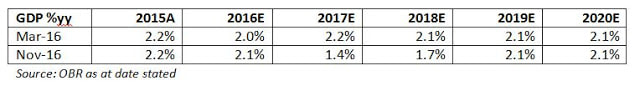

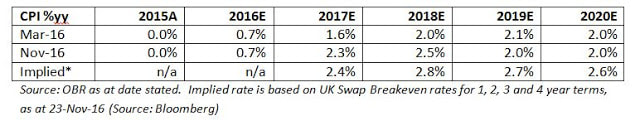

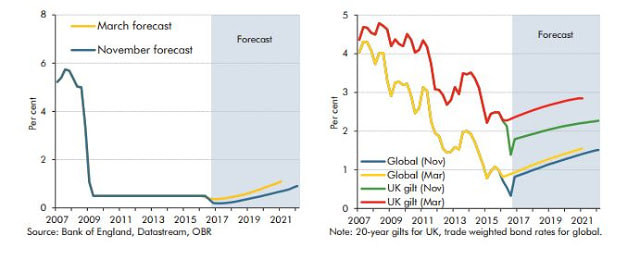

Growth estimates cut UK GDP’s growth rate has been downgraded relative to pre-referendum expectations, with a cut from 2.2% to 1.4% for 2017E and from 2.1% to 1.7% for 2018E. Inflation estimates raised Following post-referendum sterling weakness, estimates for UK inflation were increased from 1.6% to 2.3% for 2017E and from 2.0% to 2.5% for 2018E. This compares to 2.4% and 2.8% for 2017E and 2018E respectively for UK swap breakeven rates. Rising interest rate environment With higher inflation expectations there is upward pressure on Bank Rates after a protracted “lower for longer” regime. Spending focus: infrastructure and innovation

The government spending plans shows clearly defined cous – with budget to increase infrastructure spending from 0.8% of GDP today to 1.0-1.2% from 2020. This supply side stimulus that focuses on productivity gains is welcome if fiscally manageable. NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: www.gov.uk; Chart credit: OBR; Table credit: OBR Data, Bloomberg Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed