|

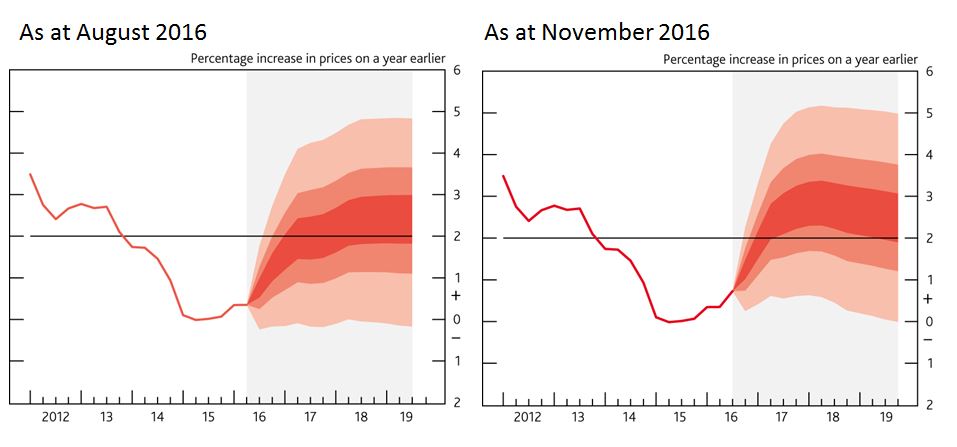

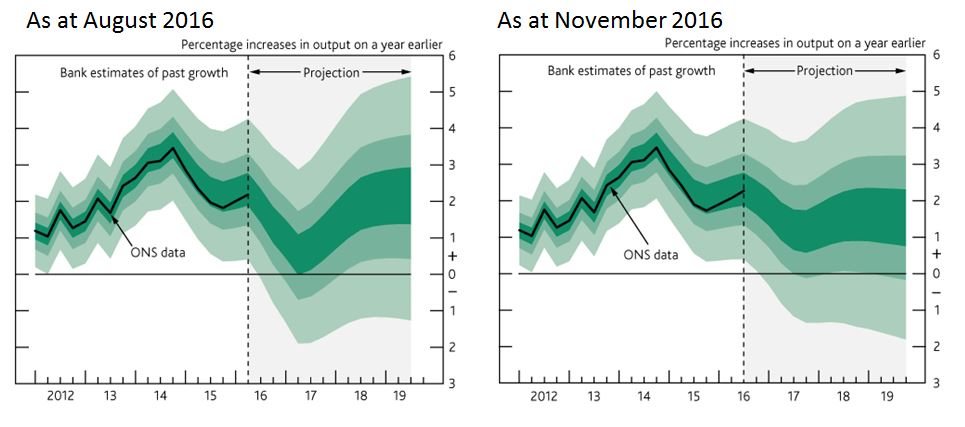

Inflation The Bank of England has raised its 2017 inflation estimate to 2.7%, from the current rate of 1%. The Bank does not expect inflation to return to its 2% target until 2020. The rise in inflation expectations was explained by the decline in the pound since the EU referendum, which is driving up prices of imported goods. Fig 1. Projections for UK CPI based on market interest rate expectations Source: http://www.bankofengland.co.uk/publications/Pages/inflationreport/2016/nov.aspx Growth The economic growth rate forecast was also raised from 0.8% to 1.4% for 2017, whilst expectations were cut for 2018 from 1.8% to 1.5%, signalling that the Brexit impact will be felt later than originally expected. Further interest rates considered in August have been clearly ruled out. Fig 2. Projections for UK GDP based on market interest rate expectations Source: http://www.bankofengland.co.uk/publications/Pages/inflationreport/2016/nov.aspx

NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: N/A; Chart credit:Bank of England; Table credit: N/A Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed