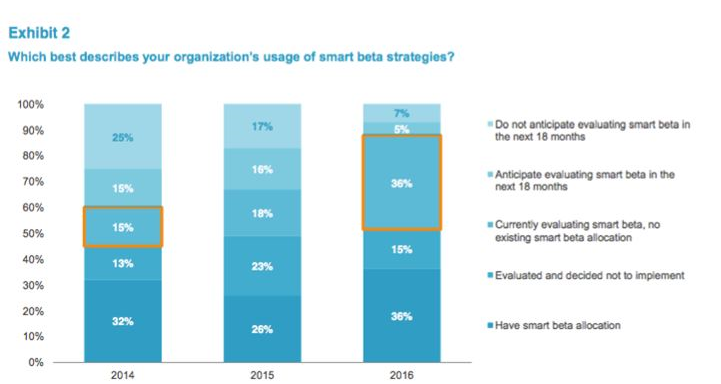

A survey published this week of 250 institutional asset owners with AUM in excess of USD2 trillion suggests that there is continued growth of interest in reviewing Smart Beta strategies. The survey is published by FTSE Russell and is available here. It suggests that 36% of institutional asset owners are currently evaluating smart beta, up from 15% in 2014. This implies the potential for large inflows into smart beta strategies over the coming 12-24 months. What is smart beta? From an index construction perspective, if beta is defined as index-based investment strategy constructed using a cap-weighted approach (size factor), smart beta can be defined as an index-based investment strategy using an alternatively weighted approach (any factor other than size). From a portfolio construction perspective, smart beta can be defined as an asset allocation strategy constructed using different optimisation techniques to combine a range of index-based investment strategies. What the factor? Risk and return can be broken down into many contributing factors. Analysing factors requires the ability to statistically distil, isolate, and observe a factor for significance. There are therefore potentially thousands of factors, depending on your ability to analyse them, which could include aside from the obvious (size and volatility), quality, momentum, value, liquidity, profits, dividend yield, leverage, etc which make up the components of earnings and/or the cost of capital which classically define a company’s value. The broadening and deepening of data availability and accelerating computing power is facilitating the growth in this quantitative approach. How do factors help? Buying the (cap-weighted) index for an asset-class (e.g. S&P 500 NYSEARCA:SPY, NYSEARCA:IVV (US); LON:CSPX (UK)) could be seen as a straightforward “passive” approach. Through a factor lense, however, it looks like a blind overweight of a size factor. Size factor may outperform in some market conditions and underperform in others. So while asset owners traditionally thought of asset allocation in terms of geographies and asset classes, they are starting to consider portfolio analysis and construction from a factor perspective. It’s no secret that sovereign wealth funds have been early adopters of smart beta investing: the transparency of a rules-based approach is additionally attractive. Is “smartie” the new “hedgie”? Like the original attraction of hedge fund, return enhancement and risk reduction are the primary motivations for reviewing Smart Beta strategies, according to the FTSE Russell report. Unlike hedge funds, cost savings are an attraction too. Sounds familiar? One of the original motivations for including hedge funds in a portfolio was for return enhancement and portfolio risk reduction through the inclusion of an uncorrelated asset. This ostensibly required exceptional skill, and hence exceptionally high fees. But the mantra supported the exponential growth in hedge funds from niche to mainstream from the early 2000s. Arguably, smart beta strategies can serve the same purpose from a portfolio construction perspective, but using a systematic rules-based approach that replaces manager risk (unpredictable, rarely consistent), with model risk (predictable, consistent). Combined with ego-free fees, it’s no wonder that there is so much interest in this investment approach. Flexible delivery? Furthermore, unlike hedge funds, smart beta strategies can be delivered to in-house managers, segregated accounts,– the equivalent of being able to “enjoy in your own home” – as well as ETPs and CITs (Collective Investment Trusts). Relative to hedge funds, this creates greater transparency about the counterparty risk you are taking. Has the switch started already? As if on cue, two stories on the same day this week illustrate the point. In the UK, some listed hedge funds are reported as losing two-thirds of their assets as performance disappoints and expensive alpha proves elusive. Separately, in the US there are reports of further M&A activity in the smart beta space with Hartford Funds, a $74bn asset manager acquiring Lattice Strategies, a San Francisco-based smart boutique with $215m AUM. This is the latest in a series of acquisitions by large asset managers of quantitative boutiques. What kind of smart beta equity strategies are available? Smart beta equity strategies for USA (NY-listed) and world markets (London-listed) include factor based strategies from BlackRock’s iShares® such as Quality (eg NYSEARCA:QUAL (US) & LON:IWQU (UK)), Value (eg NYSEARCA:VLUE (US) & LON:IWVL (UK)), Momentum (eg NYSEARCA:MTUM (US); LON:IWMO (UK)), and Size (eg NYSEARCA:SIZE (US); LON:IWSZ (UK)). What about multi-asset? Our approach has been to focus on risk-based portfolio construction which is why we launched our multi asset Global Max Sharpe Index (ticker ESBGMS) and multi-asset Global Min Volatility Index (ticker ESBGMV) back in December 2014. Our view is that smart beta is a new and powerful part of the portfolio construction toolkit. Conclusion We see smart beta as a diversifier for classically constructed portfolios and as a flexible tool for analysing and managing factor exposures at different stages of the market cycle. If the large institutional asset owners follow through their interest in smart beta with mandates, it will be an investment style that is impossible to ignore. NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice. For more information see www.elstonconsulting.co.uk Image credit: FTSE Russell

The portfolio puzzle The Rubik’s cube has become a popular metaphor for the marketing teams of ETF providers. With good reason. For each client there’s a portfolio construction puzzle to be solved with building blocks, representing geographies, sectors, asset classes, factors and styles. There has been rapid expansion from providers of ETFs tracking main-market indices, with the largest institutional providers capturing the lion’s share of flows, owing to their ability to deliver on four key ETF governance criteria – consistency, liquidity, transparency and, of course, price. This means that ETFs for main market cap-weighted indices are increasingly commoditised. After all, there doesn’t seem to be anything overly smart about replicating market beta, other than the smartness of saving on fees relative to 'closet-tracker' active funds. Traditional cap-weighted index investing is a preference: either out of philosophy or necessity. Innovation means smarter? Hence R&D of institutional investors, index providers and ETF manufacturers alike has focused more on “smart beta”. This has triggered a slew of innovation – both superficial and substantive. At a superficial end, age-old alternative weighting strategies (eg value indices that screen stocks for low book values, or dividend-weighted indices) have been rebranded as being “smart”. In these cases, for “smart” read “non-market-cap weighted”. In fairness, this rebranding is part of broadening of alternative weighting strategies that are factor-based. More substantively, research programmes such as EDHEC-Risk Institute’s Scientific Beta have been instrumental in promoting fresh thinking the field of both factor-based and risk-based smart beta strategies. Factor-based approach As a result, providers are focusing on making building blocks smarter. Instead of relying on the ‘traditional’ factor of market capitalisation for index inclusion, smart beta indices (and related ETFs) look at alternative factors: book value, dividend yield, volatility, for example. In that respect, the FTSE Russell 1000 Value Index launched in 1987 is probably the oldest factor index on the block. More recent factor indices are stylistic: Both iShares (Oct-14) and Vanguard (Dec-15) havelaunched global equity factor ETFs focusing on Liquidity, Min Volatility, Momentum and Value. The sophistication of factor-based index construction will continue to increase with the increase in data availability and computing power. Risk-based approach Portfolio strategists meanwhile can apply quantitative rules-based approaches to portfolio construction, creating static or dynamic asset allocation strategies from a growing universe of both cap-weighted and alternatively-weighted index tracking funds. These strategies – such as Maximum Sharpe, Minimum Variance, Equal Risk Contribution and Maximum Deconcentration – offer an alternative to the standard but troubled single period mean variance optimisation (“MVO”) approach. MVO’s limitations Single period MVO approach remains the traditional bedrock of very long-run investing in normal market conditions where the sequence of returns does not matter. However it runs into difficulty in the short-run when markets are non-normal and sequence of returns matters a lot. So unless you are a large endowment with an infinite time horizons, or perhaps can afford to invest for yourself and your family without ever needing to withdraw any capital, relying entirely on the MVO approach for asset allocation gives false comfort. For cases where there are constraints that challenge the MVO model - due to multiple or limited time horizons, expected capital withdrawals, risk budgets, and unstable risk/return/correlation profiles of asset classes (collectively known as real life) - portfolio construction requires a smarter, more adaptive approach that observes, isolates and captures the reward from shifting risk premia over time. Risk-based portfolio strategies attempt to achieve this and are designed to offer a liquid alternative approach to investing that is uncorrelated with traditional Single-Period MVO strategies. What’s the problem to solve? Whether assessing factor-based ETFs, or risk-based ETF strategies, at best these new developments seem all very smart. At worst it’s just a bit different. However, as ETFs get smarter and the strategies that combine them become more sophisticated, there’s a risk that the key question in all of this gets lost in an incomprehensible barrage of Greek. The key question for portfolio managers nonetheless remains the same. What client outcome am I targeting? What client need am I trying to solve? For portfolio strategy, whether using a discretionary manager that relies on judgement, or a systematic rules-based approach that relies on quantitative inputs, the key client considerations remain return objective, time horizon, capacity for loss, and diversification across asset classes and/or risk premia. Broadening the toolkit A portfolio strategy has little meaning without an objective that focuses on client outcomes. Factor-based ETFs and Risk-based ETF portfolio strategies offer an alternative or additional set of tools to help deliver on those outcomes, in a way that is systematic, liquid and efficient. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed