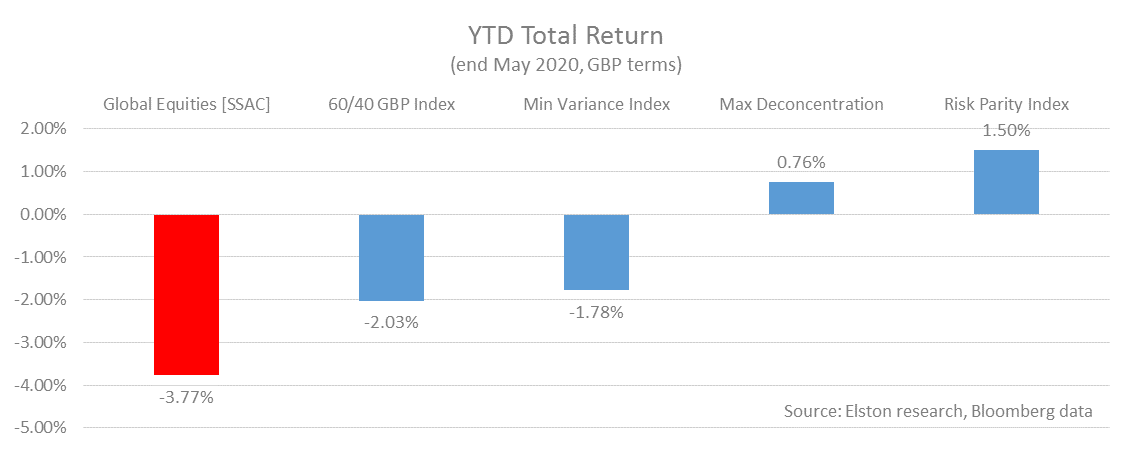

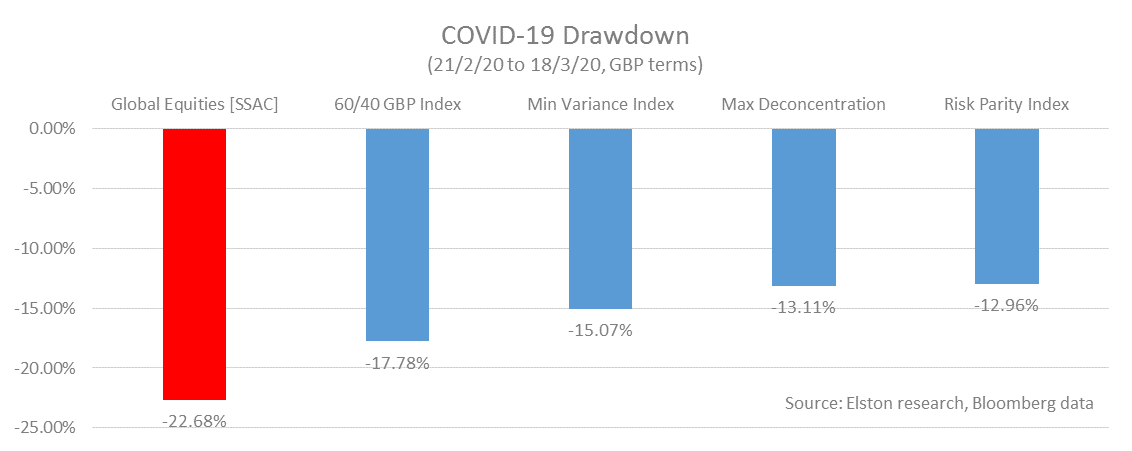

The standard rationale for multi-asset investing is to ensure diversification between equities and bonds. But how to construct that multi-asset portfolio. We summarise 4 approaches and look at performance through the “live ammo stress test” of 2020. The classic 60/40 portfolio: This represents a traditional asset-weighted portfolio for UK investors with predominantly global equities and predominantly GBP bonds. This strategy is represented by the 60/40 GBP Index [6040GBP]. The equal weight or "1/N" portfolio: This represents an equal-asset-weighted portfolio to remove overallocations to size and/or domestic biases within equity and bond exposures. This strategy is represented by the Elston Max Deconcentration portfolio [ESBGMD]. However, the problem with any asset-weighted investing is that in extreme stress periods, correlations between asset classes increase meaning that any asset-weighted diversification effect is reduced just when you need it most. Enter risk-weighted multi-asset strategies. Rather than allowing asset weights to drive portfolio risk & correlation, risk-weighted multi-asset means allowing the portfolio risk (volatility, correlation) to drive asset weights. The Min Variance portfolio: This looks at the volatility and correlation between asset classes and aims to deliver the combination of equities and bonds required to achieve the minimum variance (lowest risk) portfolio whilst remaining exposed to risk assets. This strategy is represented by the Elston Min Variance Index [ESBGMV]. The Risk Parity portfolio: This looks at the risk contribution of each asset class and aims to deliver a portfolio where each asset class contributes equal risk contribution to the overall portfolio. This strategy is represented by the Elston Risk Parity Index [ESBDRP]. Year to date performance Of these risk-based multi-asset strategies for GBP investors, the best performing YTD (to end May) has been Risk Parity +1.50%, followed by Max Deconcentration +0.76%, followed by Min Variance -1.78%, compared to -2.03% for the 60/40 GBP Index, and -3.77% for Global Equities. Drawdowns From the start of the market turmoil to the trough of the 60/40 index on 18th March, Risk Parity provided most downside protection, closely followed by Max Deconcentration. Unsurprisingly, the 60/40 index took approximately 60% of global equity downside. How to get “true diversification”

To achieve true diversification, you need to combine uncorrelated/differentiated holdings alongside your core strategy. An asset-weighted approach, such as 60/40 portfolio, does reduce beta (by definition you are taking 0.6x of market risk), but does not reduce correlation. A 60/40 portfolio is almost 100% correlated to global equities. By contrast, a risk-weighted approach creates the potential for decorrelation, thereby creating the potential for “true diversification” relative to a core portfolio. The recent market turmoil has shown that when true diversification is needed most, a risk-weighted approach has a useful role to play. For more on our risk-weighted portfolios and indices, see www.ElstonETF.com/etf-portfolios.html Comments are closed.

|

ELSTON RESEARCHinsights inform solutions Categories

All

Archives

July 2024

|

Company |

Solutions |

|

RSS Feed

RSS Feed