|

Which asset classes are not indexable; what proxies do they have that can be indexed; and why it can make sense to blend ETFs and Investment Trusts for creating an allocation to alternative asset classes In this series of articles, I look at some of the key topics explored in my book “How to Invest With Exchange Traded Funds” that also underpin the portfolio design work Elston does for discretionary managers and financial advisers. Non-indexable asset classes Whilst Equities, Bonds and Cash are readily indexable, there are also exposures that will remain non-indexable because they are:

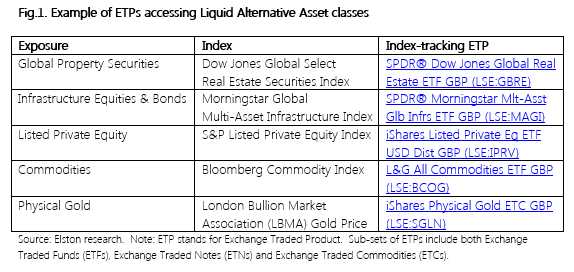

It is however possible to represent some of these alternative class exposures using liquid index proxies. Index providers and ETF issuers have worked on creating a growing number of indices for specific exposures in the Liquid Alternative Asset space. Some examples are set out below:

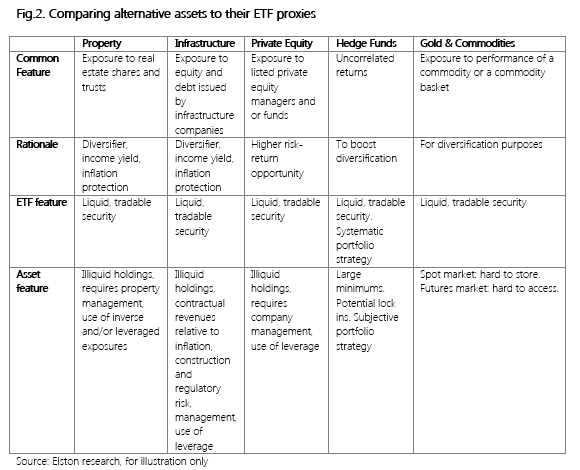

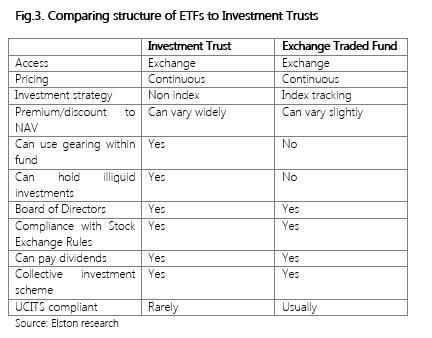

Alternative asset index proxies Whilst these liquid proxies for those asset classes are helpful from a diversification perspective, it is important to note that they necessarily do not share all the same investment features, and therefore do not carry the same risks and rewards as the less liquid version of the asset classes they represent. While ETFs for alternatives assets will not replicate holding the risk-return characteristics of that exposure directly, they provide a convenient form of accessing equities and/or bonds of companies that do have direct exposure to those characteristics. Using investment trusts for non-index allocations Ironically, the investment vehicle most suited for non-indexable investments is the oldest “Exchange Traded” collective investment there is: the Investment Company (also known as a “closed-end fund” or “investment trust”). The first UK exchange traded investment company was the Foreign & Colonial Investment Trust, established in 1868. Like ETFs, investment companies were originally established to bring the advantages of a pooled approach to the investor of “moderate means”. For traditional fund exposures, e.g. UK Equities, Global Equities, our preference is for ETFs over actively managed Investment Trusts owing to the performance persistency issue that is prevalent for active (non-index) funds. Furthermore, investment trusts have the added complexity of internal leverage and the external performance leverage created by the share price’s premium/discount to NAV – a problem that can become more intense during periods of market stress.

However, for accessing hard-to-reach asset classes, Investment Trusts are superior to open-ended funds, as they are less vulnerable to ad hoc subscriptions and withdrawals. The Association of Investment Company’s sector categorisations gives an idea of the non-indexable asset classes available using investment trusts: these include Hedge Funds, Venture Capital Trusts, Forestry & Timber, Renewable Energy, Insurance & Reinsurance Strategies, Private Equity, Direct Property, Infrastructure, and Leasing. A blended approach Investors wanting to construct portfolios accessing both indexable investments and non-indexable investments could consider constructing a portfolio with a core of lower cost ETFs for indexable investments and a satellite of higher cost specialist investment trusts providing access to their preferred non-indexable investments. For investors, who like non-index investment strategies, this hybrid approach may offer the best of both world. Summary The areas of the investment opportunity set that will remain non-indexable, are (in our view) those that are hard to replicate as illiquid in nature (hard to access markets or parts of markets); and those that require or reward subjective management and skill. Owing to the more illiquid nature of underlying non-indexable assets, these can be best accessed via a closed-ended investment trust that does not have the pressure of being an open-ended fund. ETFs provide a convenient, diversified and cost-efficient way of accessing liquid alternative asset classes that are indexable and provide a proxy or exposure for that particular asset class. Examples include property securities, infrastructure equities & bonds, listed private equity, commodities and gold. 19/4/2023 03:24:25

Nice ideas and tips that investors can follow through. Thanks for it. Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed