|

With thousands of funds available, learn how to sort the wheat from the chaff. Elston's Henry Cobbe is interviewed by Investor's Chronicle.

Read the article Watch the video Dave Baxter and Henry Cobbe discuss how to sort through the thousands of funds available, and the pros and cons of different options.

Access the podcast [7 min read, open as open as pdf]

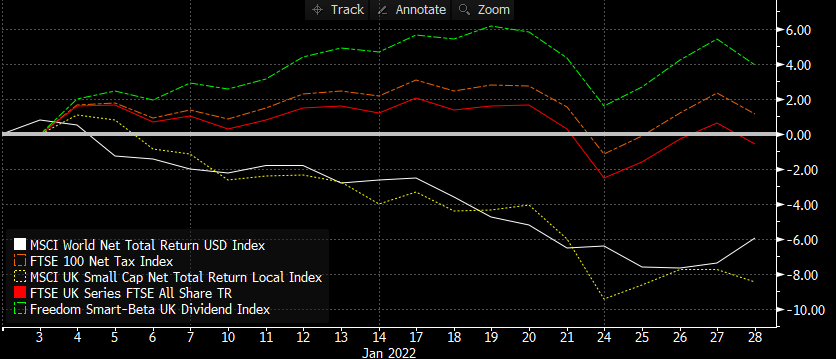

Year to date performance The dispersion between styles and segments within equities is pronounced in the UK. Given recent market stress over the prospect of a rising interest rate environment, inflationary pressure, and geopolitical tensions, year-to-date performance underscores the relative resilience of equities with a Value/Income bias relative to other UK equity segments and world equities. Year to date, world equities are down -5.93%, the FTSE All Share is flat at -0.55%. UK Small Caps are down -8.49%, the FTSE 100 is +1.14% and UK Equity Income (Freedom Smart-Beta UK Dividend Index) is +3.97%. This is because returns are underpinned by dividend income as well as exposure to energy and financials which benefit respectively from a high oil price/rising rate environment. Read in full as pdf [7 min read, open as pdf]

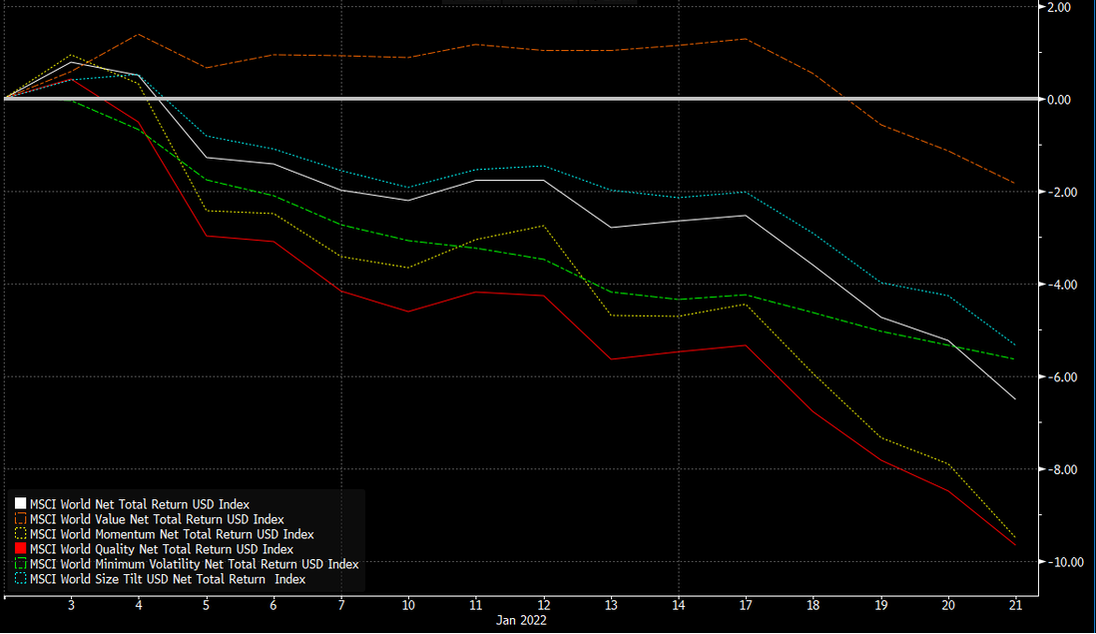

What happened this week Equity market performance has taken a tumble, speculative assets have taken a fall. Why is this, and what has changed? We explore the three market risks and the fourth geopolitical risks - the probability of each has increased materially and simultaneously. Read full report as pdf [5 min read, open as pdf]

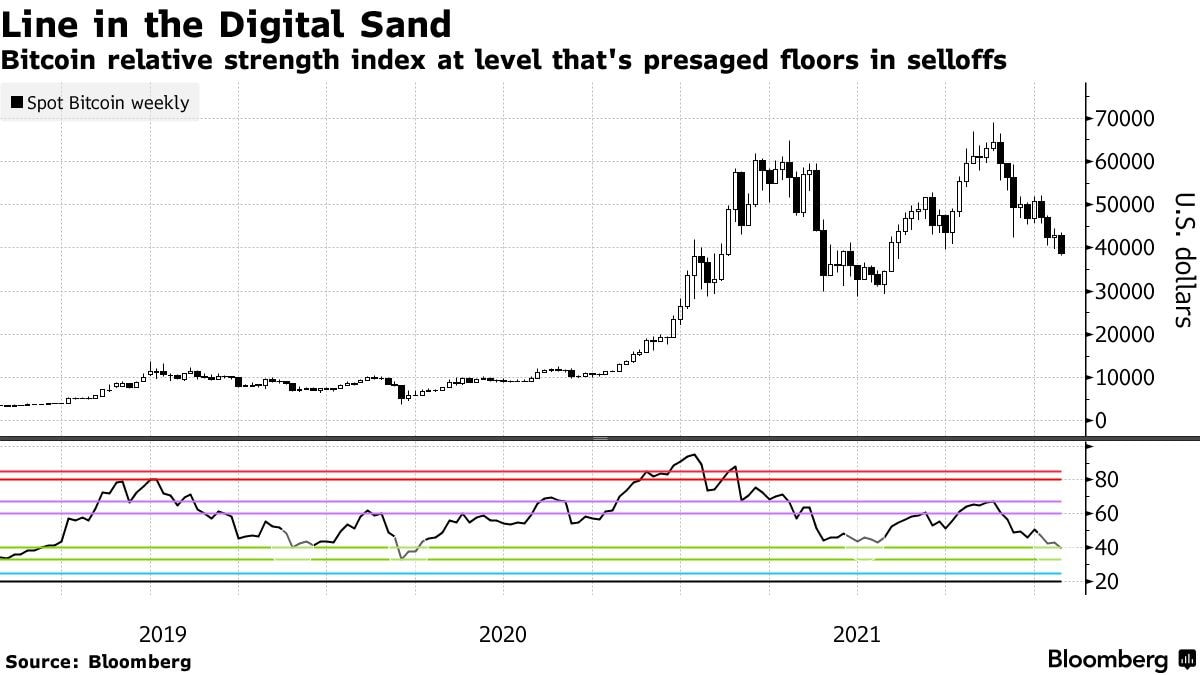

A great technology, an inappropriate asset In discussions with financial advisers, our position has consistently been that whilst blockchain is undoubtedly a breakthrough technology, Bitcoin is not an appropriate asset for retail investors’ portfolios. Read the full report in pdf

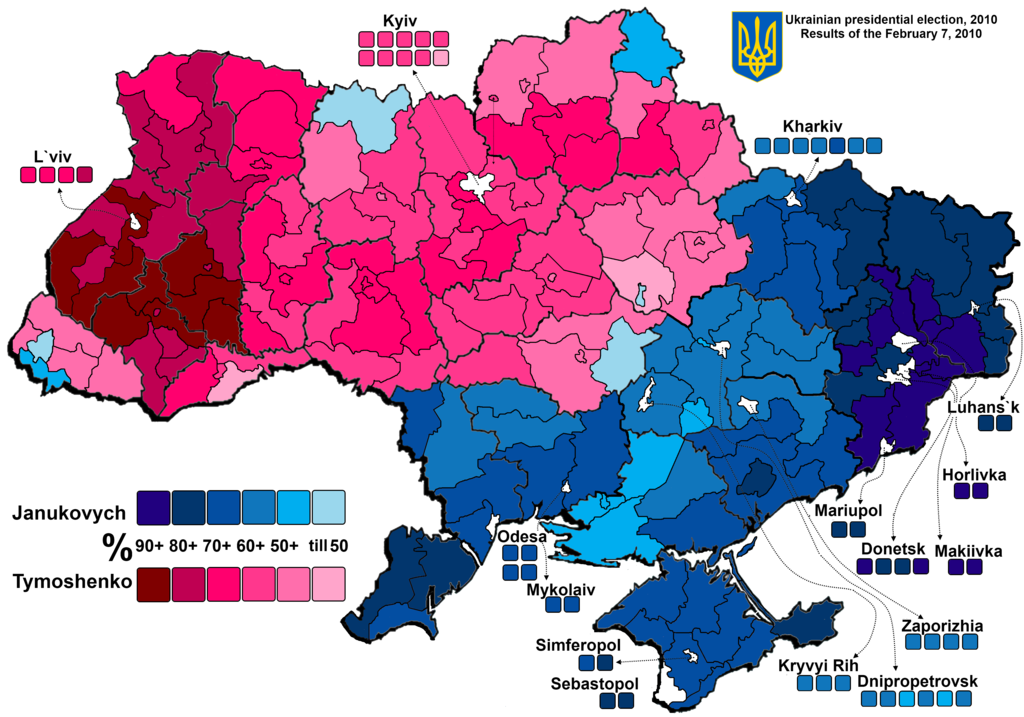

Geopolitical risk: a European war? Despite a flurry of urgent diplomatic activity in the last three weeks, the risk of a proxy or even direct war between NATO and Russia over Ukraine is real and worrying. We explore the context, summarise the diplomatic efforts and outline four potential scenarios. Full report available to Clients or on request Image shows 2010 Presidential election voting results Image author attribution: By Vasyl` Babych - Own work, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=11453740 [3 min read, open as pdf]

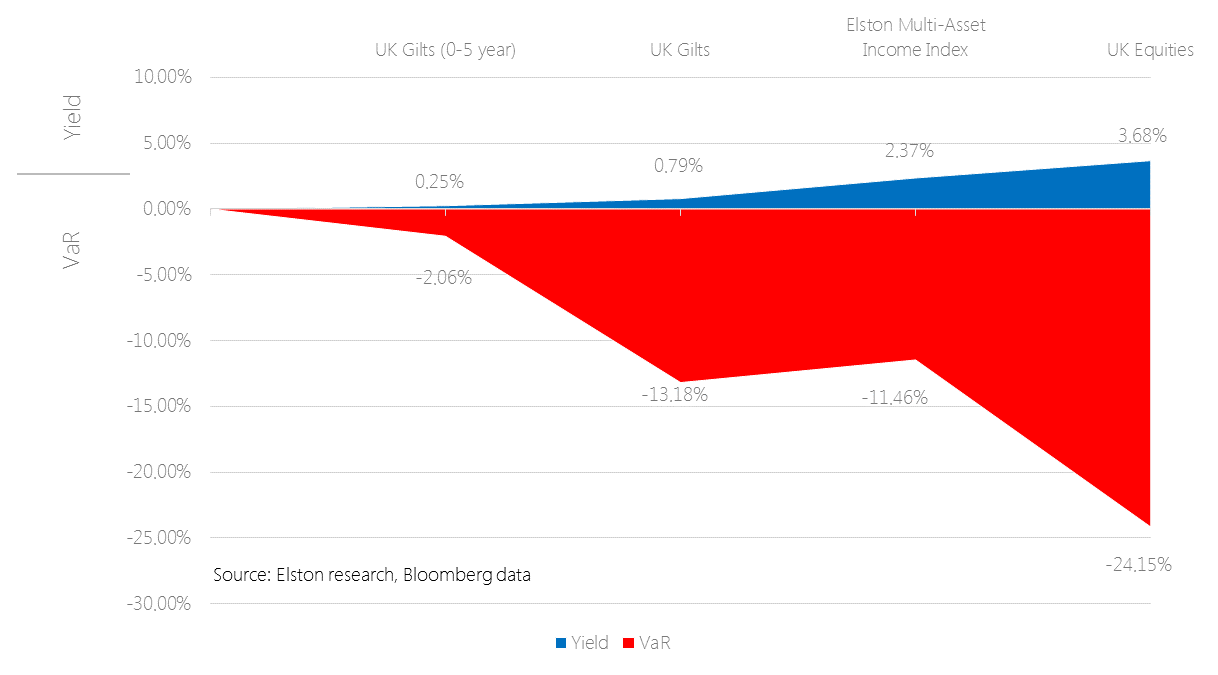

Through the looking glass: a curiouser new paradigm Traditionally you bought bonds for income, and equity for risk. Ironically, now it’s the other way round. Read the full article Watch the CPD webinar: Diversifying income risk Find out more [3 min read, open as pdf]

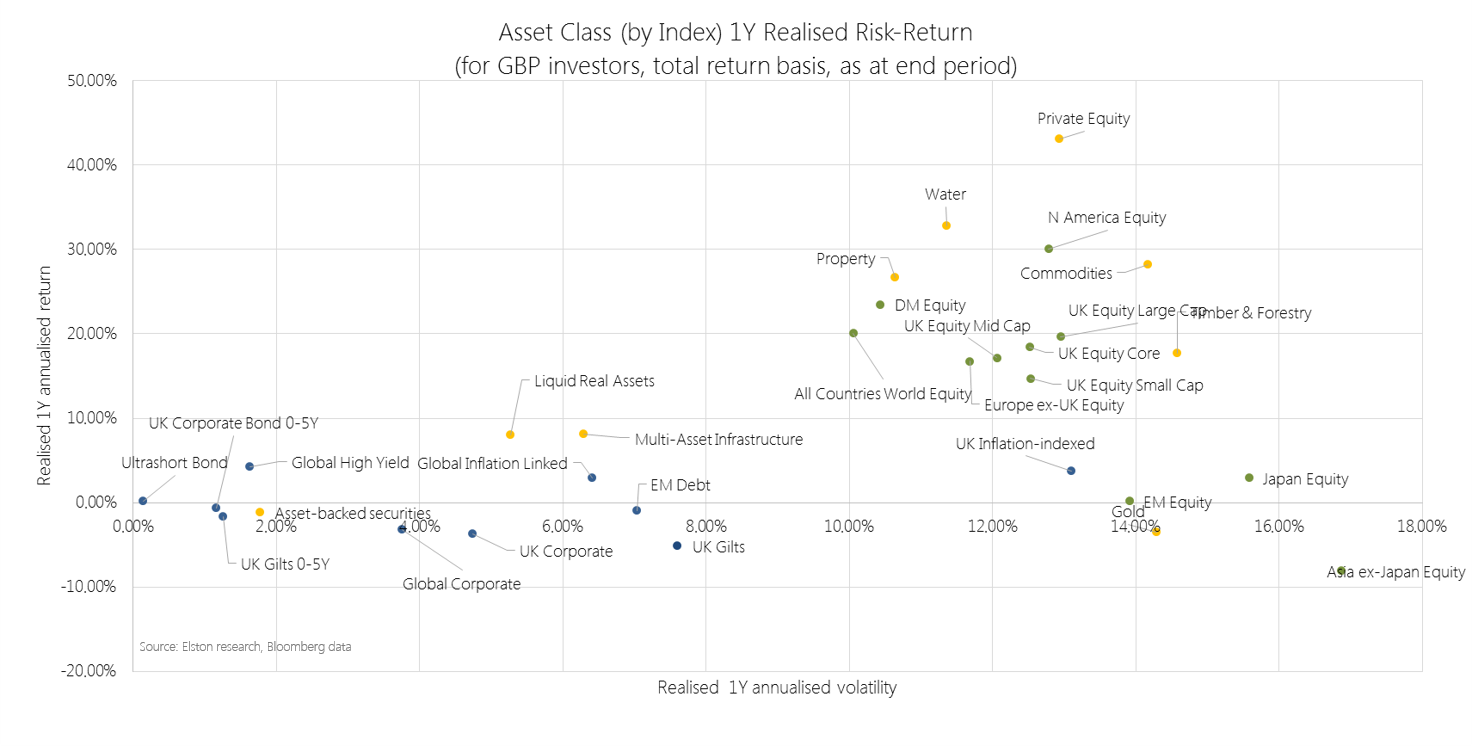

2021 in review Our 2021 market roundup summarises another strong year for markets in almost all asset classes except for Bonds which remain under pressure as interest rates are expected to rise and inflation ticks up. Listed private equity (shares in private equity managers) performed best at +43.08%yy in GBP terms. US was the best performing region at +30.06%. Real asset exposures, such as Water, Commodities and Timber continued to rally in face of rising inflation risk, returning +32.81%, +28.22% and +17.66% respectively. 2022 outlook We are continuing in this “curiouser, through-the-looking glass” world. Traditionally you bought bonds for income, and equity for risk. Now it’s the other way round. Only equities provide income yields that have the potential to keep ahead of inflation. Bonds carry increasing risk of loss in real terms as inflation and interest rates rise. Real yields, which are bond yields less the inflation rate, are negative making traditional Bonds which aren’t linked to inflation highly unattractive. Bonds that are linked to inflation are highly sensitive to rising interest rates (called duration risk), so are not attractive either. How to navigate markets in this context? The big three themes for the year ahead are, in our view:

See full report in pdf Attend our 2022 Outlook webinar [3 min read, open as pdf]

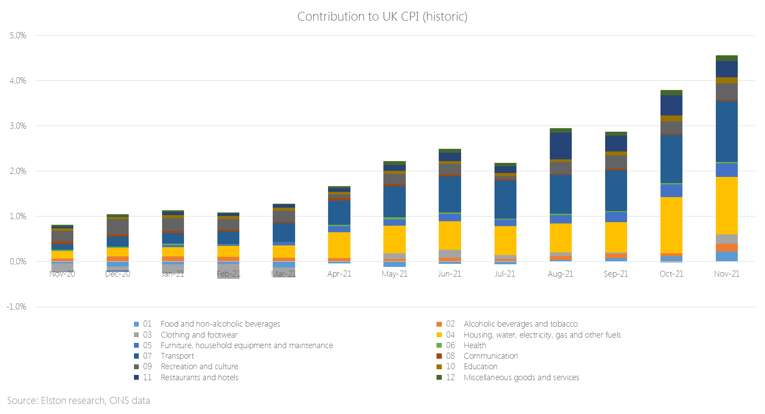

UK cost of living surges Pent up demand, disrupted supply chains and an energy crisis are hitting UK consumers hard. This is becoming a problem that is as political as it is economic. A deeper look and understanding of inflation within different segments of the CPI basket is informative. Get the full article as pdf Watch our Focus on Inflation CISI-accredited CPD webinar [3 min read, open pdf for full report with charts]

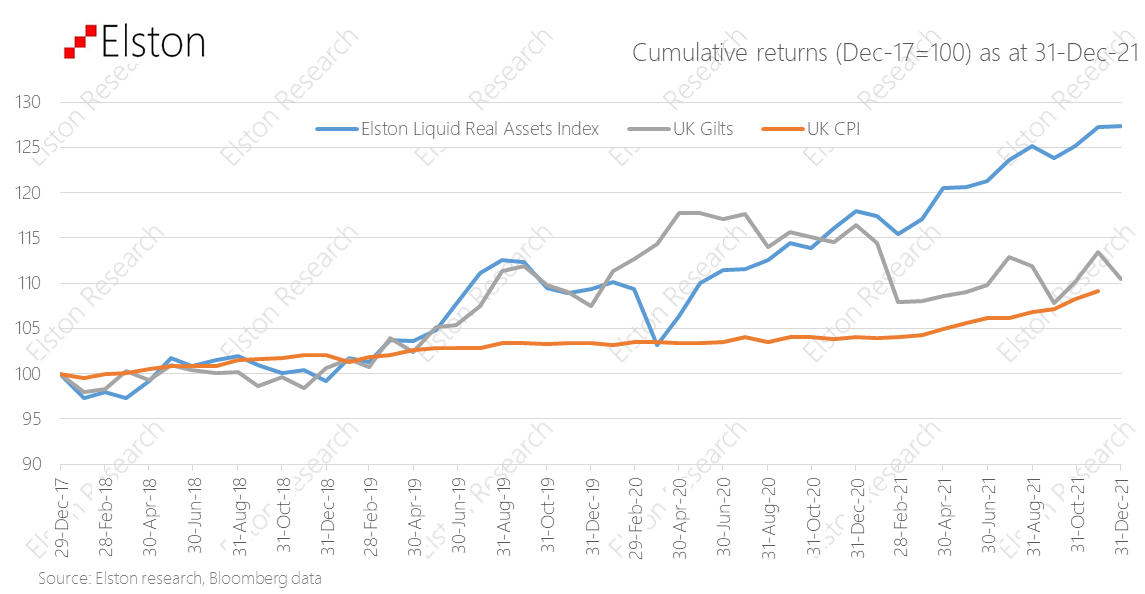

Inflation on the rise With inflation on the rise – and potentially interest rates too – nominal bonds are likely to remain under pressure. Whilst “real assets” – such as property, infrastructure and gold – have potential to preserve value in inflationary regimes, how can a switch from bonds to real assets be made without materially up-risking portfolios? This was the challenge we addressed in the design of our Liquid Real Assets index. Our Liquid Real Assets Index was developed to combine exposure to higher risk-return real asset exposures, with lower risk-return interest rate-sensitive assets, to deliver a real asset return exposure for inflation protection, in liquid format, with bond-like volatility to keep risk budgets in check. Given the rising inflationary pressures both in the US and in the UK, we take stock on the index performance year-to-date and are glad to say it’s “doing what it says on the tin. Find out more about the Elston Liquid Real Assets Index Watch the introductory webinar View the year-end index factsheet [3 min read, open as pdf]

Sustained recovery in risk assets 2021 saw a sustained recovery in risk assets, with the exception of Emerging Markets. Listed Private Equity was the top performing exposure returning +43.08% in GBP terms. Regionally, US equities remained the strongest performing market +30.06%. Real assets to the fore Real asset exposures, such as Water, Commodities and Timber continued to rally in face of rising inflation risk, returning +32.81%, +28.22% and +17.66% respectively. Our Liquid Real Assets Index (ticker ELSLRA Index) – which combines higher risk real assets and lower risk rate-sensitive assets to deliver volatility similar to bonds – returned +7.98%, whilst UK Gilts declined -5.16%. UK equity income strength Within UK equity market segments, UK Equity Income outperformed all other segments as inflation fears made income-generative, value-oriented shares relatively more attractive. UK Equity Income, represented by our Freedom Smart Beta UK Dividend Index (ticker ELSUKI Index), returned +20.77%, whilst UK Large Cap returned +19.68% and UK Core returned +18.44%. UK Small Cap was the weakest UK segment, returning +14.70% for the year. Read as pdf Register for our Quarterly Investment Outlook on 26 January 2022 |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed