|

[3 min read, open as pdf]

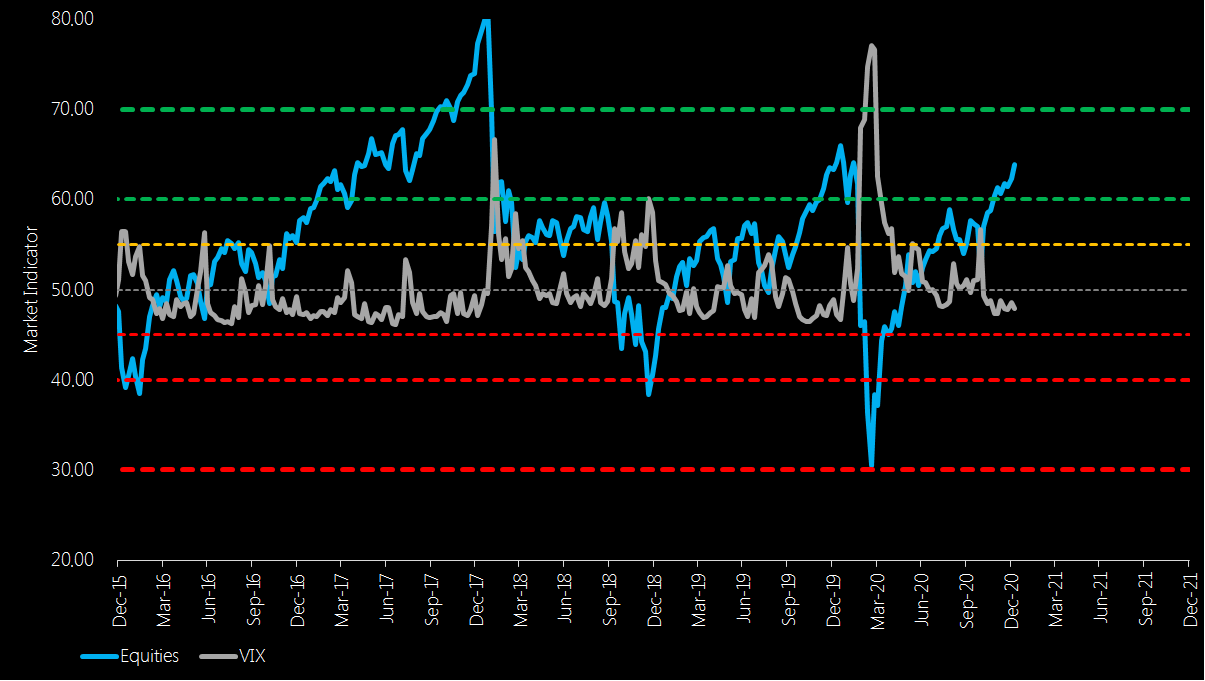

Growth shock is short and sharp The medium-term outlook for growth points more to a “short sharp shock” rather than a protracted downturn that followed the Global Financial Crisis. However vigilance around economic growth, and ongoing dependency on vaccine rollout, fiscal and monetary policy support remains key. Even lower for even longer interest rates Even lower for even longer interest rates underpins an accommodative strategy to support recovery: but also has created frothiness in some asset classes. Low nominal and negative real yields is forcing investors into refocusing income exposures, but should not lose sight of quality. Inflation in a bottle: for now Inflation caught between growths scare on the downside and supportive policy on the upside. Should inflation outlook increase, nominal bond yields will be under greater pressure and inflation-protective asset class – such as equities, gold infrastructure, and inflation-linked bonds can provide a partial hedge. Trade deal with EU should reduce GBP/USD volatility The 11th hour trade deal concluded in December between the UK and the EU should dampen the polarised behaviour of GBP exchange rate, with scope for moderate appreciation, absent a more severe UK growth shock. Market Indicators: recovery extended Market indicators suggest equities are heading into overbought territory and whilst supported by low rates and bottled inflation, are looking more vulnerable to any deterioration in outlook. Incorporating risk-based diversification that adapts to changing asset class correlations can provide ballast in this respect. Summary

With respect to 2021 outlook

Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed