|

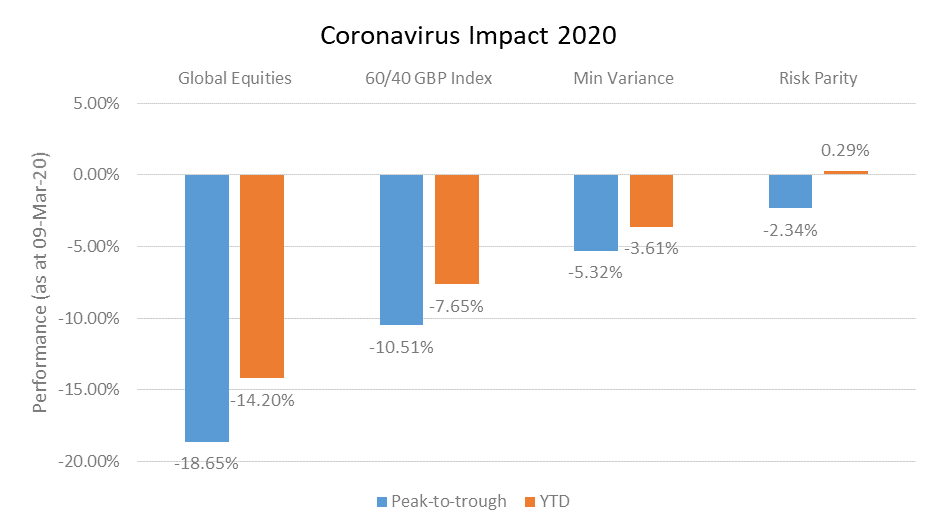

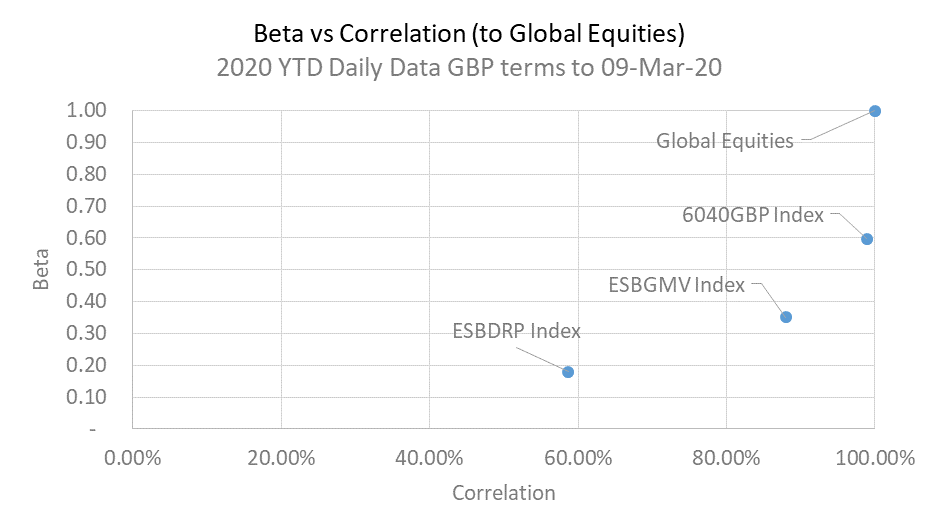

The impact of Coronavirus on multi-asset strategies is summarised below. This chart shows the peak-to-trough and YTD performance of Global Equities and Elston's multi-asset indices for GBP investors. Asset-based diversification has its limits Whilst a traditional asset-based approach to diversification can help reduce equity market beta, but it doesn't necessarily help reduce correlation. Why does (de)correlation matter The maths of diversification means that the less correlated an asset within a portoflio, the greater the diversification effect. Comparing multi-asset approach A 60/40 equity/bond portfolio (represented by 6040GBP Index), reflects a traditional multi-asset approach. Year-to-date this strategy has a beta of 0.60x but a correlation of 98.9%. By contrast, a risk-based approach to diversification not only reduces beta, but also reduces correlation. A Minimum Variance multi-asset strategy (represented by ESBGMV Index) has a beta of 0.35x and a correlation of 88.0%. A Risk Parity multi-asset strategy (represented by ESBDRP Index) has a beta of 0.18x and a correlation of 58.7%. Summary

For effective risk-based diversification, whilst maintaining exposure to risk assets with returns potential, a risk-based approach to portfolio construction makes sense. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed