What’s new? A bond ETF is not brand new: the first bond ETF launched back in 2002. But they are gaining traction, and as adoption increases the breadth and depth of bond ETFs have also broadened. In my first DIY multi-asset ETF portfolio back in 2008, the main bond ETFs available back then were for broad exposures like Gilts, Index-Linked Gilts and Corporate Bonds. Fast forward over ten years and there’s the ability to access much more targeted exposures. Investors can access both corporate and government bonds for GBP issuers as well as for major currency issuers such as USD and EUR, both unhedged and hedged to GBP. Furthermore, within these opportunity sets investors can select from a range of investment term options, whether short-term (e.g. <5 years), medium term (e.g. 5-10 years), or long-term (>10 years). As well as high yield bonds, more specialised bond exposures are also increasingly available. So whatever the exposure, there is an investable index to express it, and increasingly an ETF to track it. But what is a bond ETF and what are the benefits? A bond ETF is simply a bond fund that can be bought or sold on an exchange, like a share. This has three benefits: it enables access, provides diversification and creates liquidity. According to a recent survey of UK managers, while the access and diversification points are readily understood, there are concerns about liquidity.

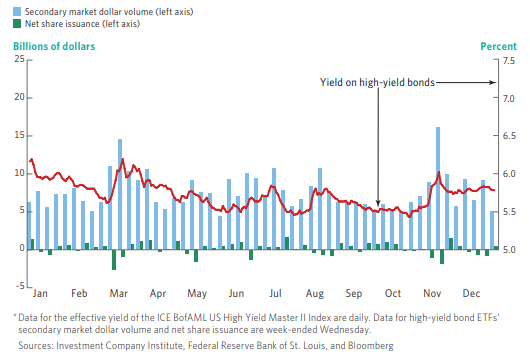

Understanding bond ETF liquidity Ultimately the liquidity of a bond fund, whether a traditional fund or an ETF is only as good as the underlying asset. We can term this “internal liquidity”. But if liquidity of a fund itself is a concern then you are probably better off in a bond ETF than a traditional bond funds. Why is that? Simply put the stock exchange creates a secondary market for ETFs (buyers and sellers of bond ETFs trading with each other without necessarily requiring a creation or redemption of units of the bond ETF that would impact underlying bond liquidity). We can term this “external liquidity”. If liquidity of the underlying asset class was a concern and you wished to exit a traditional bond fund, your redemption would be at the discretion of the fund provider and in extremis, you may find yourself gated. So if bond liquidity is a concern, avoid traditional funds and stick to ETFs: there’s a secondary market for them other than the fund issuer. Additional liquidity of bond ETFs By way of example, 2017 provided a stress test for the bond market – in particular high yield bonds. The findings are reassuring. When high yield bond yields spiked in March 2017 and high yield bond values came under pressure, we can see how high yield bond ETFs actually fared in these challenging conditions. The volumes of the secondary market trading between investors buying/selling on exchange (which requires no trading of the fund’s underlying securities) eclipsed net share redemptions (which does require trading of the underlying securities) by a significant factor. The volumes on secondary markets increased to an average of $12.7bn in the first two weeks of March (versus a previous nine-week average of $6.7bn), whilst the net redemptions of high yield bond ETFs was only $3.5bn (representing 6.1% of total assets). A similar resilience was exhibited in November 2017. So far from triggering a liquidity stampede in the underlying holdings, the presence of secondary market enabled investors to trade the ETF holding those bonds amongst themselves. This is why secondary market liquidity is seen as an advantage, rather than a disadvantage. Secondary Market Trading of High-Yield Bond ETFs Increased When Yields Rose in 2017, 29-Dec-16 to 29-Dec-17* Source: ICI 2018 Factbook. Figure 4.6

The ratio of secondary market volume to net share issuance is therefore one measure of bond ETF liquidity, but the most indicative measure of bond ETF liquidity is bid-ask spread. Conclusion Innovation for bond ETF investing is focused on more nuanced index design and construction of bond ETFs which provide the tools managers need to reflect their views as regards issuer type, term and credit quality when allocating to bonds. The adoption of bond ETFs is demand-led as it enables access, provides diversification and creates liquidity. This is and should be welcome to investors large and small. For more information and important notices, view the full report. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Business relationship disclosure: The article includes references to research by Elston Consulting that was sponsored by State Street Global Advisors Limited. I wrote this article myself, and it expresses my own opinions. Additional disclosure: This article has been written for a UK audience. Tickers are shown for corresponding and/or similar ETFs and may be prefixed by the relevant exchange code, e.g. “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.ElstonETF.com All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. Image credit: n.a.; Chart credit: ICI; Table credit: n.a. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed