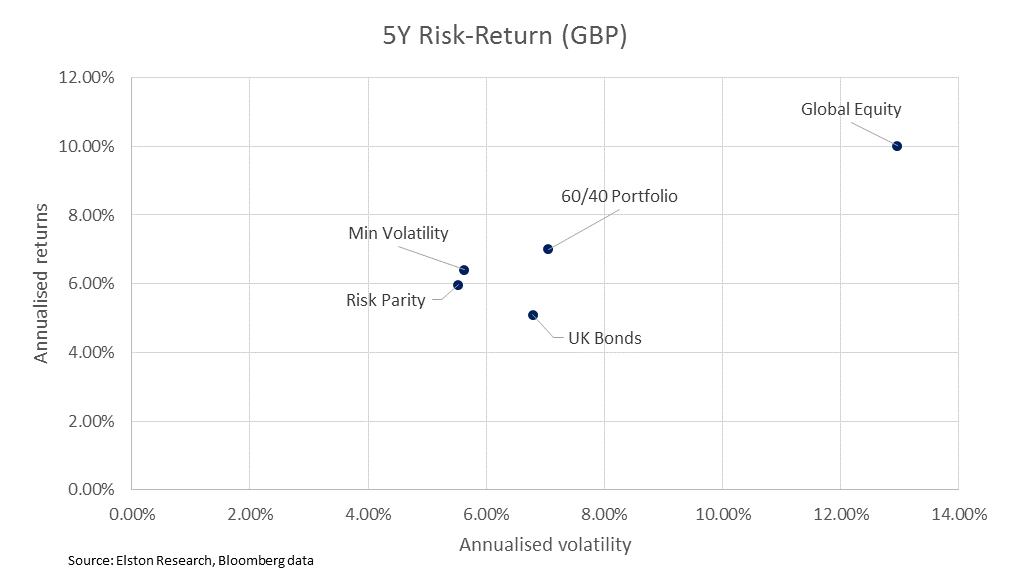

What is risk-based multi-asset? Risk-based strategies are an alternative approach to multi-asset investing. For traditional asset-based strategies, such as a 60/40 equity/bond portfolio, asset weights drive risk characteristics. For risk-based multi-asset strategies, risk characteristics drive asset weights. How does this compare to factor investing? Factor-based index strategies typically look at screening single asset class securities for a particular factor. For example, Minimum Volatility equity index is typically constructed with a single asset class, e.g. equities whose constituents exhibit the lowest volatility characteristics. By contrast, For multi-asset strategies a Minimum Variance strategy targets the minimum variance multi-asset portfolio. Risk-based multi-asset strategies reflect a portfolio construction approach, rather than a factor screen. It is the set of rules by which a multi-asset portfolio is optimised. What risk-based multi-asset strategies are available? We focus on five well researched risk-based multi-asset strategies:

Access the full report here

Clover

21/4/2019 13:20:03

Hi, very nice website, cheers! Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed