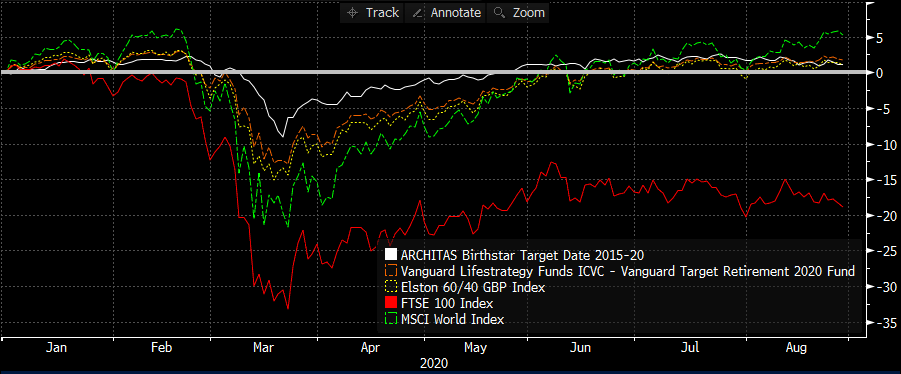

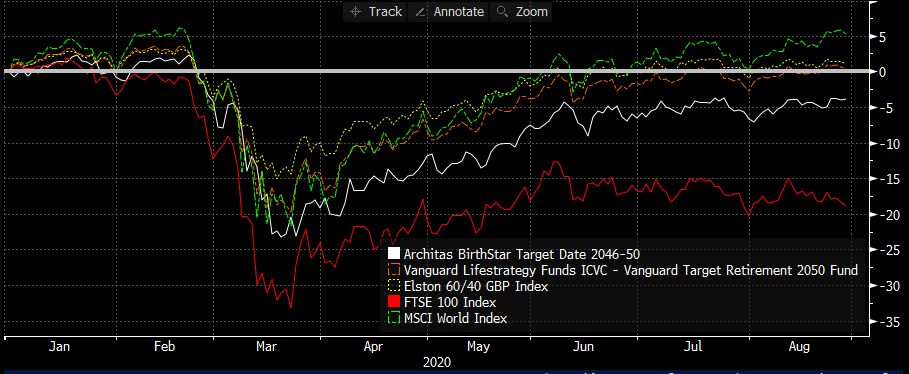

Target Date Funds are multi-asset funds whose risk profile changes over time, becoming less risky on approach to, and after the target date in the fund’s name. Investors, or their advisers, can use target date funds as an investment strategy that is purpose-built for retirement. By selecting a fund whose target date matches a planned retirement year, investors get access to an accumulation-oriented investment strategy prior to the target date, and a decumulation-oriented strategy after the target date. This makes target date funds a convenient “all-in one” fund which explains why they are often used as default funds within pension schemes, including NEST. Why a cohort-based approach makes sense It’s common sense that the risk capacity for an investor’s exposure to market risk is different at different stages of life and wealth levels. For younger investors, where wealth levels are typically lower and time horizons are longer, there is a higher capacity for loss, hence a higher exposure to higher risk-return assets makes sense. For older investors, where wealth levels are typically higher and time horizons are shorter, there is a lower capacity for loss, hence a lower exposure to higher risk-return assets makes sense. If customers can be segmented by cohorts, it makes sense that investment strategy can be too. What is the performance experience for different cohorts this year (time-weighted)? The 2015-20 Target Date Fund from Architas experienced a moderate maximum monthly drawdown of -4.71% in March 2020. By comparison, the 2020 Target Date Fund from Vanguard experienced a -6.66% drawdown. This contrasts with -9.37% for the Elston 60/40 GBP Index, -10.94% for MSCI World, and -13.81% for the FTSE 100, all in GBP terms. In this respect, investors who were in default decumulation strategies, with lower capacity for loss, saw better mitigation of downside risk relative to a traditional 60/40 “balanced” mandate. Fig.1. YTD performance of UK Target Date Funds (GBP terms) for those retiring 2015-20. Source: Elston research, Bloomberg data For investors in accumulation with target retirement date in the future, a comparison of the 2050 Target Date Funds shows Vanguard outperforming Architas – presumably owing to a more aggressive equity allocation in its glidepath. Both ranges of TDFs clearly have a low domestic equity bias, given their outperformance of the FTSE 100. Fig.2. YTD performance of UK Target Date Funds (GBP terms) for those retiring 2046-50 Source: Elston research, Bloomberg data

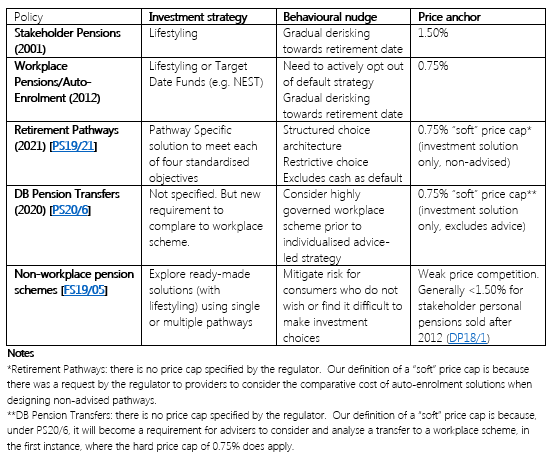

How Target Date Funds could fit in with policy evolution Ensuring there is some form of in-built lifestyling is a longstanding feature of consumer protections for pensions investment since Stakeholder times. Using behavioural finance in proposition design can provide a degree of consumer protection from poor outcomes for less confident, less engaged investors. That’s why a growing number of regulatory interventions incorporate some form of built-in lifestyling. Whilst this is complex to achieve from an administrative perspective, the fact that Target Date Funds deliver lifestyling within the multi-asset fund structure makes them a useful product type for default investment strategies. Fig.3. Key behavioural aspects and price anchors of policy interventions Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed