|

[3 minute read]

Request the research paper Register for our CISI-accredited webinar with guest speakers from the World Gold Council Throughout recorded history, gold – rare and unreactive – has held its place as a coveted precious metal. Useful as both a store of value and as a means of exchange, in the modern era, gold has a core part to play in investor portfolios. Exposure to it offers investors three key benefits: insurance against shocks, risk-based diversification and – most significantly in our current environment - a hedge against inflation. The only free lunch in financial markets? The diversification effect is not only about adding an additional asset class, it is about an uncorrelated return pattern relative to both equities and bonds. Of all the precious metals and broader commodities traded, gold holds its own as the most powerful diversifier, exhibiting consistently low correlation with other major asset classes. Resistance to volatility Not only does gold outperform other commodities over time but it has also tended to perform positively when volatility increases. In periods of high inflation and currency devaluation, gold serves to protect investors’ purchasing power. Gold’s insurance characteristics mean that the optimal allocation for gold increases when risk in a portfolio increases. Current relevance In the ultra-low interest rate environment of today, increasing inflation fears means negative real yields, therefore the opportunity cost of holding non-income-generating assets is declining. While commodities provide near-term inflation protection particularly when related to supply shocks, gold has typically provided greater inflation protection characteristics during inflationary regimes, in part because the gold price reflects broader economic growth as defined by consumer price inflation and money supply. Not the only precious metal diversifier Gold is by no means alone in the precious metals category. Other key metals in the asset class include silver, platinum and palladium, each with characteristics of their own. All three carry significant value as industrial metals required in manufacturing of batteries, super-conductors and within the auto industry, rendering their prices more vulnerable to supply and demand fluctuations, and thus increased volatility. We explore the value they can offer and the role they can play within a portfolio. How to gain access as a retail investor? While professional investors can gain access to gold via the Futures market, what are the options available to UK advisers when constructing a retail client portfolio? From precious metal ETPs to funds of producers to simply buying and storing a bar of gold, we delve into the pros and cons, offering an unbiased overview of the opportunities available. [Open full article as pdf]

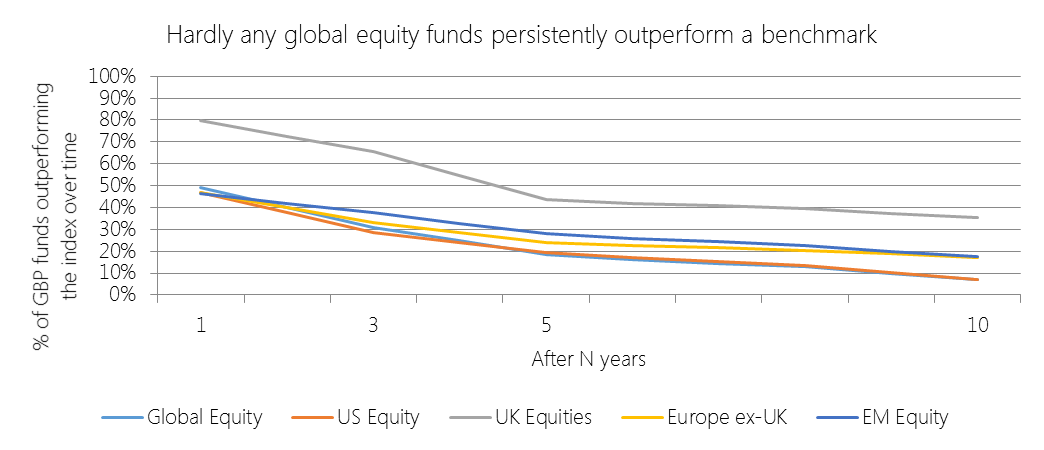

“Suppose we define a passive investor as anyone whose portfolio of U.S. equities is the cap-weight market portfolio described above. Likewise, define an active investor as anyone whose portfolio of U.S. equities is the not the cap-weight market portfolio. It is nevertheless true that the aggregate portfolio of active investors (with each investor's portfolio weighted by that investor's share of the total value of the U.S. equities held by active investors) has to be the market portfolio. Since the aggregate portfolio of all investors (active plus passive) is the market portfolio and the aggregate for all passive investors is the market portfolio, the aggregate for all active investors must be the market portfolio. All this is obvious. It is just the arithmetic of the fact that all U.S. equities are always held by investors. Its implications, however, are often overlooked.” What Bill Sharpe was saying to us was this: the performance of all active managers is, in aggregate [for a given asset class] that of the index less active fees. Which is a considerably worse deal than the charge often levelled against passive funds, namely that investors are paying for the performance of the index less passive fees. CPD Webinar: Is active management a zero-sum game? The rapid restart, supply chain disruption and scramble for gas is creating an inflationary Big Squeeze... whatever next and how to adapt? Whilst we would like to think inflation will be transitory rather than persistent, events are making that thinking look wishful. Our market update webinar will take stock of what's happening and why, and how to position portfolios from an asset allocation perspective.

To join the discussion on macro and market outlook, we are delighted to welcome Karim Chedid, CAIA, Director and Head of Investment Strategy for iShares EMEA. Agenda 1. What's driving "The Big Squeeze" - rapid restart, pent-up demand and supply shortfalls: how does this play out? 2. We assess the outlook against the "triangle" of growth, inflation and interest rates 3. We look at market regime, and portfolio resilience and vulnerabilities in an inflationary world Please join us on Wed 27 Oct at 1030am

Read the article in full (5 min read) Following the post-COVID restart, there would necessarily be an inflationary spike, from base effects alone. Central Banks’ core thesis was that this spike would be “transitory”, rather than “persistent”. However, the combination of pent-up demand, supply chain disruptions and an energy crisis suggests that inflation could prove more persistent than transitory. We look at the numbers and how this informs the “big picture triangle” of three key macro factors: growth, inflation and interest rates. Finally, we outlined potential interventions in portfolio positioning from an asset allocation perspective. Nominal bonds are known to be structurally challenged in an inflationary regime, and propose real asset exposure instead. Within equities, we would propose an income/value bias. Regiser for our 3q21 Review & Outlook: The Big Squeeze [Open as pdf]

Money market funds, and their exchange-traded equivalents “ultra-short duration bond funds”, are an important, if unglamorous, tool in portfolio manager’s toolkit. They can be used in place of a cash holding for additional yield, without compromising on risk, liquidity or cost. Money market funds are intended to preserve capital and provide returns similar to those available on the wholesale money markets (e.g. the SONIA rate that replace LIBOR). How risky is a money market fund? Money market-type funds hold near-to maturity investment grade paper. Their weighted average term to maturity is <1 year. They therefore have very low effective duration (the sensitivity to changes in interest rates). Compare gilts which are seen as a low-risk asset relative to equities. The 10-11 year duration on UK gilts (all maturities) means they carry a higher level volatility compared to cash (which has nil volatility). On the flip side, their longer term also means they have higher risk-return potential relative to cash and ultra-short bonds. By contrast, money market type funds have some investment risk as they hold non-cash assets, but given their holdings’ investment grade status, short term to maturity and ultra-short effective duration, they exhibit near-nil volatility. Platform cash, fixed term deposit or money market fund From a flexibility perspective and a value for money perspective, there's a clear rationale to hold money market funds, rather than platform cash or a fixed term deposit. Our Money Markets fund research paper that looks at 4 low cost money market funds sets out why Why does the fund structure make sense? Find out more in our CPD Webinar on Introduction to Collective Investment Schemes |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed