|

In this podcast, Henry Cobbe explores behavioural biases in an interview with Investor's Chronicle.

Access the podcast [5 min read, full article in pdf]

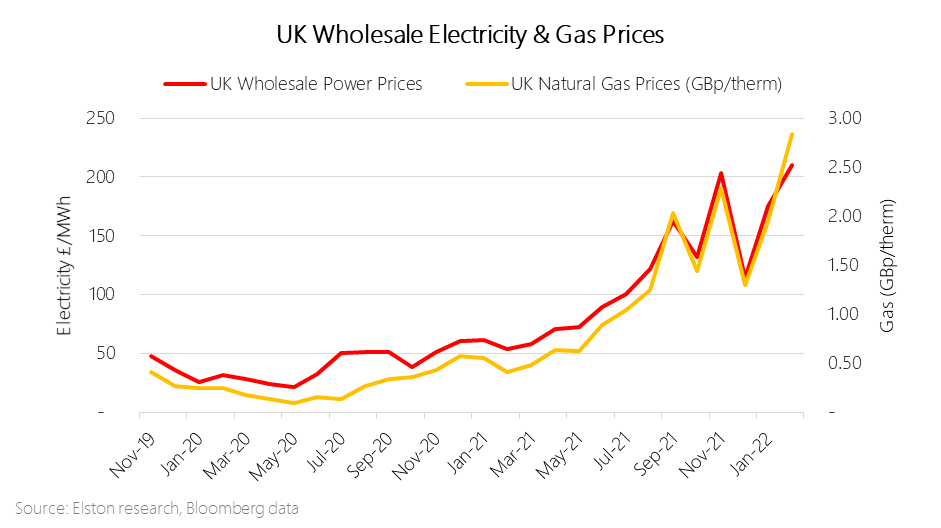

This war unleashes a European tragedy. In this insight, we outline what this far larger war means for Ukraine and Europe, how it could potentially stop, the impact on markets – with a focus on energy supply and associated risks to growth and inflation – and finally on portfolio positioning. [3 min read, open as pdf]

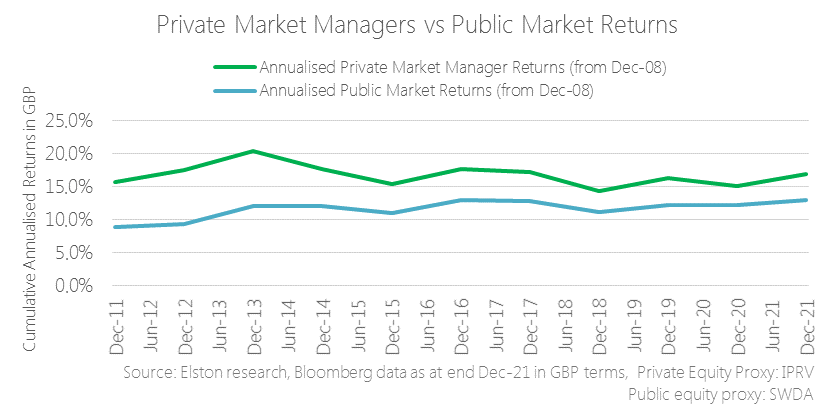

Estimating the “illiquidity premium” of private markets versus public markets is complex and cannot be done using public data. As an alternative we focus on the returns premium of private market managers to public markets. By comparing the performance of listed private market managers (whose shares are publicly traded) to a mainstream public markets benchmark, we can get a picture of the liquid return premium of the sector as a whole, relative to public markets. Read the article in full as pdf Watch the CPD webinar on this topic [3 min read, open as pdf for full article]

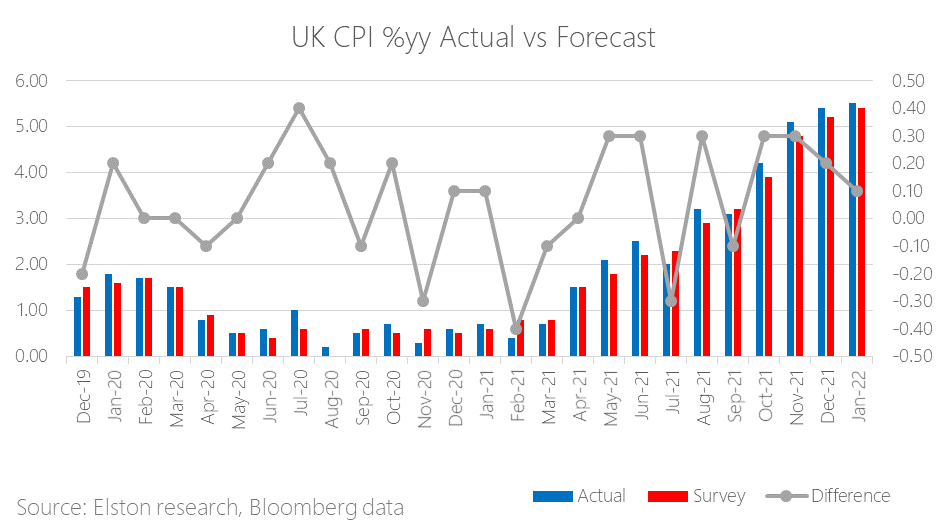

Latest UK inflation figure The latest UK inflation came in at 5.5%yy for January 2022, compared to 5.4%yy survey estimate. This is up from 5.4%yy last month and is above expectations. Higher prices of energy, clothing, housing and transport all contributed to the highest UK inflation rate in 30 years. Inflation pressure is continuing broadening and expected to peak in April when the rise in tax and price cap for energy bills takes effect. In the chart below we show how UK inflation has consistently surprised on the upside. Open as pdf for full article [3min read, open as pdf]

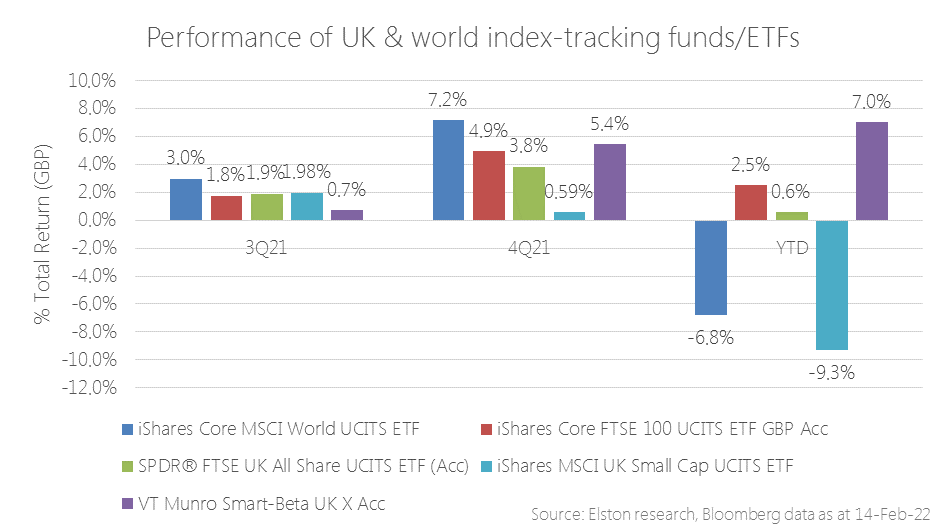

Value/Income bias for inflation protection In our 2022 outlook, we explained why inflation will remain hotter for longer and will settle above pre-pandemic levels. Within equities, we outlined our rationale for being overweight Value-factor equities with an Income bias to shorten equity duration. This built on our May 2021 view on UK equity income providing a helpful inflation hedge. The rapidity and severity of market movements against the prospect of faster-than-expected inflation and greater-than-expected interest rate tightening have only served to reinforce these views, as reflected by performance. Whereas world equities have struggled year to date, UK equities have been a relative bright spot. Within UK equity index exposures, indices that focus on dividends (with an inherent value bias), over size (market cap) have delivered best results. Our Smart-Beta UK Dividend Index [ticker ELSUKI Index] has delivered positive returns YTD ahead of more mainstream UK equity indices, driving the absolute and relative returns of the VT Munro Smart-Beta UK Fund, which is benchmarked to this index[1]. Read full article as pdf [1] Note & Commercial Interest Disclosure: Elston Indices is the benchmark administrator for the Freedom Smart-Beta UK Dividend Index, to be renamed the Elston Smart-Beta UK Dividend Index with effect from 1st March 2022. The VT Munro Smart-Beta UK Fund is benchmarked to this index. [3 min, open as pdf]

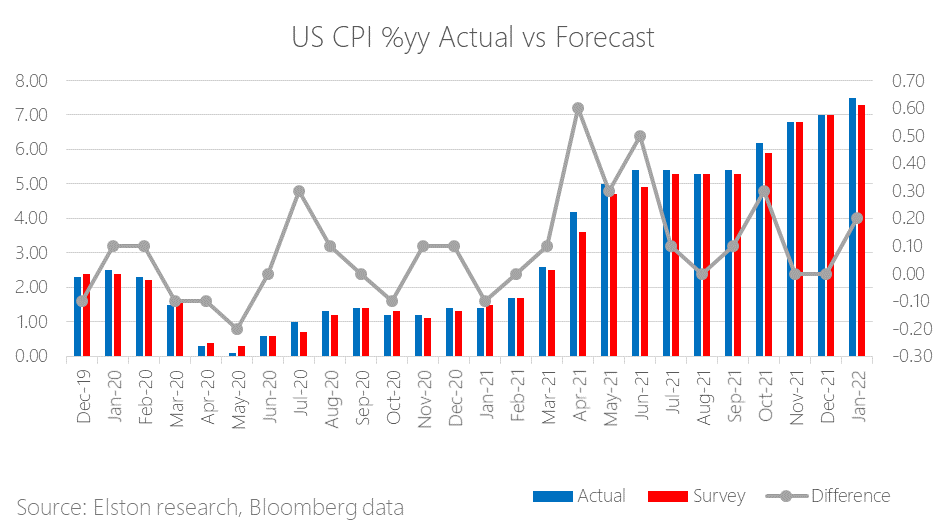

Latest US inflation figure The latest US inflation came in at 7.5%yy for January 2022, compared to 7.3%yy survey estimate. This is up from 7.0%yy last month, and is above expectations. Energy prices jumped by 27% compared to January 2021. Higher prices of accommodation and food also contributed to the highest US inflation rate in 40 years. Inflation pressure is continuing broadening as global supply failed to catch up with demand. [Read as full article] [5 min read, open as pdf]

In our 2022 outlook, we explained why inflation will remain hotter for longer and will settle above pre-pandemic levels. Advisers should consider how to adapt portfolios for inflation across each asset class – equities, bonds and alternatives. Research demonstrates how different asset classes exhibit different degrees of inflation protection over different time-frames. Equities therefore provide a long-term inflation hedge.

In this article, we explore how to adapt portfolios for inflation within and across each asset class: Equities, Bonds and Alternatives. For full article, read as pdf |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed