|

[5 min, open as pdf]

We are delighted to mark our 10 year anniversary and have issued the media release below.

Five inflation-adapted portfolios offer a new solution for advisers Elston Consulting (“Elston”), the independent investment consultant for financial advisers, is today pleased to announce the launch of five inflation-adapted portfolios available for licensing to wealth managers and financial advisers. Celebrating its 10-year anniversary, Elston is also expanding the business with the addition of two senior professionals to the team. Comprising five risk portfolios defined by equity risk, the inflation-adapted portfolios incorporate a value/income tilt within equities and use risk-constrained real asset and absolute return strategies as alternatives to bonds. The new investment portfolios underscore Elston’s continued dedication to innovating solutions for advisers. Elston today also announces the expansion of its talent base with the appointments of two senior industry professionals Hoshang Daroga, CFA as Investment Director and Scott Adams as Head of Adviser Relations. Founded by Henry Cobbe in October 2012, Elston has grown to become one of the leading independent investment consulting firms for financial advisers providing support to investment committees on their investment proposition. Henry Cobbe, Head of Research at Elston Consulting, commented: “We are delighted to welcome Hoshang to Elston, where his extensive experience, knowledge and skill will be of huge benefit to all the solutions we offer to advisers. Among them is our newest innovation, the inflation-adapted portfolios. We know advisers and their clients are looking for ways to rethink the traditional 60/40 model to mitigate the impact that inflation has on portfolios – particularly on bonds. We hope this new strategy will help meet this need.” Hoshang Daroga, Investment Director at Elston Consulting, added: “I am thrilled to be joining Elston at an exciting time for this fast-growing and dynamic business. Advisers are under increasing pressure to deliver for their clients against an incredibly challenging backdrop. In my role as Investment Director will help advisers we work with deliver agile and innovative solutions delivered in any required format – portfolios, funds or indices – using our research, analytics and insights.” Scott Adams, Head of Adviser Relations at Elston Consulting, added: “I am delighted to be joining Elston to help adviser firms we work with innovate for their clients with the enhancement of their investment proposition. I am glad I can leverage my long-term industry experience to help solve real-life problems for advisers as they adapt their business models.” About Elston Elston is an investment solutions provider designing portfolios, funds and indices for UK wealth managers and financial advisers. Examples of Elston-designed solutions are below: Elston Portfolios: Elston Portfolio Management offers portfolios designed by Elston Consulting: the Elston Global Diversified range of 5 risk-rated model portfolios, and now the Elston Inflation-Adapted Portfolios which are designed to improve inflation resilience. Elston launched its first model portfolio – a Charity Multi-Asset Income portfolio in 2015. Custom Portfolios: Elston designs, build and delivers custom portfolio for wealth managers and financial advisers using its research, analytics and insights. Funds: funds that track Elston indices include VT Elston Liquid Real Assets Index Fund, VT Elston Multi-Asset Income Fund and VT Munro Smart-Beta UK Dividend Funds (which tracks the Elston Smart-Beta UK Dividend Index. Indices: In addition to the indices above, Elston administers the following indices: Elston Equal Weight Portfolio Index, Elston Dynamic Risk Parity Index, Elston Gold & Precious Metals Index and the Elston 60/40 GBP Index. Elston launched its first index in 2014 and is a FCA-registered benchmark administrator. All trademarks are the property of their respective owners. -ends- Mini-budget unveiled: going for growth

The new Chancellor, Kwasi Kwarteng's mini-budget resonated like a old-school 1980s style Conservative tax reduction and de-regulation plan, to solve our 1970s style stagflation risk. Good call. But will the markets buy it? The aim of the mini-budget is to make the UK globally competitive and "unleash the country's potential" with a comprehensive growth plan. But it comes against the backdrop against great economic uncertainty. Will this pre-emptive dash for growth help resuscitate the economy, and will the books balance? We shall see. Whilst the steps taken are welcome and are a long-term positive, they come at a time of economic fragility. All the right policies, but at a difficult time. Markets may remain sceptical until any benefits emerge. Key points of the growth plan are summarised below: Energy: Two year price cap for retail: helps cap inflation (and therefore helps reduce interest payments on inflation linked bonds) Going for growth: tax-cuts, breaking down regulatory barriers, reforming the supply side of the economy to stimulate demand Infrastructure: road, rail, and digital infrastructure investment and acceleration of review and implementation by reviewing planning restrictions, regulations and bureaucracy. New homes: get Britain building with streamlined planning and making government land available for housing Employment: make work pay to stimulate work-seeking over benefit-taking City and bonus cap: make London the centre for global banking and scrap bonus cap (which did not affect total remuneration) Creation of new investment and tax relief zones: to accelerate development in 40 tax incentivised zones, as part of levelling up strategy. Tax simplification: will be reviewed and made simpler and fairer to stimulate economic activity: planned increase in corporation tax rate will be cancelled and will remain at 19%, the lowest rate of corporate tax in the G20. Tax-incentivised investment: will extent EIS, SEIS and VCT schemes to make Britain a country of entrepeneurs Retail: bring back VAT-free shopping for tourists Employer NI rate rises will be cancelled. Tax cut for 1m business and 28m workers whilst maintaining funding for NHS Home ownership: stamp duty abolished for home purchases above £250,000 Income tax: basic rate cut earlier at 19%, higher tax rate of 45% abolished, highest rate now 40%, as it was for over 20 years. We will be watching how Sterling reacts to this "fiscal event" - as any benefits may take time to feed through the system, and the funding of these plans has yet to be estimated or analysed. [3 min read - open as pdf]

The US Federal Reserve implemented its third consecutive 0.75% rate rise this week, taking the overall rate to 3.25%. Hot on its heels, the Bank of England followed suit, lifting UK rates 0.5% to 2.25%. The yield curve is at its most inverted since 1982, suggesting imminent recession, and following the UK's mini (maxi) budget in which tax rates were slashed, sterling plummeted against the dollar. The risk-free rate is rising: investors need to think carefully about how they are positioned. Full article available as pdf Chloé Meley of Citywire speaks to Rachel Robertson from Multrees and Andrea Acimovic from Elston about the gender diversity initiatives the world of finance needs.

Access the podcast [5 min read, open as pdf]

The thirty-year anniversary of Black Wednesday was marked by the Sterling reaching its lowest levels against the dollar since 1985. Part of this is a function of dollar strength against global currencies, another part about rising concerns on the UK economic outlook and future policy-making. Sterling’s weakness and outlook is forcing investors to consider how to manage currency risk in their portfolio across each asset class. Full article available as pdf [3 min read, open as pdf]

[3 min read, open as pdf]

[3 min read, open as pdf]

[3 min read]

[5 min read, open as pdf]

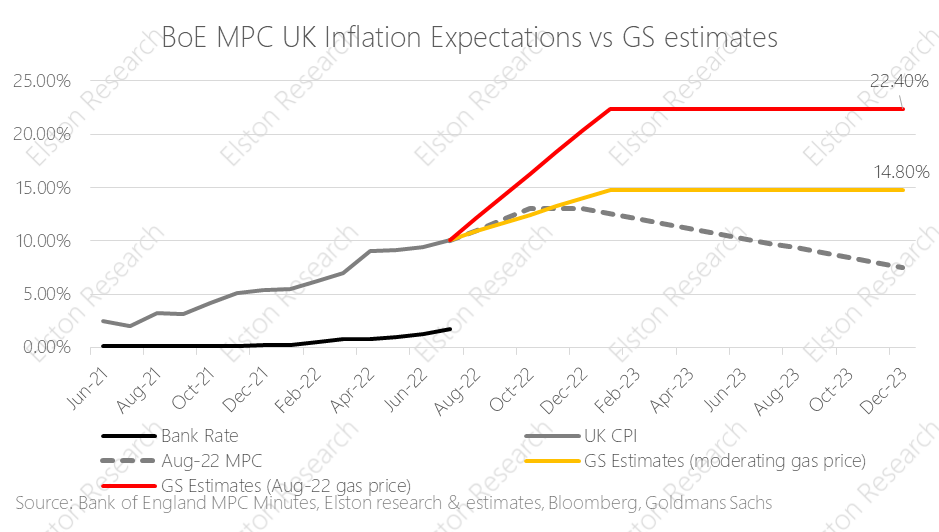

With low growth, soaring inflation and spiking interest rates, advisers need to rethink the definition of risk. Focus on volatility is focus on the “wrong problem”. Instead, advisers should focus on preserving purchasing power (mitigate inflation risk) to protect client outcomes. That requires a fundamental rethink around traditional definitions of risk, asset allocation and diversification. For full article including charts, open as pdf |

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed