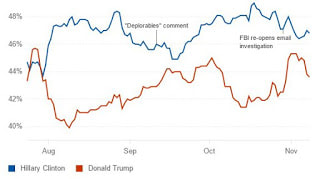

Voting results Trump swept to victory with 42 of 50 states declared, Trump leads Clinton 244 electoral votes to 215, with 26 to win, collecting 48.2% of the vote vs Clinton 47.1% (as at 0630 GMT today). The result with 46 of 50 states declared gives a Trump win of 278 electoral votes to 218, with 48.0% of the Vote vs Clinton 47.3% (as at Trump acceptance speech). Impact EQUITIES: expect US equities (NYSEARCA:SPX; LON:CSPX) and global equities (NYSEARCA:ACWI; LON:SSAC) to be volatile, with emerging markets (NYSEARCA:EEM; LON:IEEM) to be negatively impacted, particularly Mexico (NYSEARCA:EWW; LON:CMXC). From a sector perspective expect a positive reaction for financials (NYSEARCA:XLF; LON:SXLF), healthcare (NYSEARCA:XLV; LON:SXLV) and US infrastructure/utilities (NYSEARCA:XLU; LON:SXLU). BONDS: expect near-term flight to safety driving government bond (NYSEARCA:TLT; LON:IGLO) yields down and prices up. ALTERNATIVES: Expect flight to safety to drive relative outperformance in gold (NYSEARCA:SGOL; LON:GBS) and precious metals (NYSEARCA:GLTR; LON:AIGP), oil (NYSEARCA:IEO; LON:SPOG) as well as copper (NYSEARCA:JJC; LON:COPA). CURRENCY: expect USD short-term weakness vs GBP, CHF and JPY. Why pollsters got it wrong? The result compares to pre-election polls of Clinton 46.8%, Trump 43.6%. Pollsters got it wrong for two reasons 1) voter turnout amongst disaffected voters was higher so mix of voters in sample size is no longer indicative, and 2) “secret Trumpers” – voters who may not admit to voting for Trump in polls, but did. Source: RealClearPolitics Why Bookies got it wrong? By analysing political spread-betting odds, it is possible to derive an implied probability figure for the respective candidates. On the night before election, these gave Clinton an implied 84% probability of success and Trump 16%. As results started coming in, the implied probability for Trump spiked to close at 97% before betting closed. The probabilities were so wrong because a market-derived estimate is only as good as the aggregate views of the market participants betting against each other. And given spread-betting is more a past-time for affluent city types, rather than Trump’s core supporters, it is, like Brexit, liable to the same “groupthink” effect which makes it impossible for them to fathom that anyone would vote for Trump, because they over-estimate the size and influence of their “group”. Source: betdata

What next? The risks to a Trump victory were asymmetrical on the downside to a Clinton victory on the upside – and markets will react accordingly. The next few weeks will set the tone of the new President’s administration. It will soon become clear whether or not the toxicity of this campaign will subside in favour of pragmatic policy focus, now that the election is over. Personalities aside, with the new administration, markets need to assess is the outlook for 1) Growth and earnings; 2) inflation and interest rates; and 3) employment and trade. So once the dust settles, and the ticker tape is swept up, the focus will shift policy in Trump’s first 100 days and, more imminently, the Fed’s rate decision in December. NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: Google; Chart credit: RealClearPolitics, betdata; Table credit: N/A Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed