|

With inflation at current levels, nominal bonds will remain under pressure. We explore the more resilient alternatives within the bonds universe as well as property, infrastructure, liquid real assets and targeted absolute return funds.

For full article, see Trustnet. [3 min read, open as pdf]

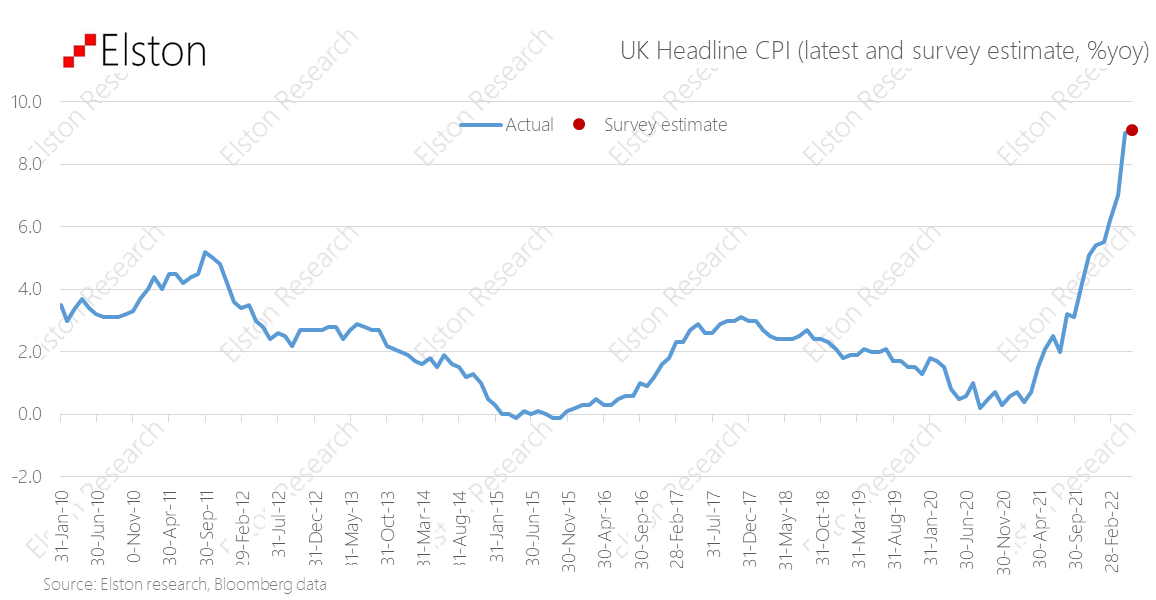

This is the highest UK inflation rate in 40 years. Higher prices for energy, motor fuel, and clothing explained for half of the increase in prices. Inflation pressure is not yet peaked with Bank of England expecting 11% in 4q22 and a further step-up in the retail energy price cap. [5 min read, open as pdf]

Markets entered panic mode this week on fears, that all three “macro” factors – Growth, Interest Rates and Inflation – are all heading the wrong direction.

Full article, open as pdf [5 min read, open as pdf]

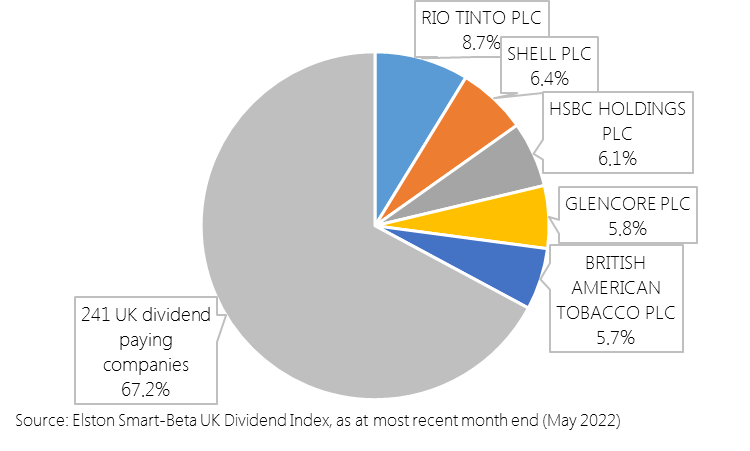

Each quarter we are publishing the Top 5 holdings of our Elston Smart-Beta UK Dividend Index. These are the UK’s largest dividend payers as a proportion of the total dividend pool. For full report open as pdf The costs of investing compound and have a negative impact on your ultimate return. Henry Cobbe is interviewed by Investor's Chronicle.

Read in full [5 min read, open as pdf]

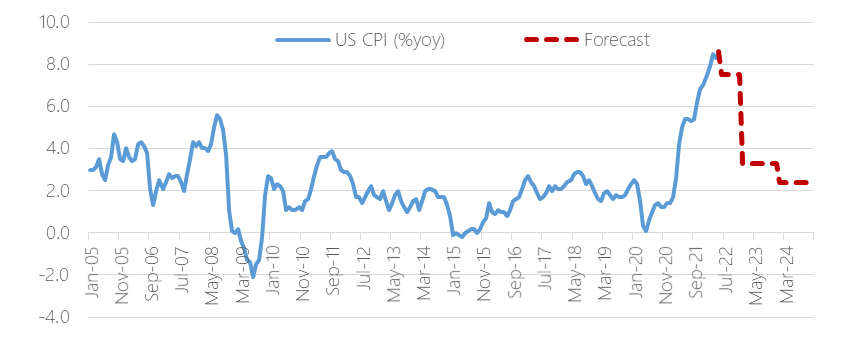

The latest US inflation came in at 8.3%yy for May 2022, higher than survey estimate. This is up from 8.3%yy last month, and is topping expectations. Gasoline prices jumped by 49% compared to May 2021. Higher prices of food and shelter also contributed to the highest US inflation rate in 40 years. Inflation pressure is broadening as energy and groceries prices surge. [For full article and charts, open as pdf] [5 min read, open as pdf]

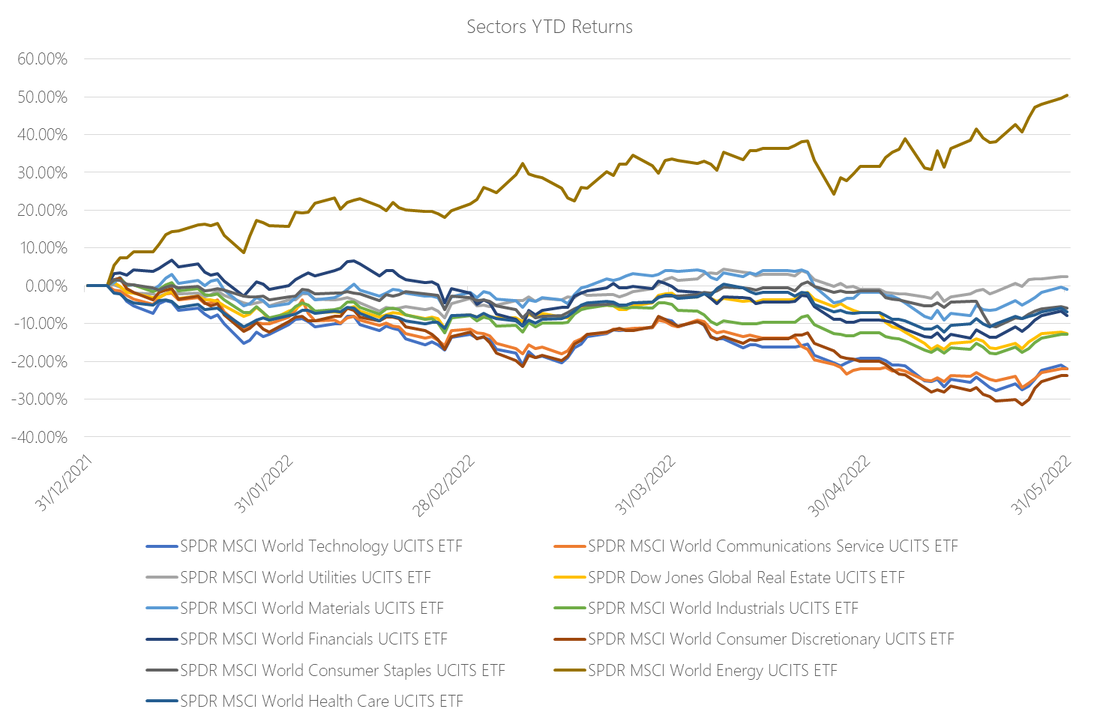

The uncertainty of the current market environment is prompting a pivot away from sectors that have served investors well, in many cases since the financial crisis but particularly during the Covid-19 pandemic. With inflation rampant, commodity prices spiralling, supply chains choked and the much relied-on ‘Fed Put’ (whereby central banks rescue markets by flooding them with liquidity) a thing of the past, investors are rotating away from Technology and Real Estate and into traditionally “boring”, but dependable sectors like Industrials, Materials and Energy. For full article, see pdf |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed