In this report, we analyse the data around a selected opportunity set of bond indices as represented by London-listed ETFs. The report covers global, USD, EUR, GBP and Emerging Market bond markets, for aggregate, government, corporate, high yield and emerging market exposures. Whilst the bond market dwarfs the equity market, the majority of ETFs are focused on equity exposures. That is gradually changing with growing acceptance of bond ETFs as a convenient and liquid way of accessing targeted bond exposures by geography, issuer type, credit quality, or maturity profile. In this report, we:

For more information and important notices, view the full report. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Business relationship disclosure: This article references research by Elston Consulting that is sponsored by State Street Global Advisors Limited. I wrote this article myself, and it expresses my own opinions. Additional disclosure: This article has been written for a UK audience. Tickers are shown for corresponding and/or similar ETFs and may be prefixed by the relevant exchange code, e.g. “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.ElstonETF.com All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. Image credit: Elston; Chart credit: n.a.; Table credit: n.a.

What’s new? A bond ETF is not brand new: the first bond ETF launched back in 2002. But they are gaining traction, and as adoption increases the breadth and depth of bond ETFs have also broadened. In my first DIY multi-asset ETF portfolio back in 2008, the main bond ETFs available back then were for broad exposures like Gilts, Index-Linked Gilts and Corporate Bonds. Fast forward over ten years and there’s the ability to access much more targeted exposures. Investors can access both corporate and government bonds for GBP issuers as well as for major currency issuers such as USD and EUR, both unhedged and hedged to GBP. Furthermore, within these opportunity sets investors can select from a range of investment term options, whether short-term (e.g. <5 years), medium term (e.g. 5-10 years), or long-term (>10 years). As well as high yield bonds, more specialised bond exposures are also increasingly available. So whatever the exposure, there is an investable index to express it, and increasingly an ETF to track it. But what is a bond ETF and what are the benefits? A bond ETF is simply a bond fund that can be bought or sold on an exchange, like a share. This has three benefits: it enables access, provides diversification and creates liquidity. According to a recent survey of UK managers, while the access and diversification points are readily understood, there are concerns about liquidity.

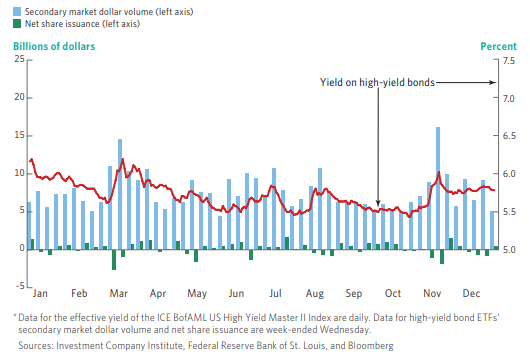

Understanding bond ETF liquidity Ultimately the liquidity of a bond fund, whether a traditional fund or an ETF is only as good as the underlying asset. We can term this “internal liquidity”. But if liquidity of a fund itself is a concern then you are probably better off in a bond ETF than a traditional bond funds. Why is that? Simply put the stock exchange creates a secondary market for ETFs (buyers and sellers of bond ETFs trading with each other without necessarily requiring a creation or redemption of units of the bond ETF that would impact underlying bond liquidity). We can term this “external liquidity”. If liquidity of the underlying asset class was a concern and you wished to exit a traditional bond fund, your redemption would be at the discretion of the fund provider and in extremis, you may find yourself gated. So if bond liquidity is a concern, avoid traditional funds and stick to ETFs: there’s a secondary market for them other than the fund issuer. Additional liquidity of bond ETFs By way of example, 2017 provided a stress test for the bond market – in particular high yield bonds. The findings are reassuring. When high yield bond yields spiked in March 2017 and high yield bond values came under pressure, we can see how high yield bond ETFs actually fared in these challenging conditions. The volumes of the secondary market trading between investors buying/selling on exchange (which requires no trading of the fund’s underlying securities) eclipsed net share redemptions (which does require trading of the underlying securities) by a significant factor. The volumes on secondary markets increased to an average of $12.7bn in the first two weeks of March (versus a previous nine-week average of $6.7bn), whilst the net redemptions of high yield bond ETFs was only $3.5bn (representing 6.1% of total assets). A similar resilience was exhibited in November 2017. So far from triggering a liquidity stampede in the underlying holdings, the presence of secondary market enabled investors to trade the ETF holding those bonds amongst themselves. This is why secondary market liquidity is seen as an advantage, rather than a disadvantage. Secondary Market Trading of High-Yield Bond ETFs Increased When Yields Rose in 2017, 29-Dec-16 to 29-Dec-17* Source: ICI 2018 Factbook. Figure 4.6

The ratio of secondary market volume to net share issuance is therefore one measure of bond ETF liquidity, but the most indicative measure of bond ETF liquidity is bid-ask spread. Conclusion Innovation for bond ETF investing is focused on more nuanced index design and construction of bond ETFs which provide the tools managers need to reflect their views as regards issuer type, term and credit quality when allocating to bonds. The adoption of bond ETFs is demand-led as it enables access, provides diversification and creates liquidity. This is and should be welcome to investors large and small. For more information and important notices, view the full report. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Business relationship disclosure: The article includes references to research by Elston Consulting that was sponsored by State Street Global Advisors Limited. I wrote this article myself, and it expresses my own opinions. Additional disclosure: This article has been written for a UK audience. Tickers are shown for corresponding and/or similar ETFs and may be prefixed by the relevant exchange code, e.g. “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.ElstonETF.com All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. Image credit: n.a.; Chart credit: ICI; Table credit: n.a.

We conducted a Survey of senior portfolio managers and decision makers from firms whose combined assets under management is in excess of £500bn. The survey was designed to get a better understanding on how those managers approach bond investing. Our key findings based on the survey are summarised below:

For more information and important notices, view the full report. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Additional disclosure: The data in this article comes from an Elston ETF Research report “Bond ETF Investing Survey” that was sponsored by State Street Global Advisors Limited. We warrant that the information in this article is presented objectively. For further information, please refer to important Notices and Disclosures in that Report which is available on our website www.ElstonETF.com This article has been written for a UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This article reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.ElstonETF.com Image credit: Elston Consulting; Chart credit: Elston Consulting; Table credit: Elston Consulting

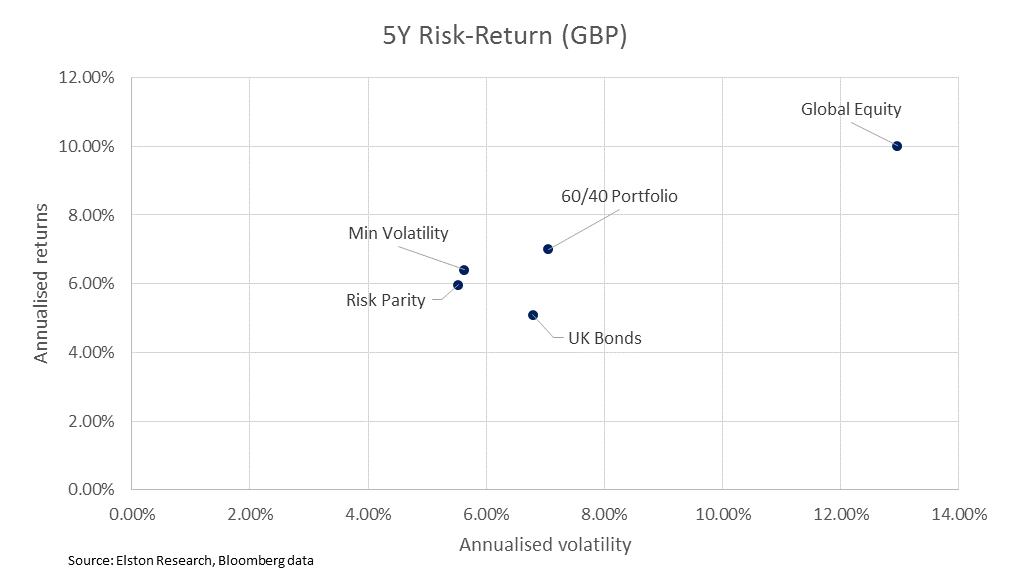

Multi-asset risk-based strategies offer an alternative approach to portfolios construction.

Examples of multi-asset risk-based strategies include: Minimum Variance, Risk Parity, Maximum Deconcentration, Maximum Sharpe and Maximum Decorrelation. These strategies target a particular risk objective and that risk objective drives the underlying asset weightings. We see a growing role for multi-asset risk-based strategies as more informed comparator to traditional asset-based multi-asset comparators such as a 60/40 equity/bond portfolio. Potential application for risk-based strategies Potential applications include: Portfolio diversifier: Investors traditionally use hedge funds and/or absolute return strategies as diversifiers within a portfolio context owing to their differentiated risk-return characteristics. Similarly, risk-based strategies offer a systematic approach to delivering differentiated strategies for diversification purposes. More specifically, the objectives of a Max Deconcentration and Max Decorrelation are to deliver a differentiated approach (for a given opportunity set subject to parameter constraints). Return enhancement: Risk-based strategies have the potential to enhance portfolio returns. More specifically, the objective of a Max Sharpe strategy is to deliver maximum risk-adjusted returns (for a given opportunity set subject to parameter constraints). Risk mitigation: Risk-based strategies have the potential to mitigate portfolio risk. More specifically, a Min Variance strategy is optimised to deliver a risk-return characteristic close to the theoretical Minimum Variance Portfolio (for a given opportunity set subject to parameter constraints). Benchmarking purposes: Using risk-based strategies as comparators to Hedge Funds, Diversified Growth Funds and Target Absolute Return Funds provides additional performance insight without the problems that are inherent in peer group type measures. Get the full report Factor-based investing – an alternative approach to cap-weighted indices

Factor-based investing focuses on identifying broad persistent characteristics for securities within a single asset class. Factor-based indices ascribe weights to securities within an index based on those factor characteristics. Factor-based indices are therefore typically single asset in nature, and represent an alternative approach to capitalisation weighted indices. For example, Minimum Volatility equity index is typically constructed with a single asset class, e.g. equities whose constituents exhibit the lowest volatility characteristics. Risk-based strategies – an alternative approach to multi-asset When looking at multi-asset strategies, there are two approaches. For asset-based investing, asset weights determine portfolio risk characteristics. For risk-based investing, portfolio risk characteristics determine asset weights. Risk-based indices are therefore typically multi-asset in nature, and represent an alternative approach to asset-based (e.g. 60/40) multi-asset indices. For exanoke, a Minimum Variance index strategy targets the minimum variance multi-asset portfolio. Risk-based multi-asset strategies therefore reflect a portfolio construction approach, rather than a factor screen. It is the set of rules by which a multi-asset portfolio is optimised. What are the advantages of a risk-based strategy? The advantages of long-only risk-based index strategies are that they: 1. Provide a systematic approach to risk management 2. Can be constructed with liquid underlying ETFs 3. Do not use leverage or shorting Get the full report here http://www.elstonetf.com/store/p3/Multi-Asset_Indices%3A_risk-based_strategies.html Risk-based strategies are an alternative approach to multi-asset investing.

For traditional asset-based strategies, such as a 60/40 equity/bond portfolio, asset weights drive risk characteristics. For risk-based multi-asset strategies, risk characteristics drive asset weights. The objectives of multi-asset risk-based strategies are derived from different branches of portfolio theory can be defined as follows Minimum Variance: Aims to minimise the overall strategy volatility by using pairwise correlations and volatilities of stocks to provide a good proxy for the least risky portfolio in the Modern Portfolio Theory framework. Risk Parity: Aims to achieve equal risk contribution from asset classes under the assumption of identical pair-wise correlations structures. The same as inverse volatility weighting. Maximum Deconcentration: A naïve diversification strategy that aims at maximising the effective number of holdings, equivalent to minimising concentration. Maximum Sharpe: Aims to combine assets to achieve a strategy with the highest risk-adjusted return in excess of the risk-free rate. Maximum Decorrelation: Aims to minimise the volatility of a strategy assuming that individual volatilities are identical, thereby constructing the strategy based on correlation structure alone (solving for the least correlated strategy). Get the full report here http://www.elstonetf.com/store/p3/Multi-Asset_Indices%3A_risk-based_strategies.htm

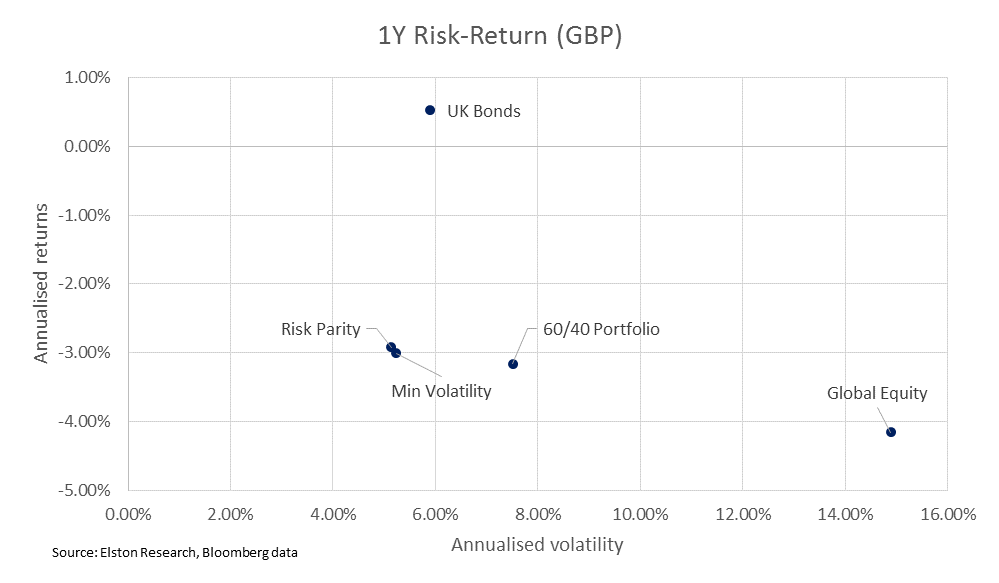

Positioning for a GBP recovery? With Brexit doom and gloom mostly priced in, all eyes are on sterling which has become the Brexit barometer. So which way for sterling? Stating the obvious:

In the event of a relief rally in GBP, how can investors position portfolios accordingly? Translation effect Recall that the GBP currency impact on portfolios in 2016 was massive. As GBP depreciated, investors whose global equity portfolios were unhedged enjoyed strong performance thanks to the translation effect of foreign earnings. The same applied to FTSE 100 which looked stronger against a weakening GBP. The reverse would also therefore be true. Any significant appreciation in GBP would see (foreign) global equity returns offset by GBP strength and would weigh on the FTSE 100. So for those who were lucky enough to be unhedged as sterling fell can’t rely on luck if sterling rises. Toolkit for GBP recovery Like everyone else, we have no crystal ball as to how Brexit could play out, but we can identify some of the tools that investors may want to have in their armoury to implement their views, whatever their risk posture, in case of a GBP recovery. We look a selection of exchange traded products to access currency pairs, ultrashort bonds, shorter duration bond and GBP hedged equities to implement a tactical position for different risk levels. 1. Short-term currency exposure On the approach to and in the event of any deal, for very short term exposure (<1 month), investors could consider gaining rapid currency exposure by using a currency pair ETC and if seeking additional risk could use a leveraged exposure. Leveraged exposures should be short-term in nature and investors should ensure they understand the risks. Currency pairs GBPP: ETFS Long GBP Short USD LGB3: ETFS 3x Long GBP Short USD 2. Volatility dampener Investors can tactically allocate to ultrashort GBP bonds if they are looking for a cash-like volatility buffer with more yield than cash with a GBP return profile. Ultrashort duration Bonds ERNS: iShares GBP Ultrashort Bond ETF JGST: JP Morgan GBP Ultra-Short Income UCITS ETF 3. Short duration bond exposure Tactical allocations to short duration GBP bond exposures is available both for UK gilts and GBP corporate bonds for investors seeking GBP bond exposure without being over-exposed to interest rate risk from the longer-duration nature of the main indices. Short duration Gilts IGSL: iShares UK Gilts 0-5yr UCITS ETF GLTS: SPDR® Bloomberg Barclays 0-5 Year Sterling Corporate Bond UCITS ETF Short duration GBP Corporate Bonds IS15: iShares £ Corp Bond 0-5yr UCITS ETF SUKC: SPDR® Bloomberg Barclays 0-5 Year Sterling Corporate Bond UCITS ETF 4. Equities hedged to GBP To access equities hedged to GBP, rather than running a currency overlay, investors can access GBP hedged versions of mainstream ETFs. At 29-30bp TER, these are slightly more expensive than their conventional versions, but the cost difference represents the cost and convenience of running the currency overlay. Most regional equity ETF exposures offer GBP hedged versions, or investors can use ETFs tracking MSCI World (GBP hedged) as a proxy for risk assets. For example: Global equities (GBP hedged) IWDG: iShares Core MSCI World UCITS ETF GBP Hedged XDWG: Xtrackers MSCI World UCITS ETF 2D – GBP Hedged Conclusion Whilst no deal is supposedly ruled out, there is no certainty as to what any deal would look like. Whatever the politics, if you believe there is potential for a recovery in sterling, ETPs provide tactical ways of positioning portfolios accordingly. In 2018 Risk Parity and Min Volatility multi-asset strategies offered some downside cushioning and lower volatility relative to a 60/40 Equity/Bond portfolio for GBP investors.

Risk-based strategies: 1. Offer a systematic approach 2. Are designed to be differentiated 3. Have potential to enhance returns, mitigate risk or improve diversification Get the full report

What is risk-based multi-asset? Risk-based strategies are an alternative approach to multi-asset investing. For traditional asset-based strategies, such as a 60/40 equity/bond portfolio, asset weights drive risk characteristics. For risk-based multi-asset strategies, risk characteristics drive asset weights. How does this compare to factor investing? Factor-based index strategies typically look at screening single asset class securities for a particular factor. For example, Minimum Volatility equity index is typically constructed with a single asset class, e.g. equities whose constituents exhibit the lowest volatility characteristics. By contrast, For multi-asset strategies a Minimum Variance strategy targets the minimum variance multi-asset portfolio. Risk-based multi-asset strategies reflect a portfolio construction approach, rather than a factor screen. It is the set of rules by which a multi-asset portfolio is optimised. What risk-based multi-asset strategies are available? We focus on five well researched risk-based multi-asset strategies:

Access the full report here |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed