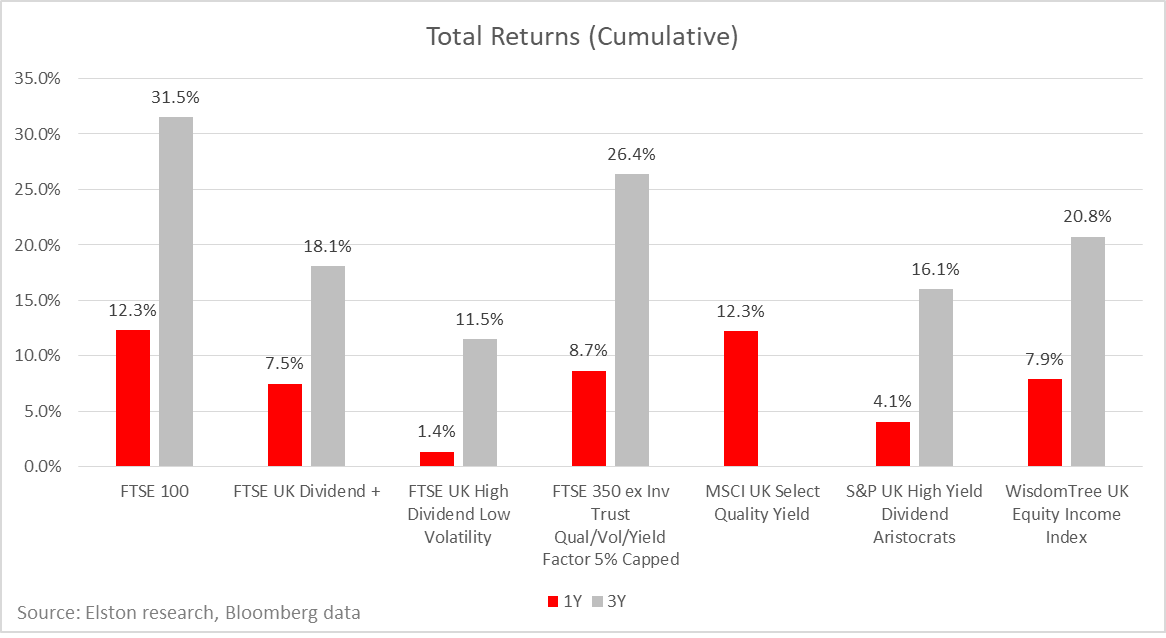

UK Equity Income Indices Investors have a choice of UK Equity Income index strategies, each with different risk-return characteristics, weightings methodologies and factor tilts. These difference influence the performance of each index strategy (all figures below are on a total return basis for GBP investors). Best performing for 2017 The best performing strategies for UK Equity Income in 2017 were:

This compares to +12.3% for FTSE 100 (best tracked by HSBC FTSE 100 UCITS ETF (LON:HUKX)). Best performing over last 3 years The best performing strategies for UK Equity Income over the last 3 years were:

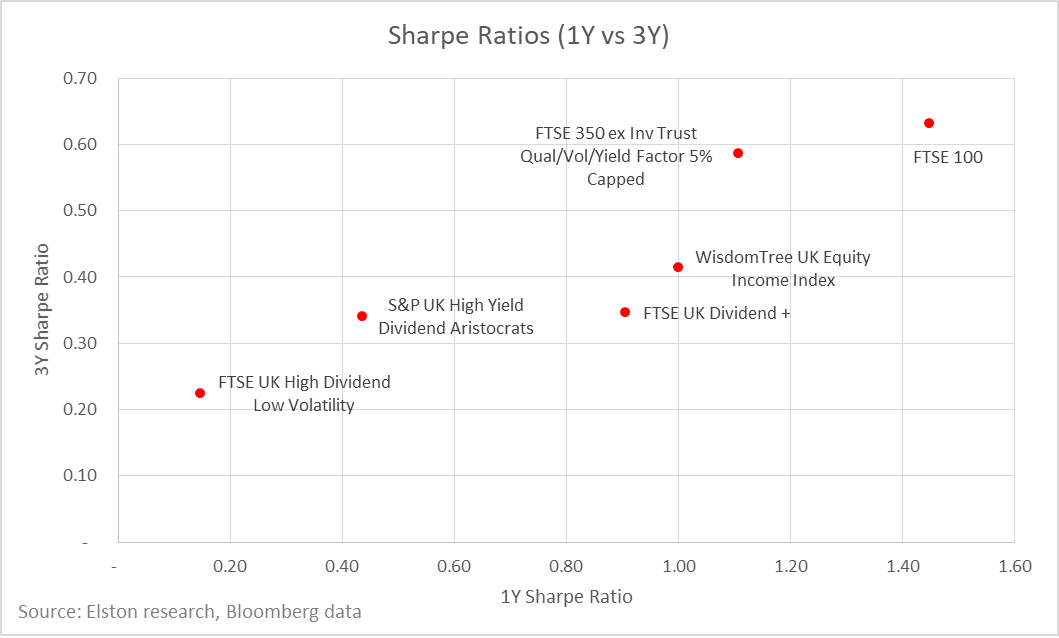

This compares to +31.5% cumulative return for FTSE 100 (best tracked by HSBC FTSE 100 UCITS ETF (LON:HUKX)). Fig. 1: Total Returns (Cumulative) by strategy/index (cumulative, GBP terms) Best risk-adjusted returns The best risk-adjusted returns in 2017 of available UK Equity Income indices was achieved by:

To look at consistency of risk-adjusted returns, we have plotted 1Y Sharpe ratios vs 3Y Sharpe ratios for each UK Equity Income index strategy in Fig.2 below. Fig.2. 1Y & 3Y Sharpe Ratios, selected UK Equity Income index strategies (GBP terms) Conclusion Different index construction methodologies has a material impact on performance outcomes – both in absolute terms and on a risk-adjusted basis. A naïve interpretation is to consider performance in isolation, however our view is that index selection is more nuanced than that: it should relate to the objectives and constraints of individual client portfolios and the desired exposure - on asset-basis, risk-basis and factor-basis and the interaction between the selected strategy and the rest of a client portfolio. Note: Scope of our comparison For these reports, we have analysed the indices and ETFs detailed in Fig.3. Fig. 3: UK Equity Income Indices & ETFs vs HSBC FTSE 100 UCITS ETF (LON:HUKX) [ENDS]

NOTICES: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. This article has been written for a US and UK audience. Tickers are shown for corresponding and/or similar ETFs prefixed by the relevant exchange code, e.g. “NYSEARCA:” (NYSE Arca Exchange) for US readers; “LON:” (London Stock Exchange) for UK readers. For research purposes/market commentary only, does not constitute an investment recommendation or advice, and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product. This blog reflects the views of the author and does not necessarily reflect the views of Elston Consulting, its clients or affiliates. For information and disclaimers, please see www.elstonconsulting.co.uk Photo credit: N/A; Chart credit: Elston Consulting; Table credit: Elston Consulting All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. Chart data is as at 30-Dec-17 Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed