|

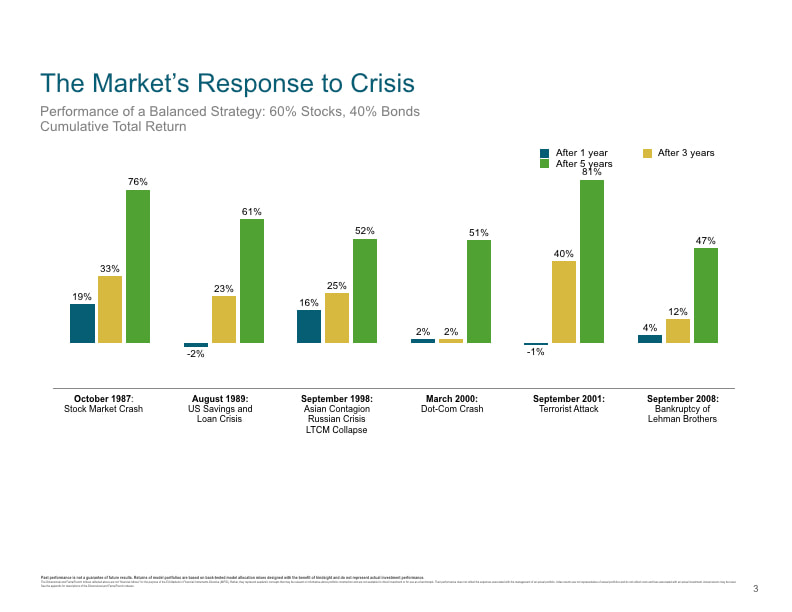

Global stocks have been on something of a rollercoaster ride just lately, with markets trading at, or near, a two-year low. Doubtless many investors, especially those who are close to retirement, are feeling fearful. Fear is a hugely powerful emotion. It makes us do irrational things, and the sad fact is that, in the context of investing, there’s no shortage of people who want to take advantage. The Californian financial adviser and blogger Robert Seawright wrote an excellent article on this subject the other day. “When the markets are roiling,” he wrote, “fear is pitched all day, every day, and human nature buys it. And pays a premium. A very big premium.” “Fear makes money,” says Daniel Gardner in his book The Science of Fear. “The countless companies and consultants in the business of protecting the fearful from whatever they may fear know it only too well. The more fear, the better the sales.” So, what’s the answer, apart from steering well clear of salespeople? First things first: don’t feed the fear. When behavioural finance expert Greg Davies was invited on to Bloomberg to talk about the market rout in 2008, he was asked, live on air, what should investors if they’re really worried. “They should stop watching Bloomberg for a start,” he replied. Apparently, they tend not to invite him now. But, more importantly, investors who are anxious need to do some reading and arm themselves with an understanding of the bigger picture. To do it properly, it’s going to take you a little while. If you don’t have time, you could just watch a short video just released by Dimensional Fund Advisors, on how markets reward investors who stay disciplined at times such as these. The video is presented by DFA’s Vice-President and Head of Advisor Communication, Jake DeKinder. In the video, Jake says this: "Recent events have increased the feeling of uncertainty and may have led some to question whether to not to make changes to their investment approach. "It’s important to remember that while these events might seem frightening in the moment, they are not necessarily unique or unusual. “Throughout history capital markets have rewarded investors who are able to stay disciplined. After many major events, financial markets have recovered and delivered positive returns.” So what sort of events is Jake referring to? Well, here’s a series of graphs showing how a balanced portfolio comprising 60% equities and 40% bonds fared in the one, three and five years following the last six major market downturns: What these graphs show very clearly is that those who stayed invested while so many others didn’t were amply rewarded on each occasion.

Here’s Jake DeKinder again: "Over the long term, investors who have been able to remain patient and tune out the short-term noise surrounding these events have been rewarded for doing so. “In the face of uncertainty, it’s important to remember this historical perspective, and focus on the things we can control, rather than the things we can’t.” If you’re in any doubt about what, if anything you should be doing, you should seek the help of a financial adviser. Otherwise, take Jake DeKinder’s advice: tune out the noise, think long term and disregard anything that’s out of your control. And most of all, fear not. Christmas is costly enough without baling out of the stock market. Here’s the Dimensional video: Dimensional Fund Advisors: Markets reward discipline Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed