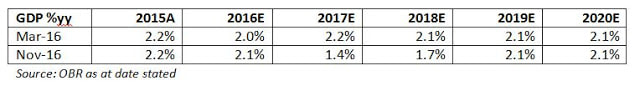

Growth estimates cut UK GDP’s growth rate has been downgraded relative to pre-referendum expectations, with a cut from 2.2% to 1.4% for 2017E and from 2.1% to 1.7% for 2018E. Inflation estimates raised Following post-referendum sterling weakness, estimates for UK inflation were increased from 1.6% to 2.3% for 2017E and from 2.0% to 2.5% for 2018E. This compares to 2.4% and 2.8% for 2017E and 2018E respectively for UK swap breakeven rates. Rising interest rate environment With higher inflation expectations there is upward pressure on Bank Rates after a protracted “lower for longer” regime. Spending focus: infrastructure and innovation

The government spending plans shows clearly defined cous – with budget to increase infrastructure spending from 0.8% of GDP today to 1.0-1.2% from 2020. This supply side stimulus that focuses on productivity gains is welcome if fiscally manageable. NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: www.gov.uk; Chart credit: OBR; Table credit: OBR Data, Bloomberg

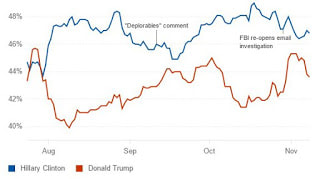

Voting results Trump swept to victory with 42 of 50 states declared, Trump leads Clinton 244 electoral votes to 215, with 26 to win, collecting 48.2% of the vote vs Clinton 47.1% (as at 0630 GMT today). The result with 46 of 50 states declared gives a Trump win of 278 electoral votes to 218, with 48.0% of the Vote vs Clinton 47.3% (as at Trump acceptance speech). Impact EQUITIES: expect US equities (NYSEARCA:SPX; LON:CSPX) and global equities (NYSEARCA:ACWI; LON:SSAC) to be volatile, with emerging markets (NYSEARCA:EEM; LON:IEEM) to be negatively impacted, particularly Mexico (NYSEARCA:EWW; LON:CMXC). From a sector perspective expect a positive reaction for financials (NYSEARCA:XLF; LON:SXLF), healthcare (NYSEARCA:XLV; LON:SXLV) and US infrastructure/utilities (NYSEARCA:XLU; LON:SXLU). BONDS: expect near-term flight to safety driving government bond (NYSEARCA:TLT; LON:IGLO) yields down and prices up. ALTERNATIVES: Expect flight to safety to drive relative outperformance in gold (NYSEARCA:SGOL; LON:GBS) and precious metals (NYSEARCA:GLTR; LON:AIGP), oil (NYSEARCA:IEO; LON:SPOG) as well as copper (NYSEARCA:JJC; LON:COPA). CURRENCY: expect USD short-term weakness vs GBP, CHF and JPY. Why pollsters got it wrong? The result compares to pre-election polls of Clinton 46.8%, Trump 43.6%. Pollsters got it wrong for two reasons 1) voter turnout amongst disaffected voters was higher so mix of voters in sample size is no longer indicative, and 2) “secret Trumpers” – voters who may not admit to voting for Trump in polls, but did. Source: RealClearPolitics Why Bookies got it wrong? By analysing political spread-betting odds, it is possible to derive an implied probability figure for the respective candidates. On the night before election, these gave Clinton an implied 84% probability of success and Trump 16%. As results started coming in, the implied probability for Trump spiked to close at 97% before betting closed. The probabilities were so wrong because a market-derived estimate is only as good as the aggregate views of the market participants betting against each other. And given spread-betting is more a past-time for affluent city types, rather than Trump’s core supporters, it is, like Brexit, liable to the same “groupthink” effect which makes it impossible for them to fathom that anyone would vote for Trump, because they over-estimate the size and influence of their “group”. Source: betdata

What next? The risks to a Trump victory were asymmetrical on the downside to a Clinton victory on the upside – and markets will react accordingly. The next few weeks will set the tone of the new President’s administration. It will soon become clear whether or not the toxicity of this campaign will subside in favour of pragmatic policy focus, now that the election is over. Personalities aside, with the new administration, markets need to assess is the outlook for 1) Growth and earnings; 2) inflation and interest rates; and 3) employment and trade. So once the dust settles, and the ticker tape is swept up, the focus will shift policy in Trump’s first 100 days and, more imminently, the Fed’s rate decision in December. NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: Google; Chart credit: RealClearPolitics, betdata; Table credit: N/A

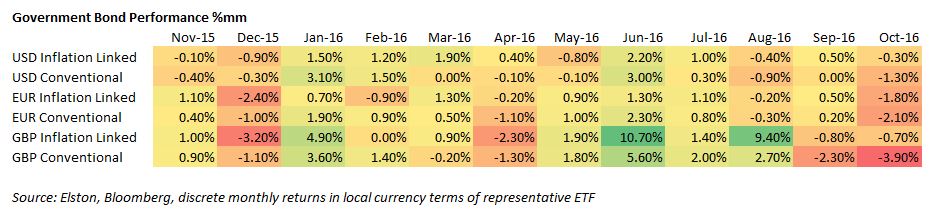

Who’s right? Given Referendums are only advisory in nature, and sovereignty rests with Parliament alone, the case had merit. And yesterday’s ruling in the High Court, the three ruling Judges agreed. The challengers maintain they are not contesting the referendum results, they just want legal process to be upheld. Others suspect the campaign is partisan, but even if so, the case still deserves to be heard. Parliamentary approval was required on the way in to Europe. It should be required on the way out. Rather than backing the down, the Government is taking the ruling to the Supreme Court in an attempt to get its way. By digging in deeper they are potentially compounding the error of not calling an election the moment that May was anointed Prime Minister. The fine line While in the summer the new Cabinet felt it was riding high on the momentum of populist support, there is a fine line between democracy and demagoguery. Had the Brexiteers had a clear plan for what happens next, there would not be a feeling of rushing headfirst into the unknown. As winter approaches, the need for a cool tempered defence of the sovereignty of Parliament is hard for even the most committed Brexiteers to deny: particularly as sovereignty was at the heart of the Leave campaign. Where’s the mandate? The Conservative government had the referendum in their electoral mandate. But not the mandate to act on its results. Nor did the country vote for May to be Prime Minister May. She should tread carefully. Borrowed time This leaves Prime Minister May with two unpalatable choices: Either to call a snap election (she should have done this when she won the leadership contest) to confirm her mandate as leader and the mandate to trigger Article 50 Or to try to brush the inconvenient constitutional truth of Parliamentary approval by taking it to the Supreme Court. Who’s afraid of an election? The new Cabinet is scared of an election. It could sweep them out of power and could push back further the decisive moment at which Article 50 is triggered as a new government reviews the position. The toxicity in Westminster between Conservative factions means that the political body count of MPs with reputations smashed or jobs lost will continue to grow. That is making the cabinet increasingly desperate. And desperate politicians make bad choices. Bottom line Chances are this Cabinet will fall apart before Article 50 gets triggered, either through extended legal wrangling in the Supreme Court (not a pretty site) or in an attempt to win a mandate by calling an election. With their parliamentary majority so slim, and the dramatis personae so different there is no guarantee they would win. [ENDS] NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a UK audience. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Image credit: clipart.co; Chart credit: N/A; Table credit: N/A October saw a sharp one month loss for global sovereigns owing to inflation fears, raised interest rate expectations and declining Central Bank appetite for QE.

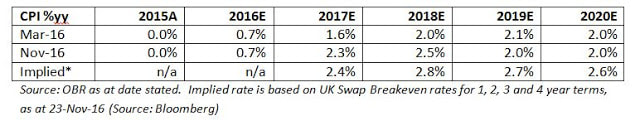

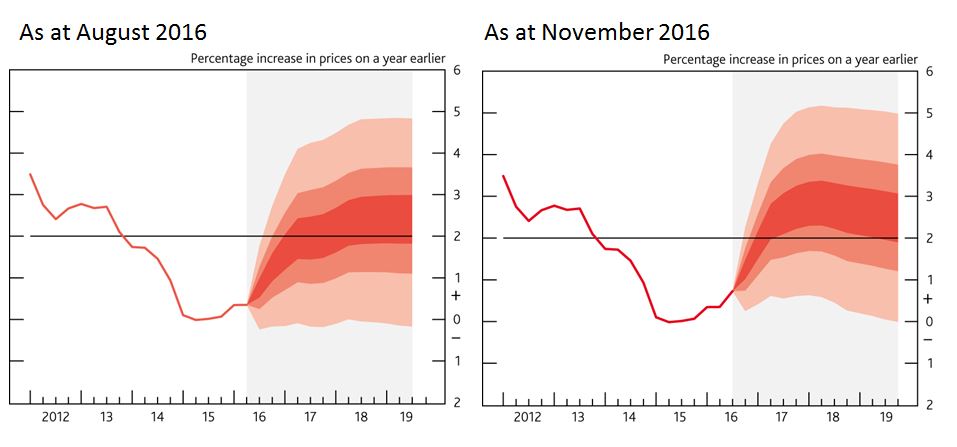

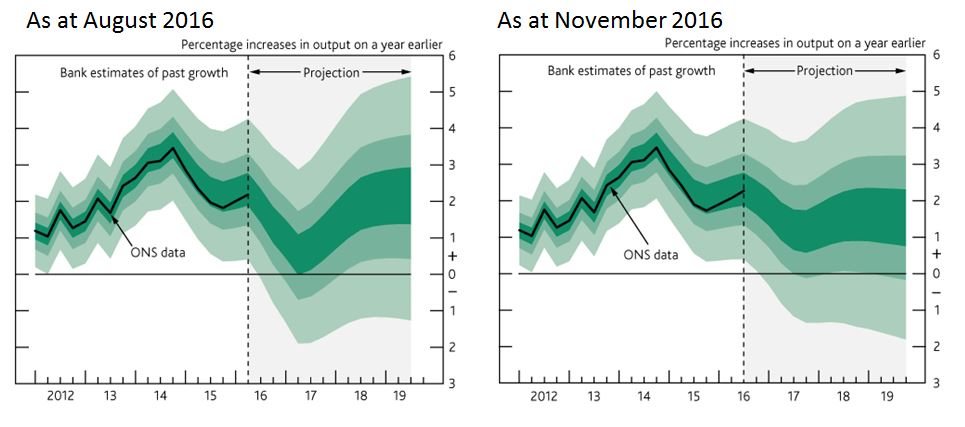

In the US, prospects of a December Fed Rate hike saw 10 year yields clime 30bp on month and 76bp from summer lows to 1.26%, whilst stronger growth numbers raised inflation expectations and positive performance for TIPS. The USD performance for inflation-linked treasuries was -0.33% (LSE:ITPS), compared to for -1.32% (LON:IBTM) for conventional treasuries. In the EU, fears over the ECB’s commitment to QE contributed to the sell off. The EUR performance for inflation-linked Euro government bonds (LSE:IBCI) was -1.78%, compared to for -2.14% for conventional Euro government bonds (LSE:IEGA). In the UK, the inflationary potential from Brexit, and vanishing expectations of any further BoE rate cuts on stronger economic growth led to a gilts sell off. The GBP performance for inflation-linked gilts (LSE:INXG) was -0.65%, compared to -3.92% for (LSE:IGLT) for conventional gilts. Inflation The Bank of England has raised its 2017 inflation estimate to 2.7%, from the current rate of 1%. The Bank does not expect inflation to return to its 2% target until 2020. The rise in inflation expectations was explained by the decline in the pound since the EU referendum, which is driving up prices of imported goods. Fig 1. Projections for UK CPI based on market interest rate expectations Source: http://www.bankofengland.co.uk/publications/Pages/inflationreport/2016/nov.aspx Growth The economic growth rate forecast was also raised from 0.8% to 1.4% for 2017, whilst expectations were cut for 2018 from 1.8% to 1.5%, signalling that the Brexit impact will be felt later than originally expected. Further interest rates considered in August have been clearly ruled out. Fig 2. Projections for UK GDP based on market interest rate expectations Source: http://www.bankofengland.co.uk/publications/Pages/inflationreport/2016/nov.aspx

NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: N/A; Chart credit:Bank of England; Table credit: N/A |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed