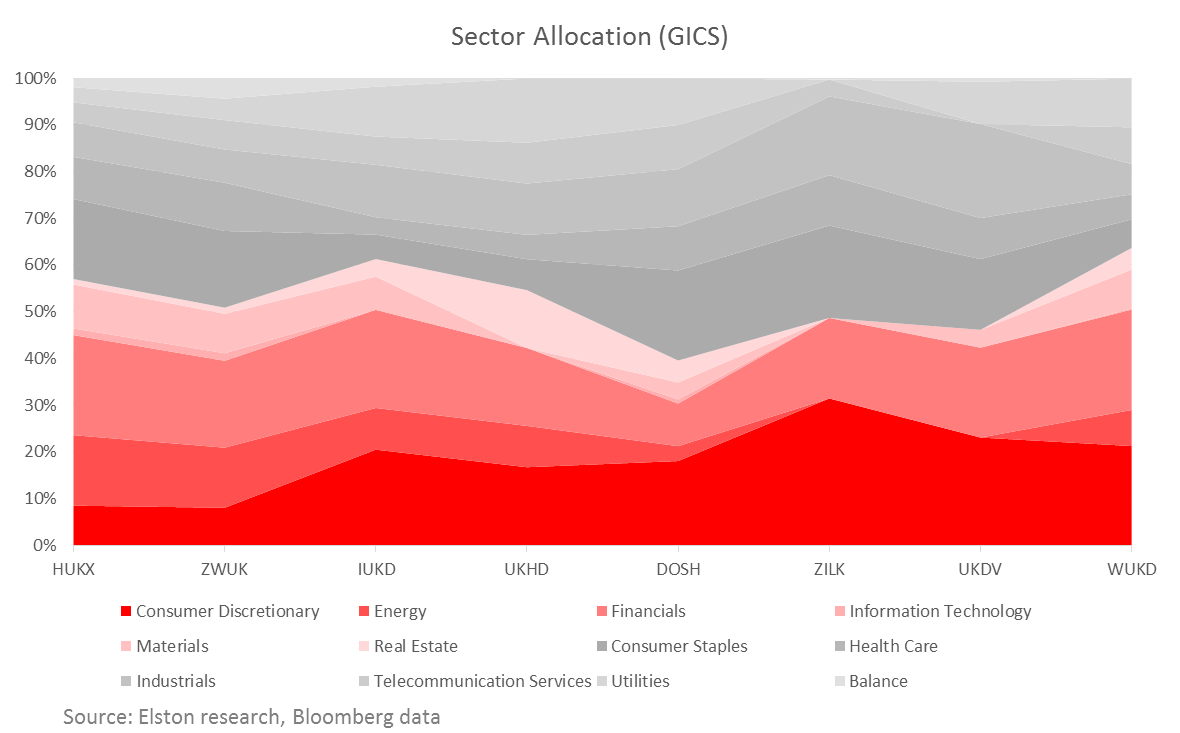

UK Equity Income ETF Choices Investors have a choice of UK Equity Income index strategies, each with different risk-return characteristics, weightings methodologies and factor tilts. Portfolio managers and advisers considering a UK Equity Income ETF should understand the differences of each to inform their selection process. In the first of a series of studies of this key sector, we have done a sector analysis of London-listed UK Equity Income ETFs, to understand their inherent characteristics relative to the UK main equity index, the FTSE 100. For these studies, we have analysed the indices and ETFs detailed in Fig.1. Fig. 1: UK Equity Income Indices & ETFs vs HSBC FTSE 100 UCITS ETF (LON:HUKX) Methodology impact on sector allocation The result of the application of various index methodologies to the UK equities opportunity set materially impacts the sector exposures of available Equity Income ETFs. In some cases, sector caps form part of the index rules. In other cases they do not. For example, the FTSE100’s bias to Energy and Financials is well documented. For some Equity Income strategies, such biases are mitigated or even eliminated. Selecting the right Equity Income ETF for the business cycle For investors that focus on the business cycle, we have analysed the available UK Equity Income ETFs by GICS sectors, and classified those GICS sectors into two broad groups – Cyclicals and Defensives. This enables us to rank UK Equity Income ETFs by their exposure to the business cycle. On this basis, investors wanting access to UK Equity Income with a Cyclical bias (coloured red in Fig.2. below), should consider (in order) LON:WUKD, LON:IUKD, and LON:HUKX. Conversely, investors wanting access to UK Equity Income with a Defensive bias (coloured grey in Fig.2. below), should consider (in order) LON:DOSH, LON:UKDV and LON:ZILK. Fig. 2: UK Equity Income ETFs by Sector Allocation vs HSBC FTSE 100 UCITS ETF (LON:HUKX) Conclusion

There is more to UK Equity Income than yield alone, by understanding the look-through sector exposures of the available UK Equity Income ETFs, investors can make more informed decisions as regards ETF selection that is consistent with their preferences, and client needs. NOTICES I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: N/A; Chart credit: Elston Consulting; Table credit: Elston Consulting All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. Chart data is as at 30-Nov-17 |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed