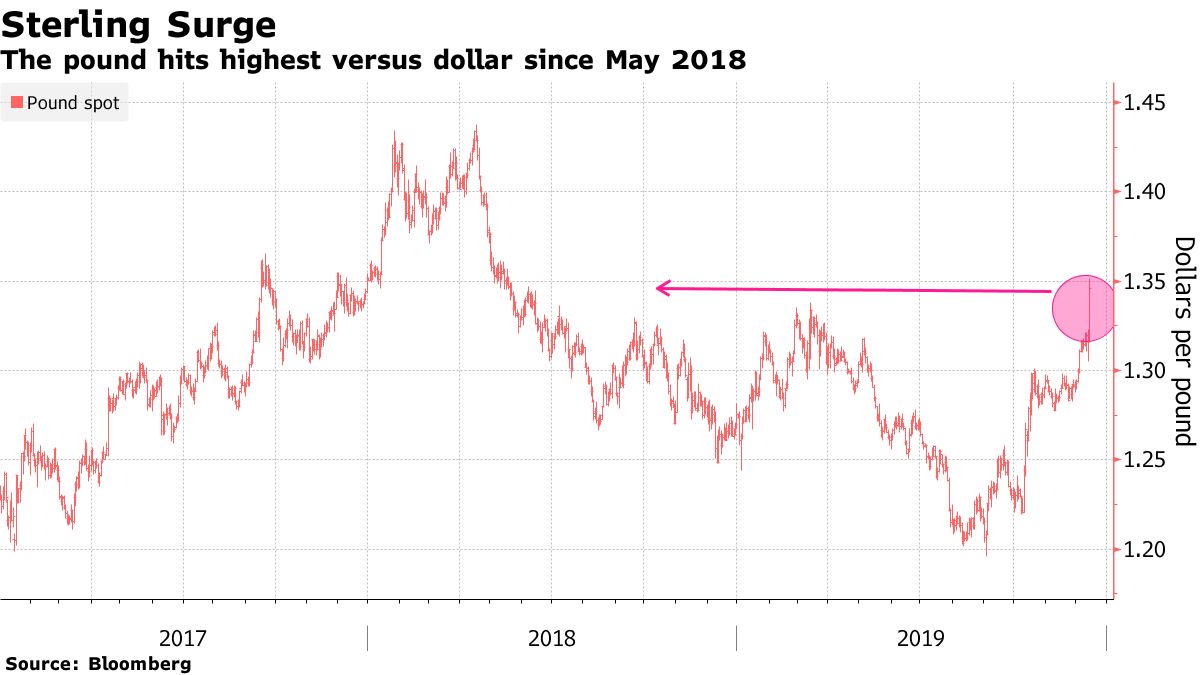

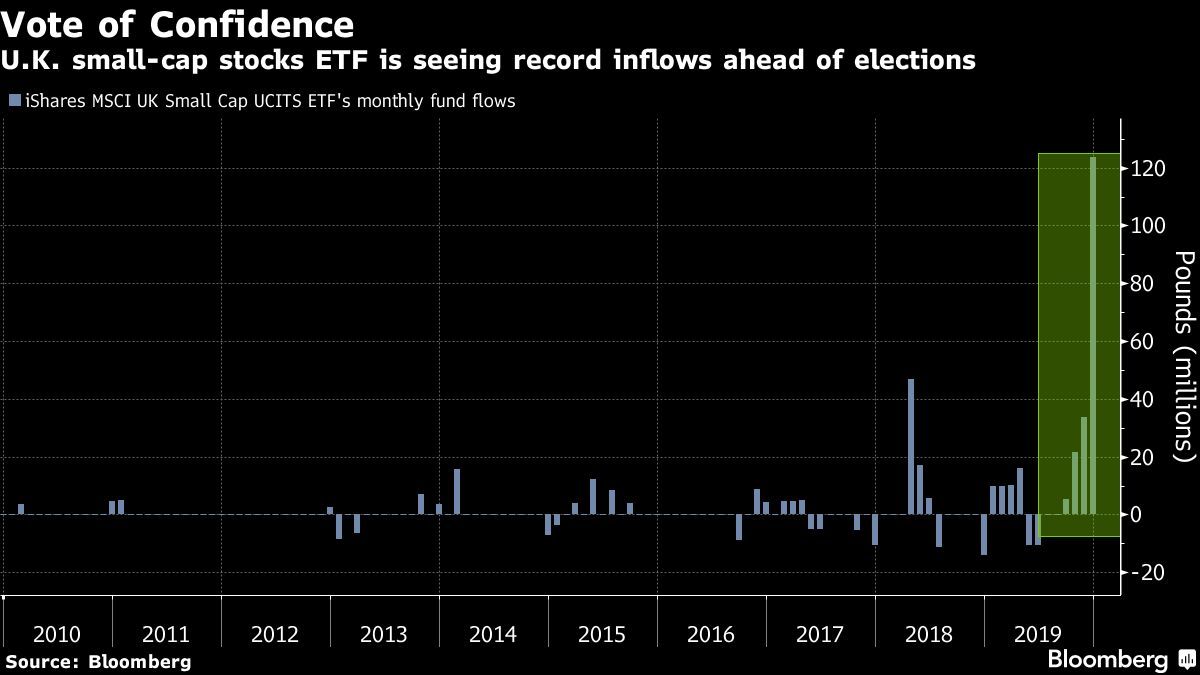

Conservative majority Conservatives are on track for a winning a clear majority in the UK general election. The campaign has centred on a core message of Get Brexit Done which has appealed to traditional Tories and disgruntled Labour voters in Leave-oriented constituencies. Furthermore, a distrust of Labour’s leadership under a hard-left Corbyn has led to a significant reduction in Labour seats despite his popularity with youth activists. A Brexit election Each party’s position on Brexit has been the key driver for voting intentions, despite efforts by all parties to also focus on domestic policy and leadership personalities. The Conservatives message was to get Brexit done. The Liberal Democrats was to Revoke Article 50, ignore the Referendum result and remain. Labour’s stance was to hold another referendum. Voters, like markets, wanted clarity over “dither and delay”. With a clear majority, and an unambiguous mandate to deliver Brexit, some say that ironically, the bigger the majority, the softer the Brexit as Johnson will not be held hostage by hard-Brexit supporting “ultras” from the European Research Group. Meanwhile, Conservative MPs that have become independents or defected to the Liberal Democrats will vanish into obscurity. Breaking through the “Red Wall” The changing composition of the Conservative win is radical. Whilst some remain-leaning Conservatives voters (and MPs) have shifted allegiance to the Liberal Democrats, constituencies in Labour’s northern heartlands known as the “Red Wall” because they have not had a Conservative MP since the 1930s or 1950s. As predominantly Leave constituencies, voters have “lent” the Conservatives their vote as more trusted to deliver on Brexit after the shambles of a hung Parliament. Strategist vindicated Love him or hate him, the result is a vindication of Johnson’s chief strategist Dominic Cummings who developed Johnson’s core strategy on becoming Prime Minister in July 2019 as “D.U.D.” standing for Deliver Brexit, Unite the Country, Defeat Labour. With the two D’s on track, it will then be for the U and a pivot to a domestic agenda once UK has left the EU on or before 31st January. The Election in 3 Charts 1. Poll tracker Based on an analysis of polling data by the BBC, average voting intentions on 11th December, the day before the election, pointed to 43% support for Conservative, 33% for Labour, and 12% for the Liberal Democrats. Source: BBC 2. Cable Sterling has rallied on exit polls that pointed to a clear Conservative win, with markets encouraged at the prospect at the end of political deadlock, the end of any risk of a hard left Labour government, and the beginning of constructive engagement with the EU to get a comprehensive trade deal in place by December 2020. On becoming PM, Johnson forewarned that “people are going to lose their shirts” by betting against Brexit, using the language of investment managers. For anyone short sterling over the past few weeks, that’s proven absolutely true. 3. ETF Flows focus on UK Small Caps In the three weeks in the run up to the UK election, investors have been positioning for a Conservative win, with a record £151m flowing into the iShares MSCI UK Small Cap UCITS ETF (Ticker: CUKS) that focuses on domestically oriented smaller capitalisation companies. Bottom line

The bottom line is like him or loathe him, Boris Johnson has through force of personality and message discipline won a majority by reaching across tribal party loyalties to secure a clear mandate. We can expect a break-neck parliamentary agenda to deliver Brexit by 31st January 2020, before pivoting to domestic policy issues. At last there will be clarity and focus over the next 5 years, and reduced risk of a hard left Labour. This is good news for the markets, but more importantly good news for the country. [ENDS] Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Additional disclosure: This article has been written for a UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) or “LON:” (London Stock Exchange). For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: as per specified source; Chart credit: as per specified source; Table credit: as per specified source. All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed