|

[3 min read, open as pdf]

Design matters The combination of GBP/USD rollercoaster since Brexit, the critical home bias decision and the market stresses of 2020 mean that the differentiating factors amongst multi-asset strategies have boiled down to three things.

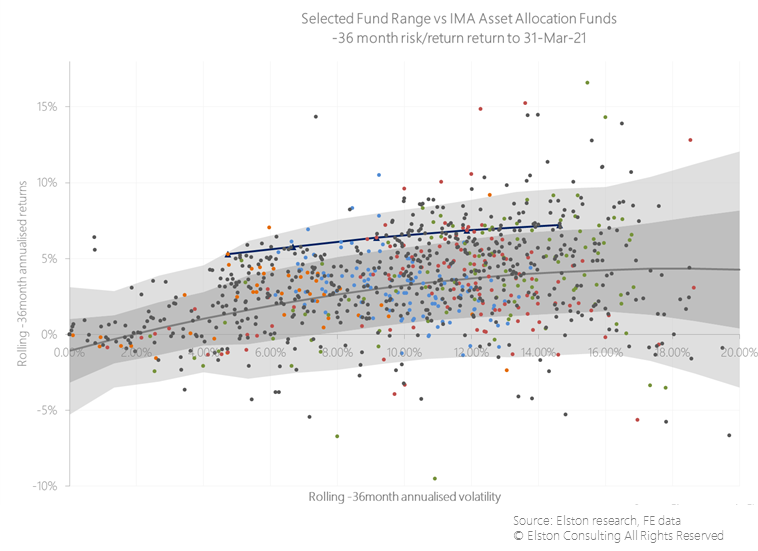

They are empirical and philosophical standpoints that portfolio designers must consider when developing a strategic asset allocation, and advisers should consider when looking under the bonnet of a multi-asset fund range. Parameter decisions are key Firms that use third-party asset allocation models that have a heavy UK equity allocation have been penalised. We have highlighted earlier the disconnect between UK’s market cap weighting at 4% of global equities, compared to its weighting in private investor benchmarks where it can be as higher as 50%. This is not rational and means UK-biased investors are penalised and missing out on world-changing trends of the broader global opportunity, set, this thing called “technology”, and demographic growth in Asia and Emerging Markets. Firms that believe that all returns should be in an investor’s base currency have been penalised for being structurally overweight a weakening GBP. There is a “hedging to your liability” argument that resonates for some liability-driven pension fund managers, but we believe that is a function of time-horizon and makes sense more for the bond portfolio, than the equity part of the portfolio. The inclusion of Alternative Assets, such as listed private equity and real assets has boosted risk-adjusted returns for some multi-asset funds but the biggest drivers remain home bias and GBP hedging policy. Results We look at the universe of multi-asset funds in the IMA Mixed Asset and Unclassified Sectors. By looking at realised risk-return, we can see how different ranges have fared relative to the median. The first thing to note is the dispersion of returns. There is very little consistency: the scattergram is more of a “splattergram” meaning selection of the right range of multi-asset funds is key. We look at the standard deviations around a regression line to get a handle on this dispersion. We also adjust these by risk “bucket”. Finally we link up the performance of each fund within a multi-asset fund range to look at the consistency of the “frontier”. Those that dominate have nothing to do with active or passive or fund selection, and everything to do with parameter design, namely UK or global equity bias and GBP hedging policy. Fig.1. Multi-asset fund universe risk-return scattergram Summary

Multi-asset funds are a convenient one-stop shop for a ready-made portfolio. But evaluating their design parameters is key to ensure it resonates with your own philosophy. Home bias, hedging policy and alternative asset policy are three due diligence questions to ask. There are many more. To see where your chosen multi-asset fund range appears in our analysis, or if you would like help reviewing your multi-asset fund choices, please contact us. https://www.elstonsolutions.co.uk/contact.htm Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed