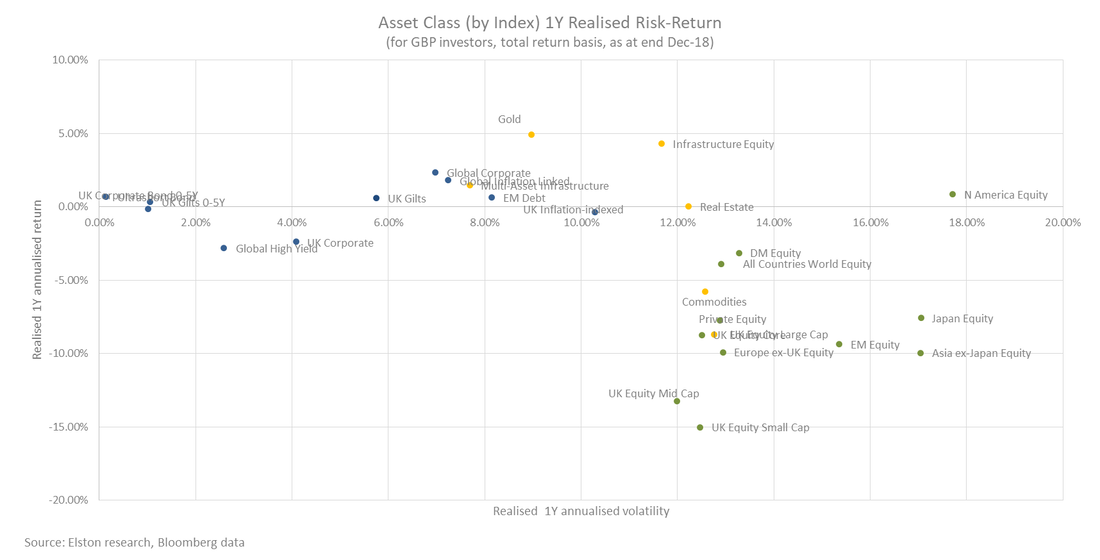

Better known as Jack, Bogle founded the investment company Vanguard in 1975. That same year he also introduced the first index fund for ordinary investors. They called it “Bogle’s folly” at the time, and commentators doubted it would ever take off. But Bogle stuck to his guns, and index funds eventually changed the face of investing. As for Vanguard, it’s now one of the largest investment companies in the world, with $5 trillion under management. Jack Bogle could have been one of the wealthiest people on the planet. But he chose a mutual ownership structure for Vanguard, which instead of enriching shareholders, drove down costs for investors. Millions of people are considerably better off today than they would have been without him. Bloomberg estimates that, over the last 45 years, Bogle has saved Vanguard investors $175 billion in fees. Add to that the money he saved for customers of other firms that lowered their fees to compete with Vanguard, and the total must run into trillions. To quote the financial blogger Morgan Housel, Bogle is the biggest undercover philanthropist of all time. But perhaps Jack Bogle’s biggest legacy is his intellectual honesty. He told investors the truth — that low-cost index funds are the best way for most of us to invest. In The Little Book of Common Sense Investing, he wrote: “Simply buy the entire stock market. Then get out of the casino and stay out. “This investment philosophy,” he went on, “is not only simple and elegant. The arithmetic on which it is based is irrefutable.” Bogle is perhaps best known as an advocate of low-cost passive investing. “The iron rule of the financial markets,” he once said, “is reversion to the mean.” Simply by the law of averages, there will always be active fund managers who have outperformed the market in the short term. But, over the long term, only a tiny fraction of them are able to beat it after you factor in the costs of using them. Yet Bogle also liked to remind people that fees and charges aren’t the only reason why investors fail to achieve their goals. They are often undone, he warned, by their emotions and by acting on impulse. Investors, he said, need to put their emotions to one side, have rational expectations for future returns, and avoid changing their strategy in response to market noise. Jack Bogle’s honesty and professional integrity didn’t exactly endear him to Wall Street. In one of his later books, Enough, he wrote: “On balance, the financial system subtracts value from society.” But, towards the end of his life he repeatedly expressed a hope that things will change, and that the financial industry will one day become a profession. “No matter what career you choose,” he urged readers of Enough, “do your best to hold high its traditional professional values, in which serving the client is always the highest priority.” Bogle then quoted the English Quaker William Penn, founder of Pennsylvania, the state he loved and lived in: “We pass through this world but once, so do now any good you can do, and show now any kindness you can show, for we shall not pass this way again.” Jack Bogle may have gone, but his legacy lives on. He truly was the man who changed investing for good. In this report, we look at the recent risk-return performance for a broad range of asset class exposures for GBP-based investors, as represented by our selected indices for each exposure.

The objective of the report is to show the historic 1 year and 3 years risk-return characteristics of the investment opportunity set available to multi-asset investors when constructing portfolios. Get the full report here The absence of a clearly defined plan for Brexit is creating damaging uncertainty for businesses and the markets.

Leaving the EU, but remaining in the EEA through EFTA would address the concerns of the majority of Referendum voters, whilst also requiring a spirit of compromise from both sides. Joining EFTA would immediately provide the UK with continued free trade within the EU/EEA, a more valuable set of external Free Trade Agreements, and the added flexibility to negotiate its own free trade deals bilaterally. Setting a timetable for re-joining EFTA provides a straightforward solution that will give the necessary confidence and direction to businesses and the markets whilst respecting the outcome of the EU Referendum. This paper, drafted for but not published by the Centre for Policy Studies in July 2016, sets out the rationale for Britain in EFTA or "BREFTA" and calls for greater engagement with the "C10": the largest ten Commonwealth economies. The broker and fund platform Hargreaves Lansdown has just brought out a list of recommended funds called the Wealth 50, which has received plenty of attention in the financial media.

HL used to have a larger list, the Wealth 150, but the list been gradually shrinking. The number of funds has been whittled down further and there are now 60 of them. The company says that the funds have been selected after quantitative and qualitative analysis by its in-house research team. It has also negotiated lower charges for its clients. Wealth 50 clients will save, on average, 30% on ongoing charges, with the cheapest actively managed fund carrying an annual charge of 0.22%. We lead such busy lives that when we’re offered a short cut, something that saves us time and effort, we generally like to take it, and that’s precisely why companies such as Hargreaves Lansdown produce these sorts of lists. But are recommended fund lists, or buy lists as they’re sometimes known, really of any benefit to investors? Research by the Financial Conduct Authority, showed they can be very misleading. In its interim report on its study into competition in the asset management industry, the FCA reported that most funds on these lists fail to beat the market and that firms that publish them are often biased towards their “own brand” funds. We shouldn’t be surprised. Academic research has consistently shown that, in the long term, only a tiny fraction of funds outperform the market on a cost- and risk-adjusted basis. Dr David Blake form Cass Business Buisness School puts the figure at around 1%. What’s more, he says, future outperformers are impossible to identify in advance. The difficulty of identifying future star managers ex ante was highlighted in a paper published last summer, Investment Consultants’ Claims About Their Own Performance: What Lies Beneath?. It was authored by Tim Jenkinson and Howard Jones from the University of Oxford’s Saïd Business School, Jose Vicente Martinez of the University of Connecticut and Gordon Cookson from the FCA. The researchers looked at the performance of funds recommended by investment consultants between 2006 and 2015. Once fees were factored in, they discovered, the funds that consultants didn’t recommend subsequently delivered better performance than those they did recommend. We simply don’t know how long the 60 funds on the Wealth 50 will remain on the list for, let alone what sort of returns the funds will deliver in the future. No one can systematically pick winning funds in advance, and that includes Hargreaves Lansdown. The bottom line is that recommended fund lists are not meant for your benefit at all. They’re essential a marketing gimmick which helps brokers and platforms to generate revenue. HL is a very successful business, which has profited from a trend towards individual investors taking more control of their retirement savings. Since 2015 it has grown its active client base by 50% and its assets under management by 70%. But its offering isn’t cheap. On top of annual fund charges and the on-going transaction costs that funds incur, HL clients also pay a platform charge of 0.45%. That may not sound like much, but the compounding effect of paying that charge year after year has a significant impact on long-term returns. Don’t be tempted, then, to choose from this or any other recommended fund list. They really are best ignored. The phenomenal rise in ETF adoption looks extraordinary. But viewed in the context of any technology upgrade – from tape to CD, from CD to MP3 – there’s nothing outstanding about it. It’s just common sense.

ETFs are just a more flexible and lower cost way of getting exposure to an asset class relative to traditional mutual funds. Whilst some vested interests in the active world murmur about “How might ETFs cope in market distress?” The answer is, repeatedly (including in recent market turmoil), “Just fine, thank you”. Born out of crisis Indeed, the massive switch from Mutual Funds to ETFs is in part a direct result of the Global Financial Crisis. In the GFC, some investors were caught out by 1) not knowing exactly what was in their fund and 2) not being able to sell funds they no longer wanted to manage their risk exposure because they were “gated”. We’ve seen similar gatings of property funds after the Brexit vote, and of bond funds in face of interest rate rises. The two greatest benefits of ETFs are, in my view, their transparency (knowing exactly what’s inside the fund on a daily basis, and how it’s likely to behave) and their liquidity (there’s a secondary market in ETFs via the exchange, which means you can buy or sell an ETF without necessarily triggering a creation/redemption process within the fund). Transparency enables a more precise way of accessing specific asset class exposures. Liquidity is not just about intra-day trading, it’s more about the simple fact that if you don’t want to hold a fund anymore, rather than relying on the goodwill of the manager to accept your redemption order, you can simply sell it on via the exchange. This simple difference is a key advantage of ETFs. Secondary market Take the high yield bond market. So in a rising rate environment, if investors wish to sell high yield bonds, with mutual funds the manager has to sell the underlying investments (putting further pressure on price and liquidity), with ETFs, the manager can simply sell the ETF to another participant willing to come in at a level that is a bargain for both. The underlying investments need not necessarily be sold. Liquidity is only ultimately as good as the underlying asset class. But in every bond market jitter (including last week’s) bond ETFs have continued to function, and enabled liquidity. I prefer to turn the question on its head: what product do you know of (aside from a mutual fund) that you can only sell back to its vendor? I’m struggling for examples: just a quick look on eBay is enough to show that there’s a secondary market in pretty much everything, be it vintage newspapers, matchbox cars or antique furniture. A quick look on the London Stock Exchange, shows there’s a market for pretty much every type of fund: global equity, UK value, UK gilts of different maturity buckets, corporate bonds of different investment grades, gold, commodities, property: you name it, you’ll find it. It’s asset allocation that counts Furthermore, I’ve never bought the argument that “ETFs only work in a bull market”. Sure equity ETFs do well in a bull market, but there are ETFs for each asset class that could be in favour at different stages of the cycle. ETFs are a portfolio construction tool to reflect a desired asset allocation. If you only want high quality, dividend paying equities, there are dual-screened income/quality ETFs. If you don’t want equity exposure, there are bond ETFs. If you don’t want long-duration bonds, there are short-duration bond ETFs. If you want a cash proxy with a bit more yield, there are Ultrashort Duration Bond ETFs. So ETFs don’t perform better or worse at different times in the cycle. Managers can perform better or worse by getting their asset allocation right. ETFs are just a straightforward way of managing a multi-asset portfolio. From closet index to true index ETFs are by definition the commoditisation of mutual fund industry (standardised formats that can be bought and sold at a published price). The plethora of index rules are the systemisation of investment process: whether you’re philosophy is traditional (cap-weighted), momentum, value, small cap, income, or quality there are now indices for most investment styles for most asset classes in most regions. The investor’s toolkit has got smarter, cheaper and more flexible. What’s not to like? Given the large number of closet index funds out there, we can expect a continued switch from closet index to true index to drive ETF adoption yet higher. In the meantime, if anyone knows of an eBay for old mutual fund holdings – please let me know. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed