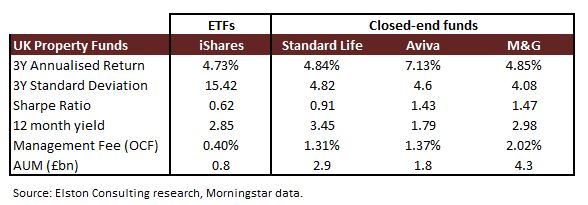

Post-Brexit fears around commercial property values has led to managers of three UK property funds locking investors in. They fear a potential rush of investors to sell units following the Brexit result in the EU Referendum. Decisions to suspend will typically reviewed every 28 days. The funds affected are those managed by Standard Life, Aviva and M&G, totalling some £9bn of assets (see table). While the justification given – to “protect the interests of all investors in the fund” – is fair and reasonable, some investors may not be too happy to be locked in for potentially quite a scary ride. The paternalistic reading is that investors are being protected from themselves, as they are denied the temptation to panic sell. Funds that locked in investors in 2008 eventually “came good”. But while investors may agree that “buy and hold” is right for the long run, that’s not the same deal as “buy and be held prisoner at the manager’s will”. This episode shines a much needed spotlight on the opacity around the underlying liquidity within funds that trade in less liquid assets. As always, investment funds are only as liquid as their underlying holdings. One of the main reasons advisers give for using funds over ETFs is that daily liquidity is not necessarily important as their investors take a long-term view. This does however deny the opportunity to make tactical adjustments to changing economic circumstances, particularly event-driven ones such as the UK referendum. What this episode illustrates that by contrast to funds, ETFs benefit from better internal liquidity (they typically invest only in liquid securities), from better daily external liquidity (as they are both OTC and exchange-traded), and from active liquidity management (the creation and redemption of units through capital markets activity by the issuer). For UK investors whose property exposure was through ETFs which such as iShares UK Property UCITS ETF (LSE:IUKP) which tracks the FTSE EPRA/NAREIT UK Property Index, the flexibility remains whether to adjust exposure or to the ride this out. And for portfolio management, flexibility counts. In terms of underlying exposure, Property ETFs and Property Funds are similar but different. Whereas property funds may have direct exposure to commercial or residential property, property ETFs typically own shares in listed real estate companies. As Property ETFs are by nature “equity only”, they can be expected to have higher volatility than property funds that which have exposure to bond-like steady streams of net rental income from less liquid direct holdings. So if risk is defined by standard deviation, it is clearly higher for a property ETF. If risk is defined by liquidity, it is clearly higher for a fund. Aside from volatility, the level of yield from property ETFs relative to funds is comparable, while the overall fee level is of course much lower. Table: Fee Comparison For investors seeking exposure to UK property as an asset class, then exchange-traded liquid ETFs that provide that from a portfolio construction perspective. But importantly, property ETFs won’t share the underlying liquidity risk that is (now) all too apparent.

NOTE Funds compared are iShares UK Property UCITS ETF (GBP), Standard Life Investments UK Real Estate Fund Retail Acc, Aviva Investors Property Trust 1 GBP Acc, M&G Feeder of Property Portfolio Sterling A Acc. Returns data as of 5th July 2016 (except M&G as of 4th July 2016). Standard deviationfigures as of 30th June 2016 for all funds. NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. For more information see www.elstonconsulting.co.uk Photo credit: pictogram-free.com. Table credit: Elston Consulting |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed