|

For someone aged 65 with average life expectancy a bond fund isn’t enough to ensure portfolio durability. Over that term the biggest risk is inflation risk and it’s harder for nominal bonds to keep pace with inflation. Inflation-linked bonds bring in high interest rate sensitivity (duration). Whilst higher yields now make for a more interesting entry point, there’s plenty of solid yield available in high quality low cost index bond funds.

But to navigate the changing outlook within the bond market a managed bond fund should also be considered as a one stop diversified managed bond portfolio. Most retirees will need a multi-asset retirement portfolio to last the course. Bonds alone are not enough. Read the quote in Trustnet Henry Cobbe explores the challenges of building portfolios for retirement and also sizing "right" allocation to UK Equities.

Read the article / access the podcast Key findings, and what advisers and policy owners should do next

Watch the replay of this CISI-endorsed CPD webinar Following the publication of the FCA TR24/1 Thematic Review on Retirement Income Advice, there's renewed focus on Retirement solutions. That's great news - we've been focused on Retirement Investing since 2012 and led our #RethinkingRetirement campaign in 2015. We continue to innovate for our clients - the Advisers we support.

In June, we are running a series of webinars focused on retirement investing. More details are below. For UK Advisers: to sort your CRP and find out about the Elston Portfolio Management Retirement Income MPS launched >3 years ago in March 2021, please arrange for a consultation. CPD Webinars on Retirement Income Advice & Solutions 1. Wed 5-Jun-24 1030am: FCA Thematic Review on Retirement Income Advice Key findings, and what advisers and policy owners should do next 2. Wed 12-Jun-24 1030am:"Flex first, fix later": exploring the future of retirement income with Sir Steve Webb An annuity too early could be poor value. 3. Wed 19-Jun-24 1030am: Assessing suitability in retirement Different challenge, different questions. 4. Wed 26-Jun-24 1030am: Retirement Investing (Introduction) Different objectives and different risks requires a different approach. 5. Read our research and Insights on Retirement Investing going back to... 2012! Times above or register to access replay. All webinars are 1h CISI endorsed CPD (1.5h CPD with online test) The long-awaited FCA thematic review of retirement income advice has finally been published, and Dear CEO letters sent. What are the key findings and what should adviser firms be putting in place to improve their proposition?

Read the full article on FT Adviser In this webinar, we are honoured to be joined by Sir Steve Webb, Partner at LCP and former Pensions Minister 2010-15 overseeing "Freedoms & Choice". Steve will discuss his recently co-authored paper for LCP titled ""The Flex First, Fix Later" pension - is this this the future of retirement?" and earlier paper "Is there a right time to buy an annuity?"

Watch the replay of this CISI-endorsed CPD webinar These rules of thumb stand the test of time. Investor's Chronicle interviews Elston's Henry Cobbe.

Read in full

Read the full CPD Article on FT Adviser The conclusion of the Retirement Outcomes Review for non-advised customers is set out in the regulator’s Policy Statement PS19/21.

The key change is the introduction of mandatory highly governed investment pathways for non-advised drawdown (we prefer the term “Retirement Pathways”, for clarity) from February 2021. In a nutshell Retirement Pathways is the new Stakeholder, but for decumulation, and with a soft price cap of 0.75% instead of 1.50%. Whilst the policy changes impact non-advised providers, a “Dear CEO” letter was sent financial advisers in January this year announcing a review of the market for pensions and investment advice “Assessing Suitability 2” (AS2) with particular reference to retirement outcomes. What are the key points of PS19/21? The policy means that:

What is the point of this policy intervention? The purpose of this policy intervention is to deliver better retirement outcomes for non-advised investors, who may not have the confidence to make robust and informed investment decisions. Key protections include, but are not limited to: ensuring cash is not a default option, ensuring costs and charges are clear, reasonable and regularly communicated ensuring investment strategies are appropriate through the introduction of default options for different objectives, and ensuring there is third party oversight of those default investment options either through an Independent Governance Committee (IGC) or a third-party Governance Advisory Arrangement (GAA). If you are thinking that sounds a bit like the governance arrangements around automatic enrolment workplace pension schemes - you are right. If you are also thinking it would have made sense to have those guidelines in place before or in conjunction with Pensions Freedom in 2014, you are also right! What will d2c drawdown look like? In the policy statement PS19/21, the regulator is requiring all d2c providers to offer mandatory investment pathways (Retirement Pathways) with effect from 1st February 2020. Retirement pathways mean offering non-advised transaction or customers going into drawdown four investment options that align to four standardised objectives formulated by the regulator. Providers must offer a single investment solution (a single fund, or a single fund from a suite of funds from the same solution such as target date funds) for each pathway. These funds will be subject to intense scrutiny by the providers Investment Governance Committee in terms of appropriateness and value for money. What are the standardised objectives? The standardised objectives are intended to align to specific actions or intended actions that non-advisers may want to take. The final wording for each standardised objective is below:

Is there a price cap? There is no price cap for Retirement Pathways. However during the consultation, the regulator suggested that providers should be mindful of the fact that in automatic enrolment workplace pension schemes the Total Cost of Investing (a term which I define to be Platform/Admin Cost + Fund OCF + Fund Transaction Costs) is 0.75%. This creates a fairly strong anchor within which d2c providers must operate. Is that price cap achievable? Yes: for example if we estimate a platform fee a for a d2c providers to be 0.30% for an investor with £100,000 at retirement, this leaves 0.45% budget for fund OCF plus transaction costs. The price anchor indirectly forces providers down the road of offering multi-asset funds that are constructed with low-cost index funds. And there’s nothing wrong with that - after all it’s the asset allocation that counts when it comes to delivering investment outcomes, not the type of fund. What kind of funds align to the standardised objectives? For investors expecting to purchase an annuity under one of the pathway options, we expect providers to offer funds that have similar asset exposures to what annuity providers hold to fund annuities. That way, when investors purchase an annuity, there is a change in how an investors receives a payout (life-long guaranteed in exchange for surrendered capital), but not a change in the asset mix used to fund that annuity. That way if annuity rates change, the assets the investor holds to purchase that annuity are the flip side of the same coin. In the workplace pension world, there are pre-retirement funds that are designed to mirror annuity providers’ annuity matching portfolios. We expect similar funds for the retail market, and are ready to construct “Annuity Conversion portfolios” should the demand arise. For the other three options, we expect that d2c providers will use multi-asset passive funds, with lower risk-return profile for investors starting to make near-term withdrawals and a medium-term risk-return profile for investors starting to make medium-term withdrawals. Whilst “relative risk” traditional multi-asset passive funds could be one option for d2c providers, we expect Target Date Funds to have an important role to play in non-advised drawdown. What does this mean for advisers? Whilst the policy is aimed at direct-to-consumer providers, there have been consistent read-throughs for financial advisers from the outset. Now that this is hardcoded into policy, we expect the forthcoming changes in the d2c market will create pressure on advisers in four different dimensions: comparison, cost, appropriateness and governance.

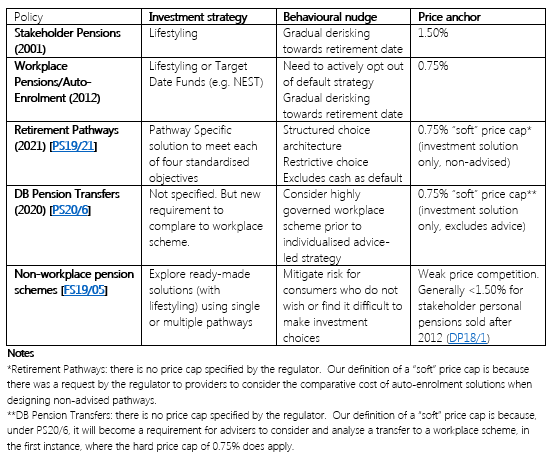

Assessing Suitability 2 Assessing Suitability focused on CIPs in general but in an era where advisers’ responsibility was primarily for clients in the accumulation phase. We believe Assessing Suitability 2 will focus on CRPs now that advisers’ responsibility includes clients in decumulation. Helping clients invest for accumulation and decumulation requires a fundamentally different approach. In accumulation, the focus is on attitude to risk, each client’s risk profile, and accumulation portfolios. In decumulation, the focus should be on capacity for loss (not a volatility figure, but economic measures of shortfall risk, income replacement ratio and liability matching), each client’s withdrawal profile (amount of timing of withdrawals and their size relative to asset pool, and the degree of confidence in achieving a particular level of income durability), and decumulation portfolios (the investment engines that are designed to support term-specific withdrawals, rather than targeting long-term growth). Retirement Pathways is transforming the investment approach for non-advised investors in decumulation. Advisers need to position themselves accordingly. The growing use of behavioural finance in policy interventions Harnessing behavioural finance interventions that address behavioural biases, such structured choice architecture and default strategies, is a growing feature of regulatory policy. It is based on the premise of investor “inertia” and is designed to provide protections for less confident and less engaged investors. For this reason, investment strategies with built-in lifestyling, such as target date funds, have a growing role to play in the personal pensions market, as well as the workplace pensions market. Needless to say, these highly governed pathway-type solutions then become a standard (in terms of design, appropriateness, and value for money) against which regulated advice can be compared and measured. Key behavioural aspects and price points of policy interventions:

*Retirement Pathways: there is no price cap specified by the regulator. My definition of a “soft” price cap is because there was a request by the regulator to providers to consider the comparative cost of auto-enrolment solutions when designing non-advised pathways. **DB Pension Transfers: there is no price cap specified by the regulator. My definition of a “soft” price cap is because, under PS20/6, it will become a requirement for advisers to consider and analyse a transfer to a workplace scheme, in the first instance, where the hard price cap of 0.75% does apply. The objective of this CPD module is to understand the principles of Retirement Investing. Learning Outcomes By completing, this CPD module, you should be able to:

A. Explain the theory underpinning lifecycle investing B. Contrast and compare the different investment approaches for accumulation and decumulation C. Summarise the different types of income strategies for retirement investing Watch this CISI-endorsed Elston CPD webinar Different objectives and different risks requires a different approach.

Watch the replay of this CISI-endorsed CPD webinar In this CPD module we look at assessing suitability for drawdown and explore sequencing risk, income risk and durability of withdrawal rates.

Watch this CISI-endorsed Elston CPD Webinar

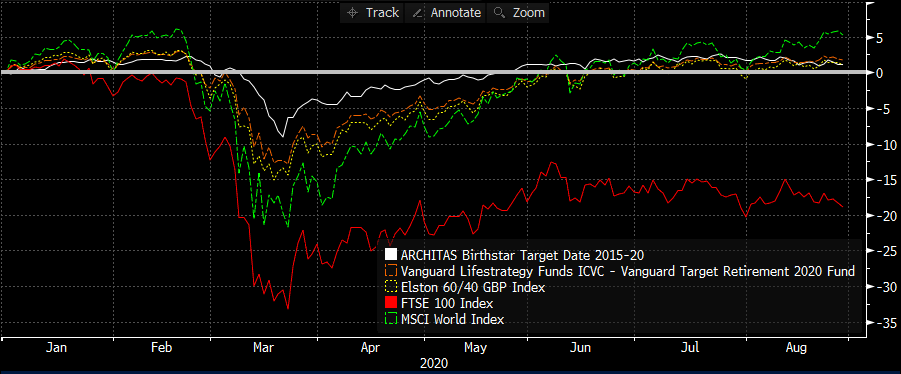

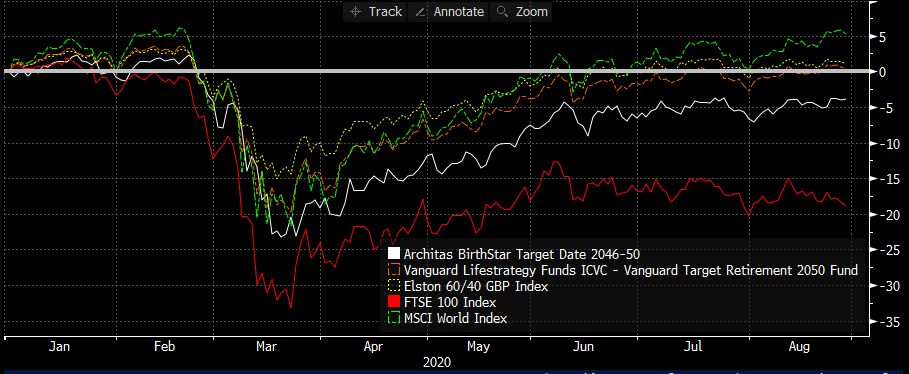

Target Date Funds are multi-asset funds whose risk profile changes over time, becoming less risky on approach to, and after the target date in the fund’s name. Investors, or their advisers, can use target date funds as an investment strategy that is purpose-built for retirement. By selecting a fund whose target date matches a planned retirement year, investors get access to an accumulation-oriented investment strategy prior to the target date, and a decumulation-oriented strategy after the target date. This makes target date funds a convenient “all-in one” fund which explains why they are often used as default funds within pension schemes, including NEST. Why a cohort-based approach makes sense It’s common sense that the risk capacity for an investor’s exposure to market risk is different at different stages of life and wealth levels. For younger investors, where wealth levels are typically lower and time horizons are longer, there is a higher capacity for loss, hence a higher exposure to higher risk-return assets makes sense. For older investors, where wealth levels are typically higher and time horizons are shorter, there is a lower capacity for loss, hence a lower exposure to higher risk-return assets makes sense. If customers can be segmented by cohorts, it makes sense that investment strategy can be too. What is the performance experience for different cohorts this year (time-weighted)? The 2015-20 Target Date Fund from Architas experienced a moderate maximum monthly drawdown of -4.71% in March 2020. By comparison, the 2020 Target Date Fund from Vanguard experienced a -6.66% drawdown. This contrasts with -9.37% for the Elston 60/40 GBP Index, -10.94% for MSCI World, and -13.81% for the FTSE 100, all in GBP terms. In this respect, investors who were in default decumulation strategies, with lower capacity for loss, saw better mitigation of downside risk relative to a traditional 60/40 “balanced” mandate. Fig.1. YTD performance of UK Target Date Funds (GBP terms) for those retiring 2015-20. Source: Elston research, Bloomberg data For investors in accumulation with target retirement date in the future, a comparison of the 2050 Target Date Funds shows Vanguard outperforming Architas – presumably owing to a more aggressive equity allocation in its glidepath. Both ranges of TDFs clearly have a low domestic equity bias, given their outperformance of the FTSE 100. Fig.2. YTD performance of UK Target Date Funds (GBP terms) for those retiring 2046-50 Source: Elston research, Bloomberg data

How Target Date Funds could fit in with policy evolution Ensuring there is some form of in-built lifestyling is a longstanding feature of consumer protections for pensions investment since Stakeholder times. Using behavioural finance in proposition design can provide a degree of consumer protection from poor outcomes for less confident, less engaged investors. That’s why a growing number of regulatory interventions incorporate some form of built-in lifestyling. Whilst this is complex to achieve from an administrative perspective, the fact that Target Date Funds deliver lifestyling within the multi-asset fund structure makes them a useful product type for default investment strategies. Fig.3. Key behavioural aspects and price anchors of policy interventions In this series of articles, I look at some of the key topics explored in my book “How to Invest With Exchange Traded Funds” that also underpin the portfolio design work Elston does for discretionary managers and financial advisers.

Aligning investment strategy with objectives Investing can be defined as putting capital at risk of gain or loss to earn a return in excess of what can be received from a risk-free asset such as cash or a government bond over the medium-to long-term. There can be any number of motives for investing: it could be to fund a future retirement via a SIPP, or to fund future university fees via a JISA. Online tools and calculators can help estimate how much is required to invest today to fund goals in the future. Investors can target a particular return, but learn to understand that the higher the required return, the higher the required level of portfolio risk. Risk and return are the “ying and yang” of investment. You can’t get one without the other. Total return can be broken down into income yield (dividends from equities and interest from bonds) and capital growth. In the UK, income and gains are taxed at different rates. If investing within a tax-efficient account, like a SIPP or an ISA, then income and gains are tax-free. If investing outside a tax-efficient account, investors must also then consider in their objectives how they want to receive total return – with a bias towards income or with a bias towards growth. Given the majority of DIY investors are able to make use of tax-efficient accounts, there is less need to consider income or growth, with many investors opting to focus on Total Returns and to use funds that offer “Accumulating” units that reinvest income, and reflect a fund’s total return. How then to build a portfolio to deliver an appropriate level of risk-return? What matters most when investing? For the purposes of these articles, I assume that readers need no reminder of the basic checklist of investing: to start early, to maximise allowances, keep topping up regularly, and to keep costs down. Then comes the key decision – what to invest in. The main driver of portfolio risk and return is not which stocks or equity funds are within a portfolio, but what the proportion is between higher risk-return assets such as equities, and lower risk-return assets such as shorter duration bonds. Put simply, whether to invest 20%, 60% or 100% of a portfolio in equities, will have a greater impact on overall portfolio returns, than the selection of shares or funds within that equity allocation. For example, when making spaghetti Bolognese, the ratio between spaghetti and Bolognese impacts the “outcome” of the overall meal, more than how finely chopped the onions are within the Bolognese recipe. While this may seem obvious, it gets lost in all the noise and news that focuses on hot stocks, star managers and performance rankings. For those that want to back up common sense with academic theory, the academic articles most referenced that explore this topic are Brinson Hood & Beebower (1986), Ibboton & Kaplan (2000), and Ibbotson, Xiong, Idzorek & Cheng (2010), all referenced and summarised in my book. Building a multi-asset portfolio to an optimised asset allocation to align to a particular risk-return objectives sounds like hard work and it is. That’s why multi-asset funds exist. The rise of multi-asset funds As investing becomes more accessible to more people, there is less interest in the detail of how investments work and more interest in portfolios that get people from A to B, for a given level of risk-return. After all, there are fewer people who are interested in the detail of how engines work than there are who are interested in how a car looks, how it drives and what they need it for. There is nothing new about multi-asset funds, indeed one could argue that the earliest investment trust Foreign & Colonial Investment Trust, founded in 1868, invested in both equities and bonds "to give the investor of moderate means the same advantages as the large capitalists in diminishing the risk by spreading the investment over a number of stocks”. In the unit trust world, managed balanced funds have been around for decades. I would define a multi-asset fund as a strategy that invests across a diversified range of asset classes to achieve a particular asset allocation and/or risk-return objective. They offer a ready-made “portfolio within a fund” thereby enabling a managed portfolio service for the investor from a minimum regular investment of £25 per month. . In this respect, multi-asset funds help democratise investing, and make the hardest part of the investor’s checklist – how to construct and manage a diversified portfolio. The different types of multi-asset fund available is a topic in itself. The ability for investors to select a multi-asset fund for a given level or risk-return characteristics for a given time frame is one of the most straightforward ways to implement a strategy once that has been aligned to a given set of objectives. Multi-Asset Fund or ETF Portfolio? The main advantage of a ready-made multi-asset fund is convenience. Asset allocation, and portfolio construction decisions are made by the fund provider. The main advantages of an ETF Portfolio are timeliness, cost and flexible. ETF Portfolios are timely. You can adjust positions the same day without 4-5 day dealing cycles associated with funds – an important feature in volatile times. ETF portfolios are good value. You can construct a multi-asset ETF portfolio for a lower cost than even the cheapest multi-asset fund. ETF Portfolio are flexible – you can tilt a core strategy to reflect your views on a particular region (e.g. US or Emerging Markets), sector (e.g. healthcare or technology), theme (e.g. sustainability or demographics), or factor (e.g. momentum or value), to reflect your views based on your research. Conclusion Setting the right objectives to meet a target financial outcome, such as funding future retirement, university fees, or creating a rainy day fund is the primary consideration when making an investment plan. Getting the asset allocation right – choosing a risk profile – in a way best suited to deliver that plan is the second most important decision. Finding a straight forward to deliver that risk-return profile, by building your own ETF portfolio or using a ready-made multi-asset index fund, is the final most important step. All the while, it makes sense to stick to the investing checklist: to start early, keep topping up, and keep costs down.

Centralised retirement propositions are on the rise as advisers increasingly have to think about clients’ decumulation journeys.

Watch the video with FT Adviser

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed