|

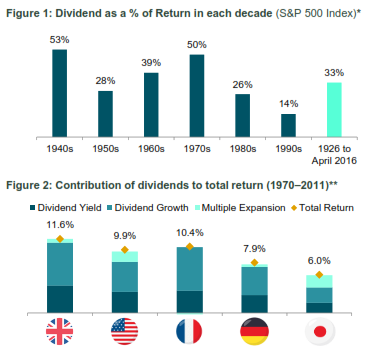

[3 min read, open as pdf] Inflation is on the rise: equities provide long-term inflation protection Inflation risk means greater focus on intrinsic value such as dividends UK equities with value and/or income bias are attractive Inflation is on the rise, and whilst it’s broadly accepted that equities can provide a long-term inflation hedge, which kind of equities are best positioned to provide this. Since the financial crisis, Value investors have been jilted by a market love affair with Momentum. The switch back to Value was already being called on purely a valuation basis since late 2019. But the rekindling of inflation risk in the market is only making companies with a Value-bias and a progressive quality income stream back in the spotlight. What is quality income? Quality means persistency, focusing on companies that regularly pay a stable or increasing dividend, whilst mitigating dividend concentration risk. “One of the most persuasive tests of high quality is an uninterrupted record of dividend payments going back many years.” Benjamin Graham Indeed, research suggests that Dividends are a key anchor of Total Returns, although this differs from market to market. Figure 1: Source: S&P Dow Jones Index Research August 2016

Figure 2: Source: JP Morgan, The Search for Income: A Global Dividend Strategy, 2012 How then to screen for companies that can deliver this type of strategy? Is it just about yield? We don’t think so. High yield is not high quality Screening for high dividend yield alone can lead to “value-traps” that negatively impact performance. The poor performance is because those high-yielding companies might be poor businesses with unstable dividends. Market cap weight or Dividend contribution weight Traditional equity indices are market-capitalisation weighted. The resulting dividend income for an index is therefore a function of each company’s size. An alternative approach is to weight the holding in each company by its contribution to overall dividends. This way the index is focused on the biggest dividend payers, rather than the biggest companies by size. This creates a direct bias towards Yield, and an indirect bias towards Value, from a factor-exposure perspective. Forward- or backward-looking Active equity income managers typically look at forward-looking dividend estimates. Index-based “passive” equity income strategies often look at historic dividend yield for ranking purposes. This is sub-optimal. We believe that index strategies that focus on equity income should use forward-looking estimates, to systematically capture upswings in earnings and dividend estimates. Equities as an inflation hedge It’s broadly accepted that equities can provide a long-term inflation hedge. But what kind of equities are likely to perform well in an inflationary regime? We believe there are three characteristics:

Why the Value focus in inflationary environment? When the two major styles of investing are compared, i.e., growth and value investing, the latter style rejects the efficient market hypothesis and choses an equity with lower expectations, which is often undervalued and would profit quickly when the market adjusts itself. During an inflationary environment, economic concepts direct that the ‘time value of money’ has a major role to play. Thus, an equity today, becomes of greater value, when compared to its worth tomorrow. Hence, value investing seems attractive in an inflationary world since the investors are less willing to pay up for future earnings and can regain their money sooner rather than later, when compared to growth investing. (Murphy, 2021) With a global pandemic, many predicted deflation as a threat; however, with the counter-balancing forces, investors soon realized inflationary threat. (Baron, 2021). Rising inflation is good for value investing for a number of reasons. In general, equity markets are dynamic and display a stronger corelation to inflationary environment, this lays a very strong premise that higher inflation and stronger earnings are co-dependent. Financially speaking, Sectors such as energy, financial are major drivers of the major economic growth. A rise in these value stocks tends to pace up the overall economic growth, thus outperforming others. (Lebovitz,2021) According to JP Morgan’s chief strategist, the change in investing style, this time around could be a more impactful due to several factors such as the failure of monetary and fiscal policies whilst recovering from a pandemic. (Ossinger, 2021) Dividends, dividends, dividends: a tried and tested approach The most fundamental explanation, by John Kingham, a value investor, states that a dividend discount model, attempts to find the true value of the stock, under any market circumstances and focuses on the dividend pay-out factors and the market expected returns. Historically, the companies with dividend have generated higher returns when compared to companies which either have no dividend or eliminated the dividend. (Park and Chalupnik, 2021) This means that dividends hold value when it comes to the total return of the portfolio. Moreover, with the market getting more and more inflationary, and equities getting exposed. Adding companies which can provide returns even in a low growth environment can create a sustainable portfolio. Government bonds have not performed well with rising inflation (Baron,2021) High yielding corporate bonds offered better protection compared to government gilts since these inflations linked bonds add value in-line with RPI Inflation according to Barclays Equity Guilt Study and can protect investors from unexpected inflation, yet they are still not considered as a safe haven like government gilts. (Dillow,2021) Investment manager of Iboss Chris Rush recently told Portfolio Adviser that in order to reduce the inflationary shock the firm had already reduced its positions from treasures and gilts and incorporated strategic bonds They also plan on holding a short duration fixed income. (Cheek, 2021) Although, it might have not been the fundamental goal, over the past several decades until 2017 dividends reported 42% of the S&P 500 Index’s total return. The global recession and now pandemic have created a lack of stability for the layer of support for future returns, however, analysts have assured there is room for recovery. (Markowicz, 2021) Summary Whether transitory or persistent, with inflation on the rise, there is a strong rationale for having an allocation to Value from a factor-exposure perspective. Those value-type firms that generate and pay a progressive dividend policy provides a level of inflation protection both in absolute terms and relative to bonds that is more than welcome, and potentially essential. Henry Cobbe & Aayushi Srivastava [ 5 min read, open as pdf]

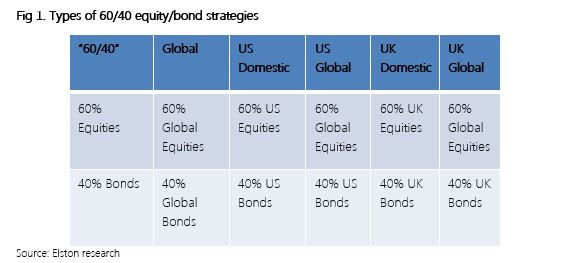

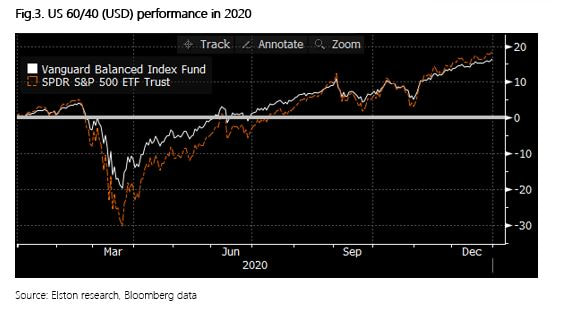

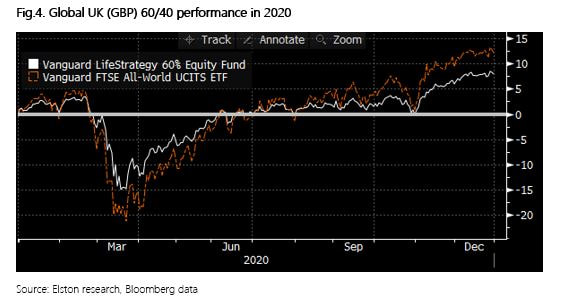

Since an article published in 2019 pointed the historic lows in bond yields, many investment firms are starting to rethink the 60/40 portfolio. This came under even more scrutiny following the market turmoil of 2020. While some affirm that the 60/40 will outlive us all, others argue against this notion. We take a look at the main arguments for and against and key insights What is a 60/40 portfolio? A 60/40 equity/bond portfolio is a heuristic “rule of thumb” approach considered to be a proxy for the optimal allocation between equities and bonds. Conventionally equities were for growth and bonds were for ballast. The composition of a 60/40 portfolio might vary depending on the base currency and opportunity set of the investor/manager. Defining terms is therefore key. We summarise a range of potential definitions of terms: Furthermore, whilst 60/40 seems simple in terms of asset weighting scheme, it is important to understand the inherent risk characteristics that this simple allocation creates. For example, a UK Global 60/40 portfolio has 62% beta to Global Equities; equities contribute approximately 84% of total risk, and a 60/40 portfolio is approximately 98% correlated to Global Equities[1]. [1] Elston research, Bloomberg data. Risk Contribution based on Elston 60/40 GBP Index weighted average contribution to summed 1 Year Value At Risk 95% Confidence as at Dec-20. Beta Correlation to Global Equities based on 5 year correlation of Elston 60/40 GBP Index to global equity index as at Dec-20. Why some think 60/40 will outlive us all. The relevance of 60/40 portfolio lies in its established historic, mathematical and academic backup. Whilst past performances do not guarantee future returns, it nonetheless provides us with experience and guidance. (Martin,2019) Research also suggests that straightforward heuristic or “rule-of-thumb” strategies work well because they aren’t likely to inspire greed or fear in investors. They become timeless. Thus, creating a ‘Mind-Gap’. (Martin,2019) In the US, the Vanguard Balanced Index Fund (Ticker: VBINX US) which combines US Total Market Index and 40% into US Aggregate bonds, plays a major role in showcasing the success of the 60/40 portfolio that has proved popular with US retail investors (Jaffe,2019). Similarly, in the UK the popularity of Vanguard LifeStrategy 60% (Ticker VGLS60A) showcases the merits of a straightforward 60/40 equity/bond approach. In 2020, for US investors VBINX provided greater (peak-to-trough) downside protection owing to lower beta (-19.5% vs -30.3% for US equity) and delivered total return of +16.26% volatility of 20.79%, compared to +18.37% for an ETF tracking the S&P 500 with volatility of 33.91%, both funds are net of fees. In this respect, the strategy captured 89% of market returns, with 61% of market risk. For GBP-based investors in 2020 the 60/40 approach had lower (peak-to-trough) drawdown levels (-15%, vs -21% for global equities) owing to lower beta. The 60% equity fund delivered total return of +7.84% with volatility of 15.12%, compared to +12.15% for an ETF tracking the FTSE All World Index with volatility of 24.29%. In this respect, the strategy captured 65% of market returns, with 62% of market risk. Why some think 60/40 has neared its end

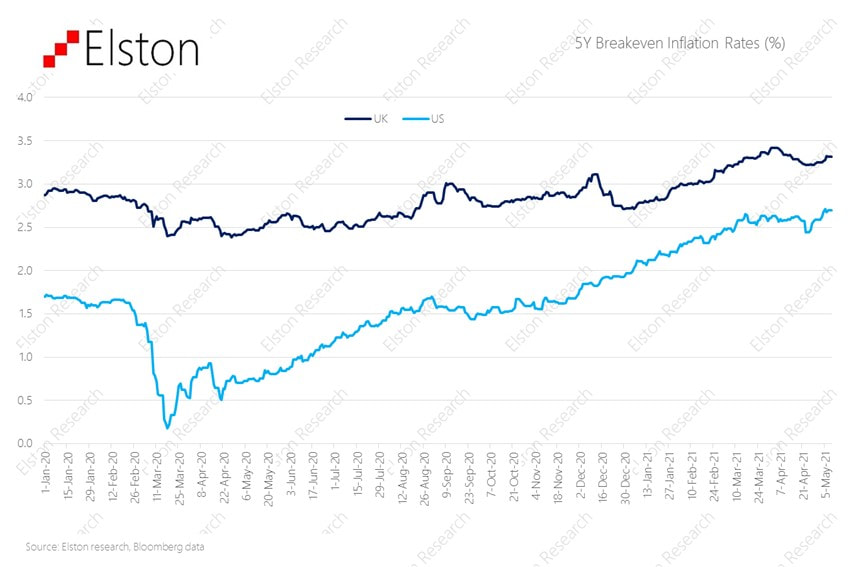

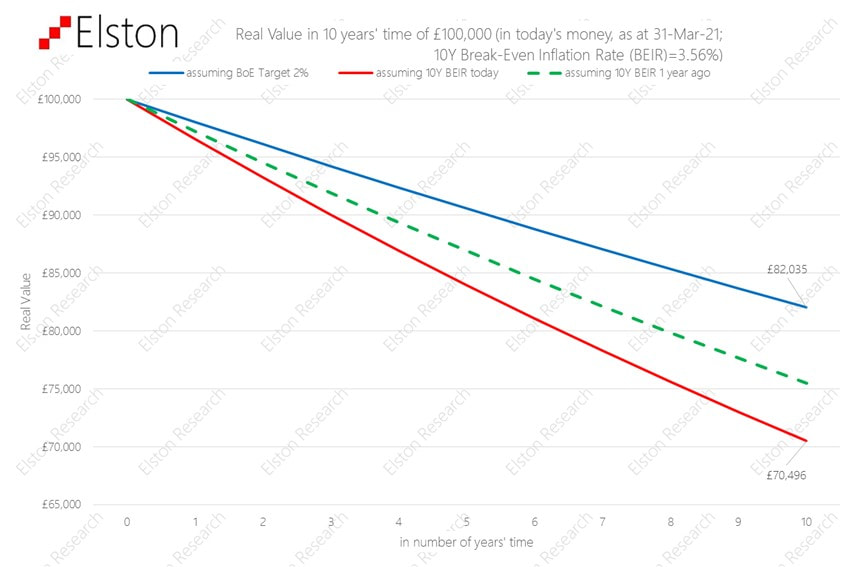

Since its inception the 60/40 portfolio, derived 90% of the risk from stocks. In simple terms, 60% of the asset allocation of the portfolio was therefore the main driver of the portfolio. Returns (Robertson,2021). This hardly a surprise given that equities have a 84% contribution to portfolio ris, on our analysis, but the challenge made by some researchers is that if a 60/40 portfolio mainly reflects equity risk, what role does the 40% bond allocation provide, other than beta reduction? The bond allocation is under increasing scrutiny now is because global economic growth has slowed and traditionally safer asset classes like bonds have grown in popularity making bonds susceptible to sharp and sudden selloffs. (Matthews,2019) Strategists such as for Woodard and Harris, for Bank of America and Bob Rice for Tangent Capital have stated in their analysis that the core premise of the 60/40 portfolio has declined as equity has provided income, and bonds total return, rather than the other way round.. (Browne,2020) Another study shows that over the past 65 years bonds can no longer effectively hedge against inflation and risk reduction through diversification can be done more adequately by exploring alternatives such as private equity, venture capital etc. (Toschi, 2021). Left unconstrained, however, this can necessarily up-risk portfolios. With bond yields at an all-time low, nearing zero and the fact that they can no longer provide the protection in the up-and-coming markets many investors query the value provided by a bond allocation within a portfolio. (Robertson,2021) Key insights While point of views might differ about 60/40 as an investment strategy, one aspect that is accepted is that the future of asset allocation looks very different when compared to the recent past. Rising correlations, low yields have led strategists and investors to incorporate smarter ways of risk management, explore new bond markets like China, create modified opportunities for bonds to hedge volatility through risk parity strategies, as well as using real asset exposure such as real estate and infrastructure. (Toschi, 2021) Research conducted by The MAN Institute summarises that modifying from traditional to a more trend-following approach introduces the initial layer of active risk management. By adding an element of market timing investors further reduce the risk, when a market’s price declines. While bonds have declined in yield, they still hold importance in asset allocation for beta reduction. Further diversifying the portfolio with an allocation to real assets has potential to provide more yield and increased return than government bonds. Summary The 60/40 portfolio strategy has established itself over many decades, it has seen investors through four major wars, 14 recessions, 11 bear markets, and 113 rolling interest rate spikes. It has proved resilience as a strategy and utility as a benchmark. Our conclusion is that 60/40 is not dead: it is a useful multi-asset benchmark and remains a starting point for strategic asset allocation strategies. But the detail of the bond allocation needs a rethink. Incorporating alternative assets or strategies so long as any increased risk can be constrained to ensure comparable portfolio risk characteristics. Henry Cobbe & Aayushi Srivastava Elston Consulting Bibliography Browne, E., 2021. The 60/40 Portfolio Is Alive and Well. [online] Pacific Investment Management Company LLC. Available at: https://www.pimco.co.uk/en-gb/insights/blog/the-60-40-portfolio-is-alive-and-well Jaffe, C., 2019. No sale: Don’t buy in to ‘the end’ of 60/40 investing. [online] Seattle Times. Available at: https://www.seattletimes.com/business/no-sale-dont-buy-in-to-the-end-of-60-40-investing/ Martin, A., 2019. The 60/40 Portfolio Will Outlive Us All. [online] Advisorperspectives.com. Available at:https://www.advisorperspectives.com/articles/2019/11/11/the-60-40-portfolio-will-outlive-us-all#:~:text=As%20two%20recent%20commentaries%20demonstrate,40%20will%20outlive%20us%20all. Matthews, C., 2021. Bank of America declares ‘the end of the 60-40’ standard portfolio. [online] MarketWatch. Available at:https://www.marketwatch.com/story/bank-of-america-declares-the-end-of-the-60-40-standard-portfolio-2019-10-15 Robertson, G., 2021. 60/40 in 2020 Vision | Man Institute. [online] www.man.com/maninstitute. Available at:https://www.man.com/maninstitute/60-40-in-2020-vision Toschi, M., 2021. Why and how to re-think the 60:40 portfolio | J.P. Morgan Asset Management. [online] Am.jpmorgan.com. Available at: https://am.jpmorgan.com/be/en/asset-management/adv/insights/market-insights/on-the-minds-of-investors/rethinking-the-60-40-portfolio/ [3 min read, open as pdf] Inflation is on the rise Easy central bank money, pent up demand after lockdowns and supply-chain constraints mean inflation is on the rise. Will Central Banks be able to keep the lid on inflation? The risk is that it could persistently overshoot target levels. It matters more over time Inflation erodes the real value of money: its “purchasing power”. If inflation was on target (2%), £100,000 in 10 year’s time would be worth only £82,035 in today’s money. But on current expectations, it could be worth a lot less than that. Real assets can help

A bank note is only as valuable as the value printed on it. This is called its “nominal value”. Remember the days when a £5 note went a long way? When inflation rises, money loses its real value. By contrast, real assets are things that have a real intrinsic value over time whose value is set by supply, demand and needs: like copper, timber, gold, oil, and wheat. Real assets can also mean things that produce an regular income which goes up with inflation, like infrastructure companies (pipelines, toll roads, national grid etc) and commercial property with inflation-linked rents. Rethinking portfolio construction Including “real assets” into the mix can help diversify a portfolio, and protect it from inflation. Obviously there are no guarantees it will do so perfectly, but it can be done as a measured approach to help mitigate the effects of inflation. The challenge is how to do this without taking on too much risk. Find out more about our Liquid Real Assets Index |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed