|

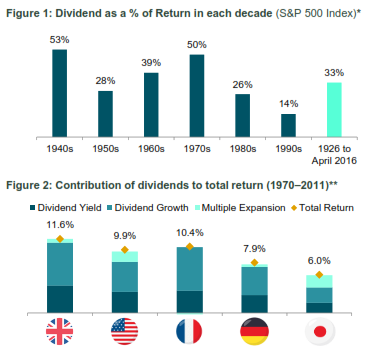

[3 min read, open as pdf] Inflation is on the rise: equities provide long-term inflation protection Inflation risk means greater focus on intrinsic value such as dividends UK equities with value and/or income bias are attractive Inflation is on the rise, and whilst it’s broadly accepted that equities can provide a long-term inflation hedge, which kind of equities are best positioned to provide this. Since the financial crisis, Value investors have been jilted by a market love affair with Momentum. The switch back to Value was already being called on purely a valuation basis since late 2019. But the rekindling of inflation risk in the market is only making companies with a Value-bias and a progressive quality income stream back in the spotlight. What is quality income? Quality means persistency, focusing on companies that regularly pay a stable or increasing dividend, whilst mitigating dividend concentration risk. “One of the most persuasive tests of high quality is an uninterrupted record of dividend payments going back many years.” Benjamin Graham Indeed, research suggests that Dividends are a key anchor of Total Returns, although this differs from market to market. Figure 1: Source: S&P Dow Jones Index Research August 2016

Figure 2: Source: JP Morgan, The Search for Income: A Global Dividend Strategy, 2012 How then to screen for companies that can deliver this type of strategy? Is it just about yield? We don’t think so. High yield is not high quality Screening for high dividend yield alone can lead to “value-traps” that negatively impact performance. The poor performance is because those high-yielding companies might be poor businesses with unstable dividends. Market cap weight or Dividend contribution weight Traditional equity indices are market-capitalisation weighted. The resulting dividend income for an index is therefore a function of each company’s size. An alternative approach is to weight the holding in each company by its contribution to overall dividends. This way the index is focused on the biggest dividend payers, rather than the biggest companies by size. This creates a direct bias towards Yield, and an indirect bias towards Value, from a factor-exposure perspective. Forward- or backward-looking Active equity income managers typically look at forward-looking dividend estimates. Index-based “passive” equity income strategies often look at historic dividend yield for ranking purposes. This is sub-optimal. We believe that index strategies that focus on equity income should use forward-looking estimates, to systematically capture upswings in earnings and dividend estimates. Equities as an inflation hedge It’s broadly accepted that equities can provide a long-term inflation hedge. But what kind of equities are likely to perform well in an inflationary regime? We believe there are three characteristics:

Why the Value focus in inflationary environment? When the two major styles of investing are compared, i.e., growth and value investing, the latter style rejects the efficient market hypothesis and choses an equity with lower expectations, which is often undervalued and would profit quickly when the market adjusts itself. During an inflationary environment, economic concepts direct that the ‘time value of money’ has a major role to play. Thus, an equity today, becomes of greater value, when compared to its worth tomorrow. Hence, value investing seems attractive in an inflationary world since the investors are less willing to pay up for future earnings and can regain their money sooner rather than later, when compared to growth investing. (Murphy, 2021) With a global pandemic, many predicted deflation as a threat; however, with the counter-balancing forces, investors soon realized inflationary threat. (Baron, 2021). Rising inflation is good for value investing for a number of reasons. In general, equity markets are dynamic and display a stronger corelation to inflationary environment, this lays a very strong premise that higher inflation and stronger earnings are co-dependent. Financially speaking, Sectors such as energy, financial are major drivers of the major economic growth. A rise in these value stocks tends to pace up the overall economic growth, thus outperforming others. (Lebovitz,2021) According to JP Morgan’s chief strategist, the change in investing style, this time around could be a more impactful due to several factors such as the failure of monetary and fiscal policies whilst recovering from a pandemic. (Ossinger, 2021) Dividends, dividends, dividends: a tried and tested approach The most fundamental explanation, by John Kingham, a value investor, states that a dividend discount model, attempts to find the true value of the stock, under any market circumstances and focuses on the dividend pay-out factors and the market expected returns. Historically, the companies with dividend have generated higher returns when compared to companies which either have no dividend or eliminated the dividend. (Park and Chalupnik, 2021) This means that dividends hold value when it comes to the total return of the portfolio. Moreover, with the market getting more and more inflationary, and equities getting exposed. Adding companies which can provide returns even in a low growth environment can create a sustainable portfolio. Government bonds have not performed well with rising inflation (Baron,2021) High yielding corporate bonds offered better protection compared to government gilts since these inflations linked bonds add value in-line with RPI Inflation according to Barclays Equity Guilt Study and can protect investors from unexpected inflation, yet they are still not considered as a safe haven like government gilts. (Dillow,2021) Investment manager of Iboss Chris Rush recently told Portfolio Adviser that in order to reduce the inflationary shock the firm had already reduced its positions from treasures and gilts and incorporated strategic bonds They also plan on holding a short duration fixed income. (Cheek, 2021) Although, it might have not been the fundamental goal, over the past several decades until 2017 dividends reported 42% of the S&P 500 Index’s total return. The global recession and now pandemic have created a lack of stability for the layer of support for future returns, however, analysts have assured there is room for recovery. (Markowicz, 2021) Summary Whether transitory or persistent, with inflation on the rise, there is a strong rationale for having an allocation to Value from a factor-exposure perspective. Those value-type firms that generate and pay a progressive dividend policy provides a level of inflation protection both in absolute terms and relative to bonds that is more than welcome, and potentially essential. Henry Cobbe & Aayushi Srivastava Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed