Traditionally, UK pension fund managers and UK private client managers alike would have a bias towards home (i.e. UK) equities. Why is this, what does the research say and what does recent experience show? Understanding “home bias” First of all, what do we mean by home bias? We define home bias is allocating substantially more to the investor’s “home” market, relative to its capitalisation-based weight in a global equity index. Given the UK’s weight in global (developed markets + emerging markets) equity indices is now approximately 4% (it has been on a steady drift lower), any allocation above that level can be considered a home bias, from a UK investor’s perspective. Yet traditionally UK pension schemes and private client managers would split an equity allocation between broadly 50% UK and 50% international (ex-UK) equities. This represents a massive home equity bias, with a UK weight that is over 10x its market-cap based weight. Why does this home bias exist? The reasons given for such a massive home bias are typically the following:

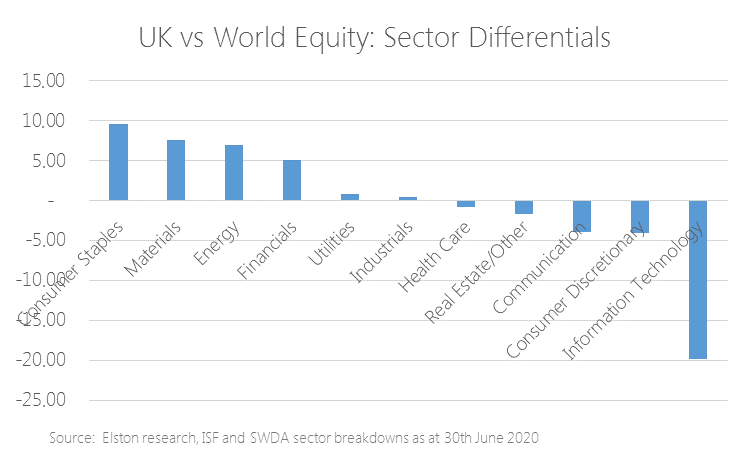

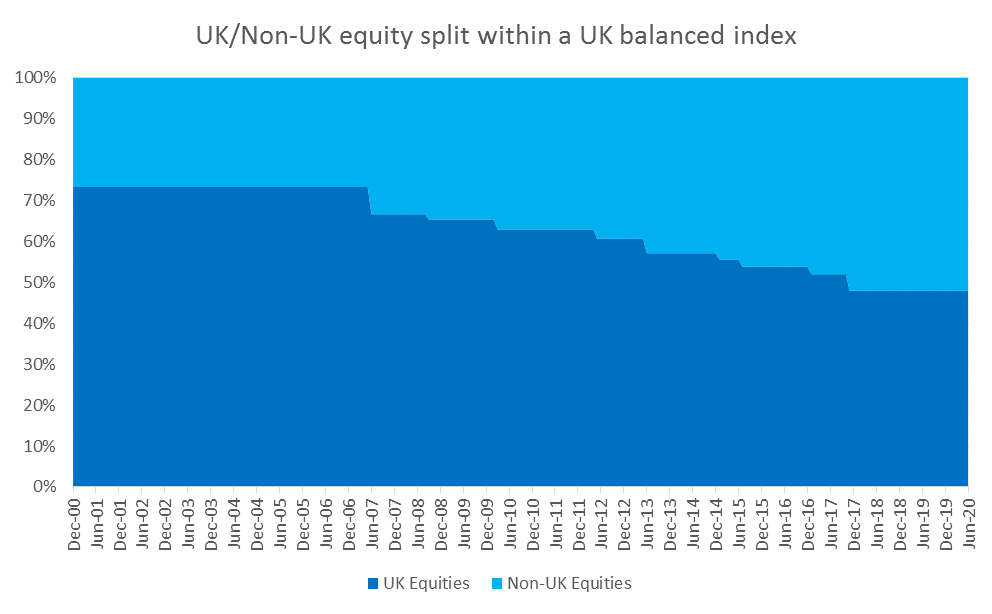

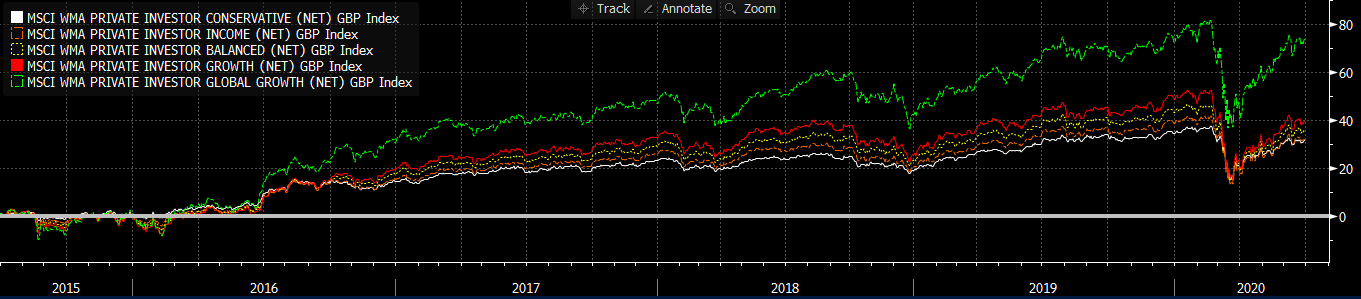

We can look at each of these in turn. Firstly, we would argue that investing in equities is not for currency/liability matching, but for return seeking and inflation beating: in which case, the broader the opportunity set, the greater the potential for returns. Put differently, a UK only investor is not only wilfully or accidentally ignoring 96% of the opportunities available in equities, by value, but would also thereby miss out almost entirely on the technology revolution led by US companies, for example, or the demographic revolutions of emerging markets. So whilst a home bias makes sense for a bond portfolio (matching changes in inflation and interest rates), a home bias for equities does not. Secondly, whilst the largest UK companies within the FTSE 100 are indeed “global” in nature, the broader, and more diversified (by sector and constituents), all share index is not. Furthermore the sector allocation of the UK market is skewed by domestic giants, can be out of step with the sector allocation for world equity markets. A UK equity bias is therefore a structural bias towards Consumer Staples, Materials and Energy, and a structural bias against Information Technology. Fig. 1. Sector Comparison UK Equities relative to World Equities Thirdly, whilst it is indeed true that UK managers will be able to get more access and insight to UK companies than, say, an overseas-based manager, for portfolio managers who focus on asset allocation over security selection, this access to management is less relevant and less valuable. Whilst we can debate the detail of all three of these arguments, they are not individually or together enough to justify an allocation to UK equities that is over 10 times its market weight. This is not a question of a rational overweight, it’s simply an irrational bias. What does the research say? There has been extensive research into why individual investors and professional managers have a preference for creating an equity portfolio with a strong home bias[1]. French & Porterba (1991) observed the predominantly home equity bias of investors based on the domestic ownership shares (as at 1989) of the largest stock markets. In each case the high domestic ownership of each respective market implies a high home equity bias at that time: US (92.2%), Japan (95.7%), and the UK (92%), for example. In 1990 UK pension funds held 21% of their equity allocation in international equities from just 6% in 1979 (Howell & Cozzini 1990). Now the figure could be closer to 50%, or even higher. The shift away from home equity bias has been steady and pronounced in the UK institutional market, but is still ingrained. However, it’s worth noting that subsequent home bias research is written in the US. Given the US represents approximately 66% of the world equity market (a share that has been steadily increasing), the central tenet of that research is that home-biased US managers miss out on the diversification benefits and increased opportunity set available from investing in markets outside the US. Hence home-bias for a US manager creates a smaller “skew” vs Global Equities than it does for a UK manager. What is current practice? Whilst the institutional UK managers have been gradually reducing home bias within equity allocations, what about UK retail portfolio managers? We looked at the MSCI PIMFA Private Investor Indices[2] – and predecessor indices – to gain an insight as to what current asset allocation practice looks like for UK-based managers in the retail market. These weightings of these indices are “determined by the PIMFA Private Indices Committee, which is responsible for regularly surveying PIMFA members and reflecting in each index the industry’s collective view for each strategy objective”[3]. Based on the “Balanced” index (and predecessor indices[4]), within a typical balanced mandate, the allocation within the allocation equities have decreased from a 70/30 UK/international split in 2000, to a 48/52 split today (see Fig.2.). Whilst this reflects a reduction in the home equity bias, it is nonetheless a material bias towards UK equities by retail investment managers. Fig.2. UK/international equity split within an indicative UK retail balanced mandate Source: Elston research, FTSE data, MSCI data In fairness, PIMFA has responded to this through the creation of a “Global Growth” index, which is 90% allocated to developed markets, and 10% allocated to emerging markets – so no UK home bias at all: but this is also a different risk profile to the Growth Index (100% equities, rather than 77.5% equities). Zimbabwean investors go global – UK investors should too We would make the case to advisers that if you were advising someone who lived in Zimbabwe, gut instinct would suggest that having the bulk of their equity allocation in Zimbabwean equities would feel like a poor and restrictive recommendation. After all, Zimbabwe makes up only a fraction of the global equity market. Without wanting to do UK plc down, the same gut instinct should apply to UK equities. If the UK is only 4% of global equities – why allocate much more than that? If you believe in equities for growth, it follows you believe in global equities to access that growth. Clients benefit from being shareholders in the changing mix of the world’s best and largest companies, not just the local champions. What does recent experience showing This debate was largely confined to theory given the relative stability of GBP to USD prior to Brexit. But given the dramatic currency weakness on the Brexit referendum, and the UK’s lack of exposure to the technology “winners” from the COVID-19 crisis, the disconnect between UK and Global Equity performance could not be more acute. Over the 5 years to 30th June, the FTSE All Share has delivered an annualised return of +2.87%p.a. in GBP terms, and MSCI World has delivered +7.53%p.a. in USD terms. That represents the difference in the performance of the underlying securities within those markets. Adjusting for currency effect too, and MSCI World has delivered +12.79%p.a. in GBP terms: an approximately 10ppt outperformance annually for 5 years. When expressed, in cumulative terms, the disconnect is more clear: over the 5 years to 30th June, the FTSE All Share has returned +15.22% in GBP terms, and MSCI World has delivered +43.80% in USD terms, and +82.66% in GBP terms: a 67.44% cumulative performance difference between those indexes, and the ETFs that track them. Fig.3. World vs UK Equity performance, 5Y to June 2020, GBP terms Source: FTSE All Share, MSCI World, Bloomberg data Delivering good portfolio returns is less about picking individual winners within each stock market, but making sure you have access to the right asset classes for the right reasons. Index funds and ETFs are a low-cost, liquid and transparent way of accessing those asset classes. UK multi-asset perspective From a multi-asset perspective, the performance difference between MSCI PIMFA Global Growth (100% equity, no home bias), MSCI PIMFA Growth (77.5% equity, with home bias) and other risk profiles is presented in Fig.4. below. Fig.4. MSCI PIMFA Private Investor Index Performance, 5Y to June 2020, GBP terms Source: MSCI PIMFA Private Investor Indices (formerly WMA), Bloomberg data The choice whether to embrace a UK home bias or avoid it has been critical and material and the main determinant of differences between multi-asset portfolio and multi-asset fund performance. The lack of UK home equity bias, is one of the key underpins of strong performance of the popular HSBC Global Strategy Portfolios and Vanguard LifeStrategy range, for example. A question of design Our preference for avoiding entirely any UK home bias for equities (but not for bonds) underpinned the construct of multi-asset funds and multi-asset portfolios that we have developed with and for asset managers. End investors in those products have benefitted from that key design parameter. Whilst we welcome managers launching global-bias multi-asset portfolios – it’s a bit late in the day as it won’t help their existing clients stuck in UK equities claw back the foregone performance of the last 5 years. The irony is that one of the reasons for the persistence of home equity bias is sustained by asset allocation providers used by wealth managers to construct multi-asset funds and portfolios. A closer interrogation of those research firms’ methodologies, parameters and constraints is required to think what makes best sense for end investors. Take action Looking to create your own investment strategy? Watch|Copy|Adapt our research portfolios Notes

[1] French, Kenneth; Poterba, James (1991). "Investor Diversification and International Equity Markets". American Economic Review. 81 (2): 222–226. JSTOR 2006858 [2] https://www.pimfa.co.uk/indices/ [3] https://www.pimfa.co.uk/about-us/pimfa-committees/private-investor-indices-committee/ [4] We define the predecessor indices to the MSCI PIMFA Private Investor Indices as: MSCI WMA Private Investor Indices, FTSE WMA Private Investor Indices, FTSE APCIMS Private Investor Indices Notices Image credit: Lunar Dragoon Commercial interest: Elston Consulting is a research and index provider promoting multi-asset research portfolios and indices. For more information see www.elstonetf.com

Ashley Reid

10/8/2020 13:01:00

Hi Henry, please see below a few thoughts on your recent paper. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed