|

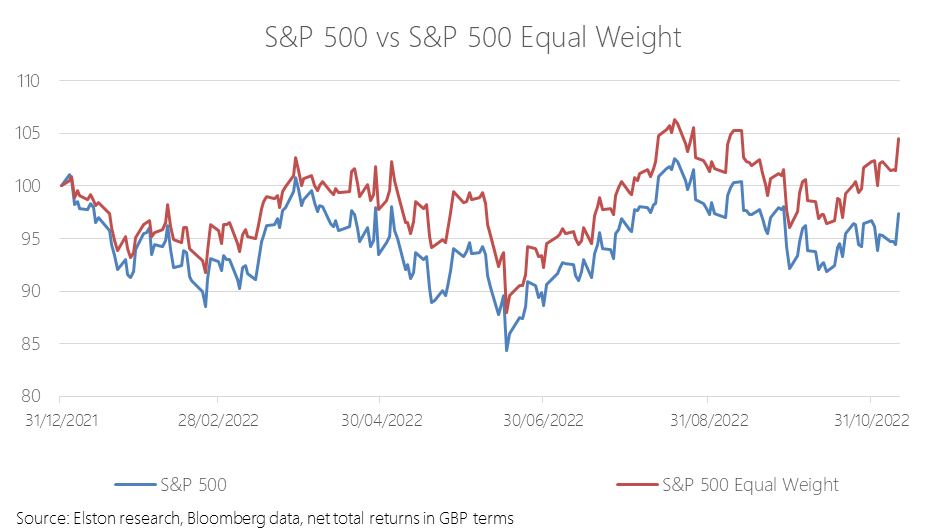

In this article for IG, Henry Cobbe explores a fresh approach to equity diversification.

Read in full

https://www.ftadviser.com/investments/2022/11/28/understanding-bonds-in-an-inflationary-environment/ [5 min read, open as pdf]

[5 min read, open as pdf]

[3 minute read, open as pdf]

[5 min read, open as pdf]

A private market allocation is structurally hard to reverse if things go wrong with any of 1) the investor’s liquidity needs, 2) the private market fund’s underlying investments, or 3) the realised returns relative to risk-free investments (e.g. gilts) for a given term. As such, an allocation to private markets should be seen more like an irreversible decision, unlike almost all other investments available to institutional investors which can be sold at a day, week or month’s notice. In this brief note, we do not set out the case for investing in private markets – that has been set out extensively elsewhere. We do however raise some points of challenge to those stated advantages. [Read full paper as pdf] In this article for IG, Hoshang Daroga CFA, Investment Director at Elston Consulting, looks at the easing of Covid-19 restrictions in China.

Read in full In this article for IG, Henry Cobbe explores looks at an alternative approach to US indices.

Read in full UK inflation at 11.1%yy for Oct-22

For full updates including charts, open as pdf [3 min read, open as pdf]

US inflation at 7.7%yy for Oct-22

This is lower than the survey estimate… … and a decrease from 8.2%yy last month Represents lessening inflation pressures For full update including charts, open as pdf [3 min read, open as pdf]

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed